Aircraft Tire Size

Aircraft Tire Market Growth Projections and Opportunities

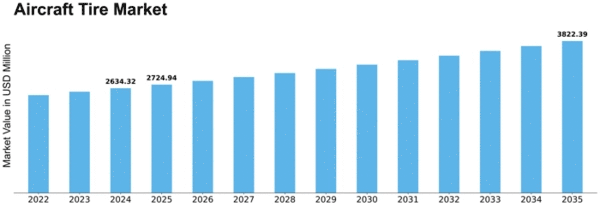

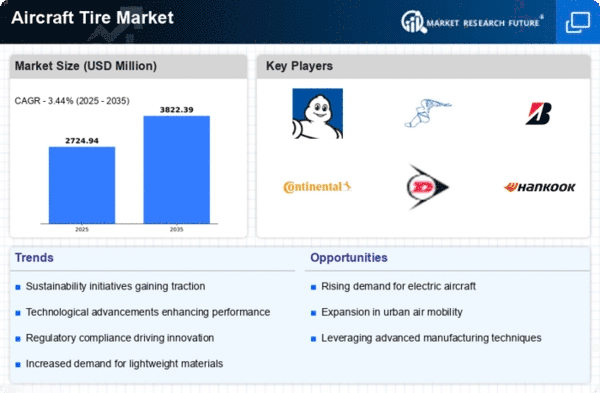

The aviation market for aircraft tires ensures safe takeoff and landing and optimal aircraft performance. The market overview includes factors that affect aircraft tyre demand, innovation, and competition. New innovations affect airplane tyre sales. As aircraft designs and aviation technology advance, tires that meet modern aircraft specifications are needed. New manufacturing methods, tread patterns, and materials may improve tire durability, performance, and safety. To meet aircraft manufacturers' and airlines' evolving needs, these technological advances must be implemented. The Aircraft Tire Market is projected to expand 3.90 percent annually till 2032. The market is worth $3.24 billion. Aircraft tires are made of steel, nylon string, artificial and natural rubber, and others. They are made from these materials and are crucial to aircraft performance. Casing plies are cloth cord layers coated in high-modulus rubber on both sides of the tire. Tire strength comes from these plies. Various manufacturers provide tires to the civilian and military sectors, including airplanes and ships. The aviation tyre market is heavily influenced by economic factors. Aircraft tire demand is directly affected by the aviation sector's health, including air travel demand, airline profitability, and aircraft manufacturing. In periods of economic prosperity, airlines expand their fleets, requiring more tires. In a recession, airlines may postpone tire replacements to minimize costs. The aviation tyre sector depends heavily on regulations. Aviation authorities must set strict safety and performance standards for all aircraft components, including tires. Both tire manufacturers and aircraft operators must comply with these regulations to ensure aviation reliability and safety. Regulatory changes, such as tire performance criteria, may alter market dynamics by increasing demand for technologically advanced and compliant tire solutions. Globalization is crucial to the aviation tyre business. As airlines operate more international routes and aircraft fly to more areas, the requirement for tires that can manage a variety of weather, runway types, and operational challenges grows. The market favors tire manufacturers that can provide globally interoperable and diverse solutions for a range of aircraft types and operating conditions. Competition is important in the aircraft tyre sector. Quality, durability, and cost-effectiveness are becoming increasingly crucial as established tire makers compete for market dominance. Partnerships with airline and aircraft manufacturers and comprehensive tire maintenance services may provide a company an edge. Aftermarket services like tire retreading and repair are crucial to aircraft tyre industry competitiveness. Environmental concerns are growing in the aviation tyre sector. While the aviation industry faces pressure to reduce its environmental impact, tire manufacturers are also helping achieve sustainability goals. New tire materials and manufacturing methods reduce fuel consumption, pollutants, and tire life, aligning with industry initiatives to enhance environmental performance.

Leave a Comment