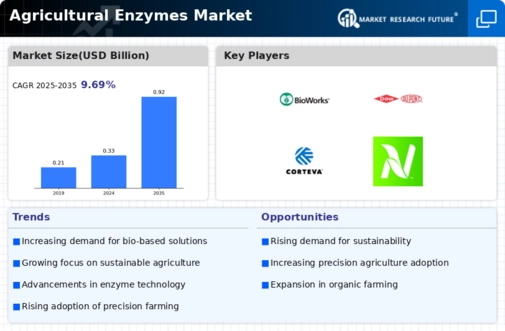

Leading market players are extensively investing in research and development in order to extend their product lines, which will help the agricultural enzymes market grow even more. Market participants are also engaging in a number of strategic initiatives to grow their worldwide presence, with significant market developments including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the agricultural enzymes industry must provide cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global agricultural enzymes industry to benefit clients and increase the market sector. In recent years, the agricultural enzymes industry has offered some of the most significant advantages to medicine. Major players in the agricultural enzymes market, including Syngenta AG (Switzerland), Novozymes A/S (Denmark), DSM N.V. (The Netherlands), Bioworks Inc. (US), AB Enzymes (Germany), Agrinos AS (US), and others, are attempting to increase market demand by investing in R&D operations.

Corteva, Inc. is a significant American agricultural chemical and seed firm that was once a division of DowDuPont until being split out as a separate public company. In 2017, the DowDuPont agricultural operations that became Corteva had revenue of more than $14 billion, putting the company in the Fortune 500 for that year. Pioneer Hi-Bred International, which DuPont purchased in 1999, is a major component of the corporation. In June 2021: Corteva Agrisciences partnered with Elemental Enzymes, a life sciences company developing novel biotechnology and enzyme solutions.

The companies expanded their multi-year global agreement to include a new bio fungicide for a broad range of row crops, including soybeans, cereals, corn, oilseeds, rice, and sugarcane, as well as turf and ornamental applications.

Nutrien is a Canadian fertilizer firm situated in Saskatoon, Saskatchewan. It is the world's leading producer of potash and the third largest producer of nitrogen fertilizer. It has approximately 2,000 retail outlets across North America, South America, and Australia, and employs over 23,500 people.

It is traded on the Toronto Stock Exchange (symbol NTR) and the New York Stock Exchange (symbol NTR), and it has a market capitalization of $34 billion as of January 2018.In addition, the merger was proposed in light of low fertilizer prices, with the belief that a larger corporation would be better able to raise pricing PotashCorp and Agrium merged to establish it, and the transaction was completed.

In March Nutrien Ag Solutions partnered with Elemental and launched peptide-based bio-pesticide