Market Trends

Key Emerging Trends in the Aircraft Tire Market

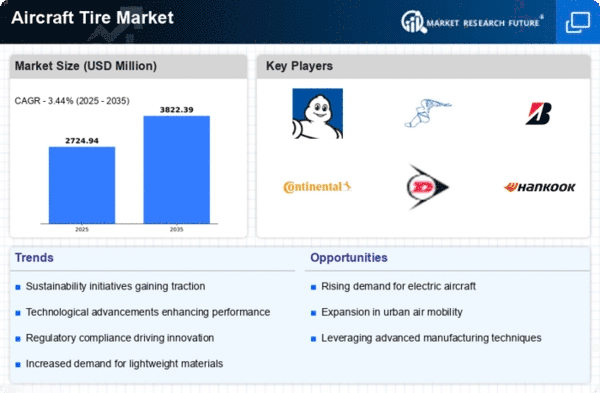

The aircraft tyre market is changing rapidly, reflecting the aviation industry. Aircraft tires are crucial to commercial and military aircraft safety and performance. They oversee safe takeoffs and landings. The market is pushed by new technology, aircraft design, and the demand for tires that can withstand modern passenger air travel. The aviation tyre industry is shifting toward durability and performance. Tire manufacturers are using materials, manufacturing methods, and construction techniques to make tires that can bear heavier loads, longer operational cycles, and tougher climates. This trend follows the aviation industry's pursuit of more efficient and reliable aircraft, which improve safety and reduce maintenance. Commercial aviation tyres are sold by several strong regional firms, and new big players provide potential for growth. Because the global aircraft industry is so large, new market players ensure opportunities for the development of new goods and applications, giving the market significant growth potential. In addition, the industry is moving toward specialist tires to fit a range of aircraft and missions. The necessity for tires designed for commercial airliners, military aircraft, and regional jets has increased. Specialized tires may have stronger sidewalls, high speed, and extreme temperature resistance. These properties make the tires perform well in various conditions. Tire pressure monitoring system innovations are also influencing market trends. Tire pressure monitoring systems (TPMS) prevent underinflation and overheating by monitoring tire pressure and temperature in real time. These devices increase safety, fuel efficiency, and operational reliability by notifying operators early. They also allow operators to do preventive maintenance and decrease tire-related occurrences. For aviation tires, environmental sustainability is becoming more essential, with a focus on developing eco-friendly tire solutions. Manufacturers are studying materials and manufacturing processes to lessen the environmental impact of tire production and disposal. Additionally, fuel-efficient tires are gaining popularity, which supports the aviation industry's goal of reducing carbon emissions and environmental effect. Tire producers and aircraft OEMs are cooperating more to provide integrated tire solutions. By working closely with aircraft manufacturers, tire companies may maximize performance and meet changing aircraft design requirements. This lets corporations tailor their products to certain aviation planes. This collaborative approach boosts system productivity and security. Geopolitical factors like international commerce and law affect airplane tyre sales. Tire manufacturers must comply with aviation safety standards and certifications, and geopolitical variables affect the global supply chain for raw materials and components. Market participants must control these components to ensure the global aviation industry has high-quality, compliant tires.

Leave a Comment