Rising Construction Activities

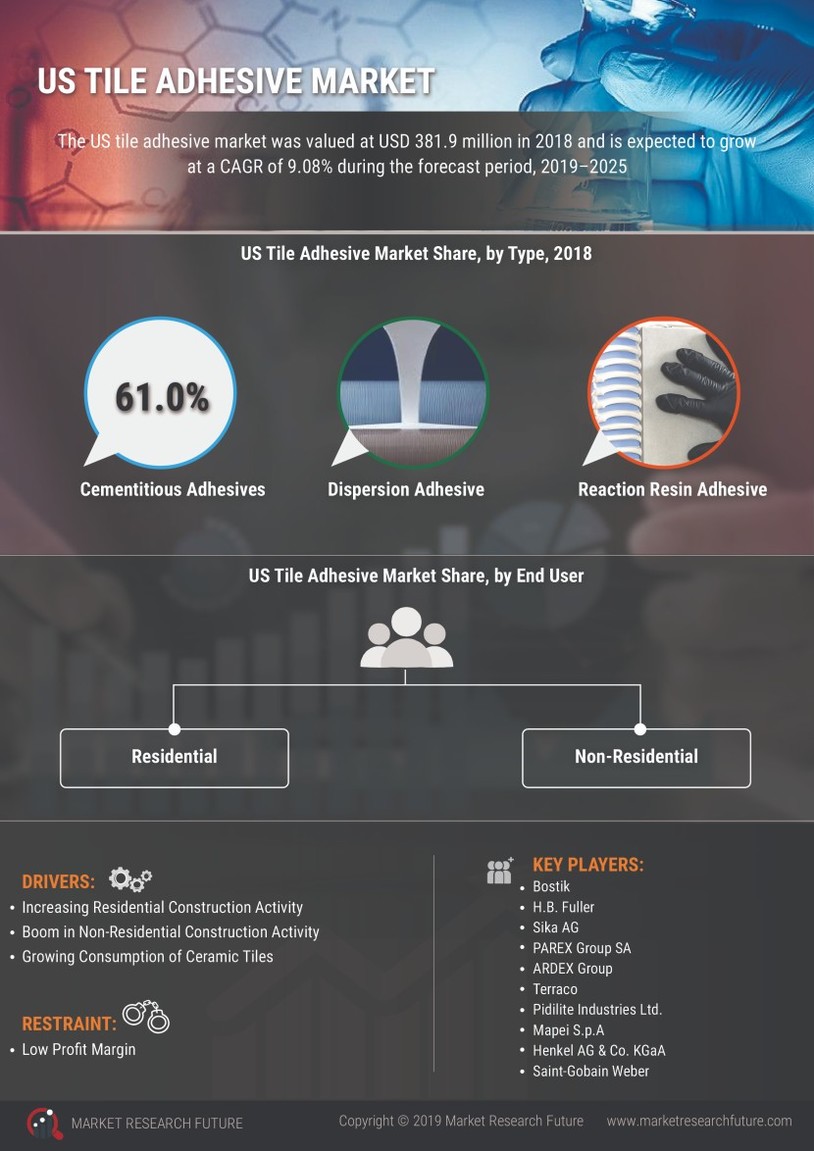

The US Tile Adhesive Market is experiencing a notable surge due to the increasing construction activities across residential and commercial sectors. According to recent data, the construction industry in the United States is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years. This growth is driven by urbanization, population growth, and the need for infrastructure development. As new buildings and renovations emerge, the demand for tile adhesives is expected to rise correspondingly. The US Tile Adhesive Market benefits from this trend, as contractors and builders seek high-quality adhesive solutions to ensure durability and performance in their projects. Consequently, the market is likely to witness a robust expansion fueled by these construction activities.

Growth of the Renovation Market

The US Tile Adhesive Market is significantly impacted by the growth of the renovation market, as homeowners increasingly invest in upgrading their living spaces. Data shows that the home renovation market in the United States is expected to reach a value of over 400 billion dollars by 2026. This trend is driven by factors such as rising disposable incomes, changing lifestyles, and the desire for modernized homes. As renovations often involve the installation of new tiles, the demand for tile adhesives is likely to increase. The US Tile Adhesive Market stands to benefit from this trend, as homeowners and contractors seek reliable adhesive solutions to ensure the longevity and aesthetic appeal of their renovations.

Increased Focus on Aesthetic Appeal

The US Tile Adhesive Market is significantly influenced by the growing emphasis on aesthetic appeal in interior and exterior design. Homeowners and designers are increasingly opting for tiles that enhance the visual appeal of spaces, leading to a higher demand for effective tile adhesives. The market data indicates that the demand for decorative tiles has risen, with a corresponding increase in the need for adhesives that can support these products. This trend is particularly evident in urban areas where modern design concepts are prevalent. As a result, manufacturers in the US Tile Adhesive Market are innovating to develop adhesives that not only provide strong bonding but also cater to the aesthetic requirements of contemporary architecture.

Regulatory Support for Sustainable Practices

The US Tile Adhesive Market is benefiting from regulatory support aimed at promoting sustainable practices within the construction sector. Government initiatives and policies are increasingly encouraging the use of eco-friendly materials, including low-VOC (volatile organic compounds) adhesives. This regulatory environment is fostering innovation among manufacturers, who are now focusing on developing sustainable adhesive solutions that meet these standards. Market data suggests that the demand for green building materials is on the rise, with a significant portion of new constructions aiming for LEED certification. Consequently, the US Tile Adhesive Market is likely to see a shift towards more sustainable adhesive products, aligning with broader environmental goals.

Technological Innovations in Adhesive Formulations

The US Tile Adhesive Market is witnessing a wave of technological innovations that are enhancing adhesive formulations. Advances in chemistry and material science are leading to the development of high-performance adhesives that offer superior bonding capabilities, flexibility, and resistance to environmental factors. For instance, the introduction of polymer-modified adhesives has improved the performance of tile installations, making them more durable and reliable. Market data indicates that these innovations are driving growth in the industry, as contractors and builders increasingly prefer advanced adhesive solutions that can withstand the rigors of various applications. As technology continues to evolve, the US Tile Adhesive Market is poised for further advancements that will redefine adhesive performance.