Growing Popularity of Home Cooking

The trend of home cooking is gaining momentum, with more individuals choosing to prepare meals at home rather than dining out. This shift is influenced by various factors, including the desire for healthier meals and cost savings. The Global Air Fryer Industry is capitalizing on this trend, as air fryers offer a convenient and efficient way to prepare a variety of dishes. Market data suggests that the demand for air fryers has surged in recent years, reflecting the increasing inclination towards home-cooked meals. This trend is likely to continue, further propelling the growth of the air fryer market.

Expansion of E-commerce and Online Retail

The rise of e-commerce has transformed the way consumers shop for kitchen appliances, including air fryers. The Global Air Fryer Industry is benefiting from the expansion of online retail platforms, which provide consumers with easy access to a wide range of products. This shift towards online shopping is supported by data showing a significant increase in online sales of kitchen appliances. As consumers increasingly prefer the convenience of purchasing items online, the air fryer market is likely to experience continued growth. This trend indicates that e-commerce will play a crucial role in shaping the future landscape of the air fryer industry.

Rising Demand for Healthy Cooking Solutions

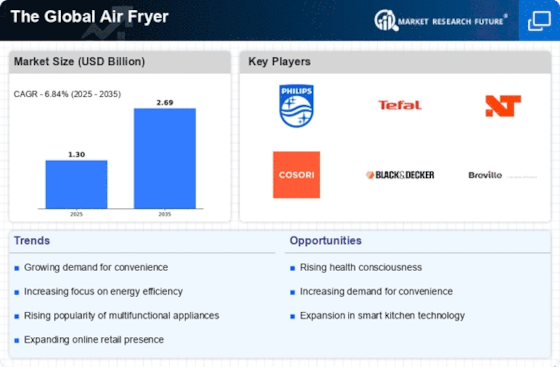

The increasing awareness regarding health and nutrition is driving the demand for healthier cooking methods. Consumers are increasingly seeking alternatives to traditional frying, which is often associated with high fat and calorie content. The air fryer, which utilizes hot air circulation to cook food with minimal oil, aligns well with this trend. In The Global Air Fryer Industry, this shift towards health-conscious cooking is reflected in the growing sales figures, with a notable increase in market penetration. As more individuals prioritize their well-being, the air fryer is becoming a staple in kitchens, suggesting a sustained growth trajectory for the industry.

Shift Towards Sustainable Cooking Practices

Sustainability is becoming a key consideration for consumers when selecting kitchen appliances. The Global Air Fryer Industry is experiencing a shift as more individuals opt for energy-efficient cooking solutions that minimize environmental impact. Air fryers, which typically consume less energy compared to conventional ovens, are appealing to eco-conscious consumers. This trend is supported by data indicating that energy-efficient appliances are gaining traction in the market. As sustainability becomes a priority for many households, the air fryer is positioned to benefit from this growing consumer preference, potentially leading to increased market share.

Technological Innovations in Cooking Appliances

Technological advancements play a pivotal role in shaping The Global Air Fryer Industry. Manufacturers are continuously innovating, introducing features such as smart connectivity, programmable settings, and enhanced energy efficiency. These innovations not only improve user experience but also cater to the evolving preferences of consumers who seek convenience and versatility in their cooking appliances. The integration of technology into air fryers has led to a surge in demand, as evidenced by the increasing number of models available in the market. This trend indicates that the industry is likely to witness further growth as technology continues to evolve.