Emergence of 5G Technology

The AI Computing Hardware Market is poised for growth due to the emergence of 5G technology, which facilitates faster data transmission and lower latency. This technological advancement enables real-time processing of AI applications, particularly in sectors such as autonomous vehicles, smart cities, and IoT devices. The rollout of 5G networks is expected to create new opportunities for AI computing hardware, as devices become increasingly interconnected and reliant on AI for functionality. Market analysts predict that the 5G infrastructure will drive a substantial increase in demand for AI computing hardware, as companies seek to leverage the enhanced capabilities offered by this technology. The integration of 5G with AI is likely to redefine operational paradigms across various industries.

Rising Demand for Data Centers

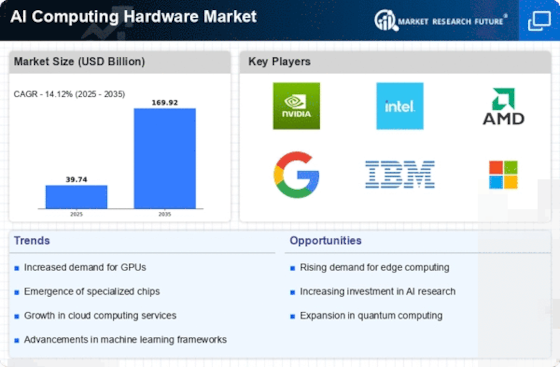

The AI Computing Hardware Market is witnessing a rising demand for data centers, driven by the exponential growth of data generated across various sectors. As organizations increasingly rely on data analytics and AI-driven insights, the need for robust data center infrastructure becomes paramount. Reports indicate that The AI Computing Hardware Market is expected to exceed 200 billion dollars by 2025, with a significant portion of this growth attributed to AI applications. This trend compels data center operators to invest in high-performance computing hardware, including servers optimized for AI workloads. Consequently, the demand for AI computing hardware is likely to surge as data centers seek to enhance their capabilities to process and analyze vast amounts of data efficiently.

Growing Investment in AI Startups

The AI Computing Hardware Market is significantly impacted by the growing investment in AI startups, which are at the forefront of developing innovative solutions. Venture capital funding for AI-related startups has surged, with billions of dollars being allocated to enhance research and development efforts. This influx of capital not only accelerates the development of AI applications but also drives the demand for advanced computing hardware necessary to support these innovations. Data indicates that investment in AI startups reached approximately 40 billion dollars in 2023, reflecting a strong interest in the sector. As these startups continue to push the boundaries of AI technology, the corresponding need for high-performance computing hardware is expected to rise, further fueling the growth of the AI computing hardware market.

Surge in AI Adoption Across Industries

The AI Computing Hardware Market experiences a notable surge in demand as various sectors increasingly adopt artificial intelligence technologies. Industries such as healthcare, finance, and manufacturing are integrating AI solutions to enhance operational efficiency and decision-making processes. According to recent data, the AI market is projected to reach a valuation of over 500 billion dollars by 2024, indicating a robust growth trajectory. This trend necessitates advanced computing hardware capable of supporting complex algorithms and large datasets, thereby driving investments in high-performance processors and specialized AI chips. As organizations recognize the potential of AI to transform their operations, the demand for AI computing hardware is expected to escalate, further solidifying its importance in the market.

Advancements in Machine Learning Algorithms

The AI Computing Hardware Market is significantly influenced by advancements in machine learning algorithms, which require increasingly sophisticated hardware to function effectively. As algorithms evolve, they demand more computational power and memory, prompting hardware manufacturers to innovate and develop cutting-edge solutions. For instance, the introduction of tensor processing units (TPUs) and graphics processing units (GPUs) tailored for AI workloads has revolutionized the landscape. Market data suggests that the demand for GPUs alone is anticipated to grow at a compound annual growth rate of over 30% through 2025. This growth is indicative of the hardware's critical role in enabling faster training and deployment of machine learning models, thereby propelling the AI computing hardware market forward.