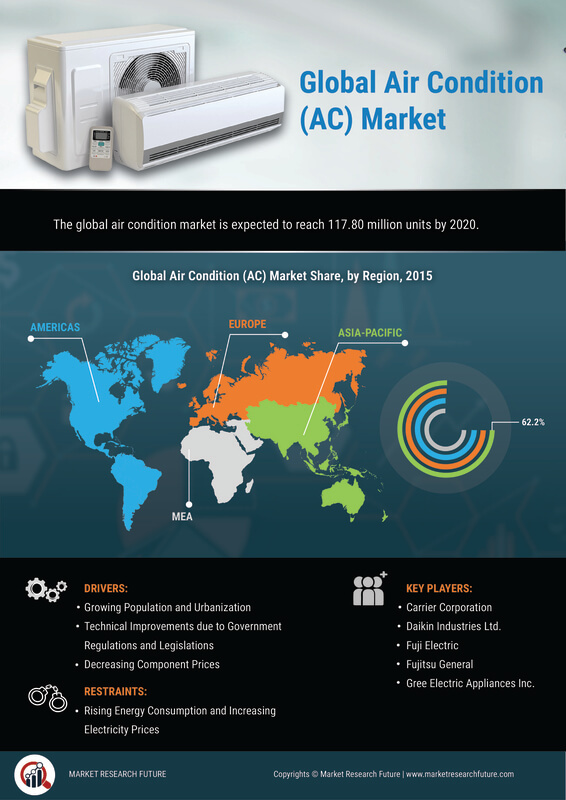

Urbanization and Population Growth

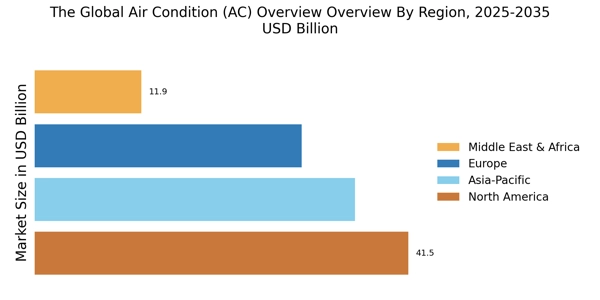

Urbanization continues to accelerate, with more individuals relocating to urban centers in search of better opportunities. This demographic shift is likely to increase the demand for air conditioning systems, as densely populated areas often experience higher temperatures due to the urban heat island effect. The Air Conditioning (AC) Market Overview reflects this trend, with projections indicating that the number of air conditioning units in urban areas could rise by over 30% in the next decade. As cities expand, the need for efficient cooling solutions becomes critical, prompting manufacturers to innovate and adapt their offerings to meet the growing demand. This urban-centric growth is expected to significantly influence the Air Condition Market Market Overview Industry.

Government Regulations and Standards

Government regulations aimed at reducing energy consumption and greenhouse gas emissions are influencing the Air Conditioning (AC) Market Overview. Many countries are implementing stricter efficiency standards for air conditioning units, which encourages manufacturers to innovate and produce more energy-efficient models. The market data indicates that compliance with these regulations is becoming a key factor in consumer purchasing decisions, with a growing preference for units that meet or exceed these standards. As a result, the Air Condition Market Market Overview Industry is likely to see a shift towards more sustainable practices, as companies strive to align their products with regulatory expectations and consumer demands.

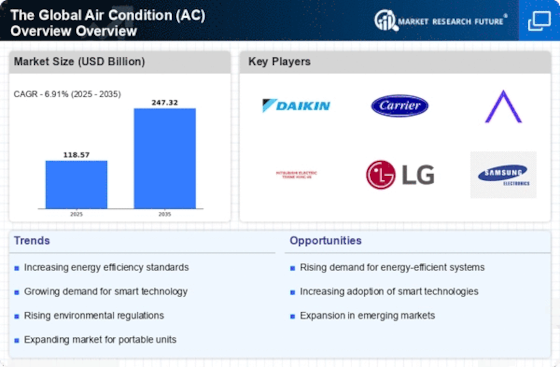

Rising Temperatures and Climate Change

The increasing global temperatures, attributed to climate change, appear to be a primary driver for the Air Condition Market market. As average temperatures rise, the demand for cooling solutions intensifies, particularly in regions that traditionally experience milder climates. The Air Conditioning (AC) Market Overview indicates that the demand for residential and commercial air conditioning units is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 5% over the next several years. This trend is likely to be exacerbated by urbanization, as more people move to cities where heat islands are prevalent. Consequently, the need for effective cooling systems becomes paramount, driving innovation and investment in the Air Condition Market Market Overview Industry.

Technological Advancements in AC Systems

Technological advancements are reshaping the Air Conditioning (AC) Market Overview, with innovations such as smart thermostats, energy-efficient compressors, and IoT integration becoming increasingly prevalent. These advancements not only enhance user experience but also contribute to energy savings, which is a growing concern among consumers. The market data suggests that energy-efficient models are gaining traction, with sales of such units expected to account for over 50% of total AC sales by 2027. This shift towards smarter, more efficient systems indicates a broader trend within the Aircon Market (AC) Market Overview Industry, where technology plays a pivotal role in meeting consumer expectations and regulatory standards.

Increased Consumer Awareness and Demand for Comfort

Consumer awareness regarding indoor air quality and comfort is on the rise, driving demand for advanced air conditioning solutions. The Air Conditioning (AC) Market Overview is witnessing a shift as consumers prioritize not only cooling but also air purification and humidity control. This heightened awareness is likely to lead to increased sales of multi-functional units that offer comprehensive climate control solutions. Market data suggests that the demand for such units could increase by approximately 20% over the next few years, as consumers seek to enhance their living environments. This trend underscores the evolving preferences within the Air Condition Market Market Overview Industry, where comfort and health considerations are becoming paramount.