Market Growth Projections

The Global Healthcare Business Intelligence Market Industry is poised for substantial growth, with projections indicating a market value of 11.1 USD Billion in 2025 and an anticipated increase to 38.5 USD Billion by 2035. This trajectory reflects a compound annual growth rate of 13.30% from 2026 to 2035. Such growth is driven by various factors, including the rising demand for data analytics, technological advancements, and the need for regulatory compliance. The market's expansion is indicative of the increasing recognition of business intelligence as a vital component in enhancing healthcare delivery and operational efficiency.

Focus on Patient-Centric Care

The shift towards patient-centric care is a pivotal driver in the Global Healthcare Business Intelligence Market Industry. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, leading to a demand for analytics that can provide insights into patient preferences and outcomes. By utilizing business intelligence tools, organizations can tailor their services to meet the specific needs of patients, resulting in improved care experiences. This focus on patient-centric approaches is likely to enhance the market's growth trajectory, as healthcare systems recognize the value of data in fostering meaningful patient relationships. The ongoing evolution towards patient-centered care models suggests a sustained demand for business intelligence solutions.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning into the Global Healthcare Business Intelligence Market Industry appears to be a significant driver of growth. These technologies enable healthcare organizations to analyze vast amounts of data efficiently, leading to improved predictive analytics and personalized patient care. For example, AI-driven analytics can identify high-risk patients, allowing for timely interventions. This technological advancement is projected to propel the market to an estimated value of 38.5 USD Billion by 2035, reflecting a compound annual growth rate of 13.30% from 2026 to 2035. The continuous evolution of technology in healthcare is likely to enhance the effectiveness of business intelligence solutions.

Emerging Markets and Global Expansion

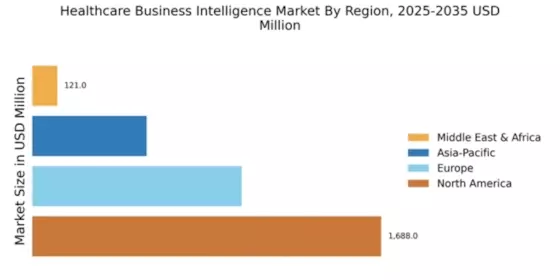

Emerging markets are playing a crucial role in shaping the Global Healthcare Business Intelligence Market Industry. As healthcare systems in developing regions evolve, there is a growing recognition of the importance of data analytics in improving healthcare delivery. Countries in Asia and Africa are increasingly adopting business intelligence solutions to address challenges such as resource allocation and disease management. This trend indicates a potential for significant market expansion, as these regions invest in healthcare infrastructure and technology. The global expansion of business intelligence in healthcare suggests a dynamic landscape, with opportunities for growth in diverse geographical contexts.

Rising Demand for Data-Driven Decision Making

The Global Healthcare Business Intelligence Market Industry experiences a notable surge in demand for data-driven decision-making processes. Healthcare organizations increasingly rely on analytics to enhance operational efficiency and improve patient outcomes. For instance, hospitals utilizing business intelligence tools report a 20% reduction in patient wait times and a 15% increase in patient satisfaction scores. This trend is expected to contribute to the market's growth, with projections indicating a market value of 3.38 USD Billion in 2024. As healthcare providers seek to optimize resource allocation and streamline workflows, the adoption of business intelligence solutions is likely to accelerate.

Regulatory Compliance and Reporting Requirements

Regulatory compliance and reporting requirements are increasingly influencing the Global Healthcare Business Intelligence Market Industry. Healthcare organizations must adhere to stringent regulations, necessitating the implementation of robust business intelligence systems to ensure compliance. For instance, the Health Insurance Portability and Accountability Act mandates the secure handling of patient data, prompting healthcare providers to invest in analytics solutions that facilitate compliance reporting. This need for adherence to regulations is likely to drive market growth, as organizations seek to mitigate risks associated with non-compliance. The emphasis on regulatory compliance underscores the importance of business intelligence in maintaining operational integrity within the healthcare sector.