Geopolitical Influences

Geopolitical dynamics significantly impact The Global airborne isr Industry, as nations prioritize national security and defense capabilities. Heightened tensions in various regions have led to increased military spending, particularly in ISR technologies. Countries are investing in advanced airborne ISR systems to enhance situational awareness and intelligence gathering. For example, defense budgets in regions such as Asia-Pacific and Europe have seen substantial increases, with ISR capabilities being a focal point. This trend suggests a growing recognition of the importance of airborne ISR in modern warfare, potentially leading to a market growth rate of around 5% annually over the next five years.

Increased Defense Budgets

The escalation of defense budgets across various nations is a crucial driver for The Global Airborne ISR Industry. Governments are recognizing the necessity of investing in advanced ISR capabilities to maintain strategic advantages. As of 2025, several countries are projected to allocate a significant portion of their defense budgets to airborne ISR systems, reflecting a commitment to enhancing national security. This trend is particularly evident in regions experiencing geopolitical tensions, where ISR capabilities are deemed essential for effective military operations. The anticipated increase in defense spending is likely to propel market growth, with estimates suggesting a compound annual growth rate of approximately 6% over the next few years.

Collaborative Partnerships

Collaborative partnerships among defense contractors, technology firms, and government agencies are becoming increasingly prevalent in The Global Airborne ISR Industry. These alliances facilitate the sharing of expertise and resources, enabling the development of cutting-edge ISR solutions. Joint ventures and collaborations often lead to the pooling of research and development efforts, which can accelerate innovation. For instance, partnerships between established defense companies and emerging tech startups are likely to yield advanced ISR systems that leverage artificial intelligence and machine learning. Such collaborations are expected to enhance the competitive landscape, driving market growth and expanding the range of ISR capabilities available to military and intelligence agencies.

Technological Advancements

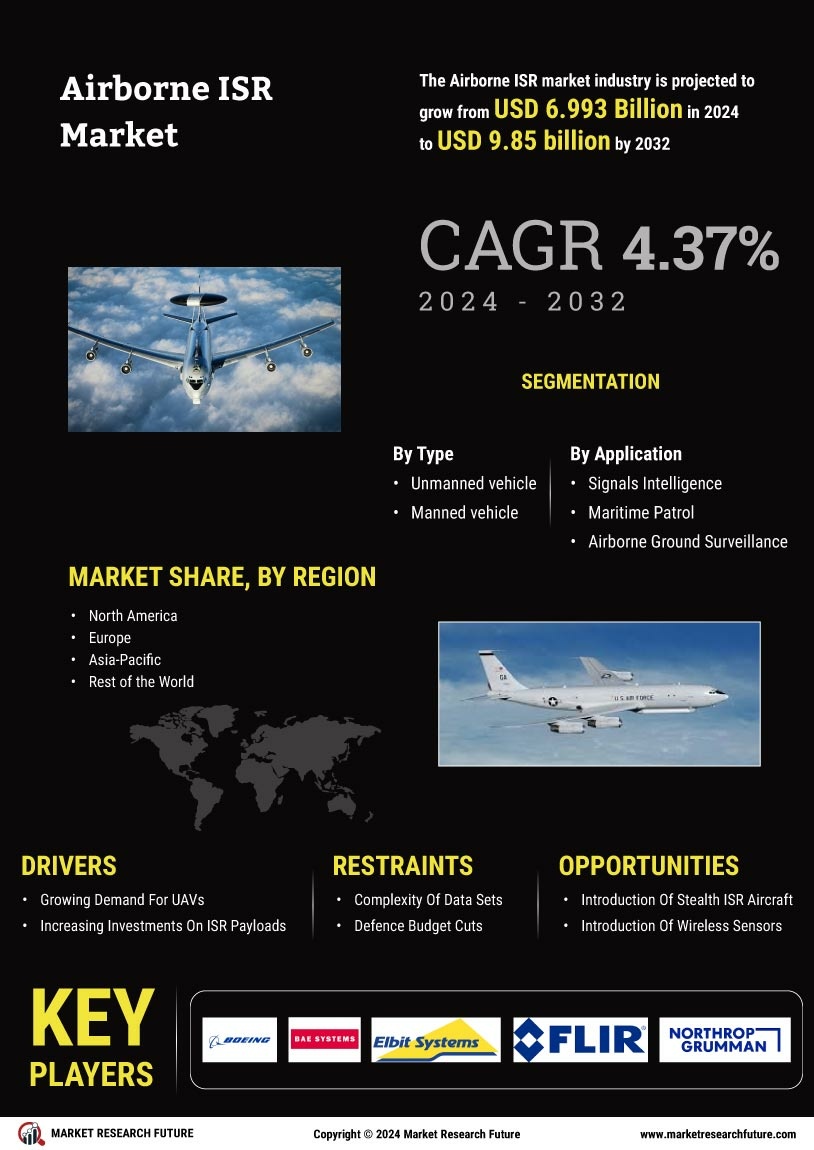

The rapid evolution of technology plays a pivotal role in shaping The Global Airborne ISR Industry. Innovations in sensor technology, data processing, and artificial intelligence are enhancing the capabilities of airborne ISR systems. For instance, the integration of high-resolution imaging sensors and advanced radar systems allows for improved surveillance and reconnaissance. As of 2025, the market is projected to reach a valuation of approximately USD 10 billion, driven by these technological advancements. Furthermore, the development of unmanned aerial vehicles (UAVs) equipped with sophisticated ISR capabilities is expected to expand operational reach and efficiency, thereby attracting investments and fostering competition within the industry.

Growing Demand for Real-Time Intelligence

The demand for real-time intelligence is a driving force in The Global Airborne ISR Industry. As military operations become increasingly complex, the need for timely and accurate information is paramount. Airborne ISR Market systems provide critical data that supports decision-making processes in various operational scenarios. The rise of asymmetric warfare and counter-terrorism operations has further underscored the importance of real-time intelligence. Consequently, military organizations are investing in advanced ISR platforms that can deliver actionable insights swiftly. This growing demand is expected to contribute to a robust market expansion, with projections indicating a potential market size increase of 7% annually in the coming years.