Ai Recruitment Size

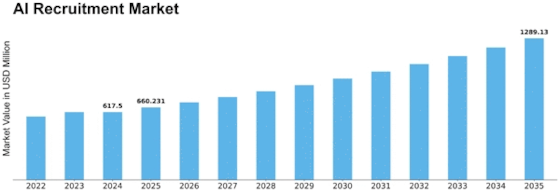

AI Recruitment Market Growth Projections and Opportunities

Important market factors are shaping the AI recruiting industry and its evolutionary cycle. Growing demand for talents across the globe is another important ingredient in driving more streamlined and effective methods of recruiting. Finding and recruiting the best people becomes more important than ever as companies grow and compete in a global market. Fortunately, businesses can overcome this stumbling block with the help of AI-oriented recruiting means.given resources that facilitate hiring and guiding them one step ahead in an atomized talent market.

In addition, technological developments and the rapid advancement of AI are also major market considerations. AI recruiting solutions have become increasingly complex and precise thanks to developments in computer vision, natural language processing, and algorithms for machine learning. Such developments aid the development of even better and more effective technologies for finding, screening, and choosing candidates. As AI technology develops, the AI recruiting industry is poised to see more lightning-like breakthroughs and innovative solutions. With the rapid implementation of remote and flexible work arrangements, employment has changed in nature which is exerting a profound influence on the recruitment market for AI.

With the physical location less and less important, companies are increasingly using virtual recruiting procedures. Artificial intelligence (AI) is reshaping distant recruiting in several key ways, including video interviewing platforms, chatbots, and virtual assistants. These advances in technology create a more flexible and streamlined environment for employment, with easy contact and assessment of applicants regardless of their location. Apart from technical factors, there are also ethical and regulatory considerations. The increasing understanding of fairness and bias problems in AI systems has led to a greater emphasis placed on ethical use. Using Ethical AI procedures to prevent bias in hiring is becoming a focus for many organizations.

Regulatory frameworks and guidelines are designed to ensure that AI technologies used in recruitment adhere to ethical standards, promoting transparency and fairness in applicant selection. Because of intense market competition and a need to stay competitive, organizations are investing heavily in AI recruiting solutions. As organizations increasingly value people, they seek new and novel ways to attract the best talents. By speeding up the hiring process and making it more accurate, AI puts firms at an advantage in the marketplace to get ahead of their competitors by finding and recruiting first.

Leave a Comment