Aircraft Refurbishing Market Summary

As per Market Research Future analysis, the Aircraft Refurbishing Market Size was estimated at 3.689 USD Billion in 2024. The Aircraft Refurbishing industry is projected to grow from 3.888 USD Billion in 2025 to 6.579 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Aircraft Refurbishing Market is poised for growth driven by sustainability and technological advancements.

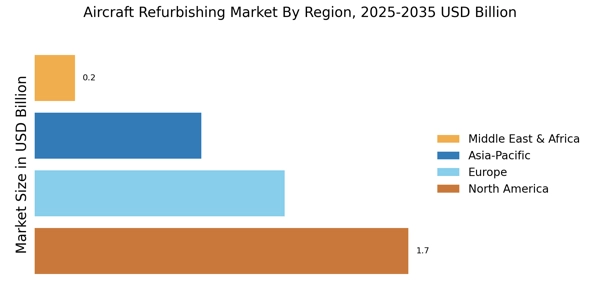

- North America remains the largest market for aircraft refurbishing, reflecting a robust demand for modernization and upgrades.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing air travel and fleet expansion.

- Wide-body aircraft refurbishment dominates the market, while narrow-body aircraft refurbishment is experiencing rapid growth.

- Key drivers include the rising demand for cost-effective solutions and a growing focus on sustainability practices.

Market Size & Forecast

| 2024 Market Size | 3.689 (USD Billion) |

| 2035 Market Size | 6.579 (USD Billion) |

| CAGR (2025 - 2035) | 5.4% |

Major Players

Bombardier Inc (CA), Gulfstream Aerospace Corporation (US), Textron Aviation (US), Dassault Aviation (FR), Boeing Company (US), Airbus S.A.S. (FR), Embraer S.A. (BR), Hawker Beechcraft Corporation (US), Piper Aircraft, Inc. (US)