-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TECHNIQUE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- GROWING DEMAND FOR LIGHTWEIGHT MATERIALS IN AEROSTRUCTURES

- INCREASED AIRCRAFT PRODUCTION AND FLEET EXPANSION

- RISING DEFENSE EXPENDITURE AND MILITARY MODERNIZATION PROGRAMS

- TECHNOLOGICAL ADVANCEMENTS IN AUTOMATED AEROSTRUCTURE MANUFACTURING

-

RESTRAINTS

- HIGH COST OF ADVANCED COMPOSITE MATERIALS

- SUPPLY CHAIN DISRUPTIONS AND MATERIAL SHORTAGES

- STRINGENT REGULATORY REQUIREMENTS

- CHALLENGES IN MANUFACTURING SCALABILITY

-

OPPORTUNITY

- ADVANCEMENTS IN COMPOSITE MATERIALS FOR LIGHTWEIGHT AEROSTRUCTURES

- INTEGRATION OF ADVANCED MANUFACTURING TECHNOLOGIES

- RISING DEMAND FOR SUSTAINABLE AND GREEN AEROSTRUCTURES

- PARTNERSHIPS WITH TECHNOLOGY STARTUPS FOR INNOVATIVE SOLUTIONS

- EXPANSION OF URBAN AIR MOBILITY (UAM) AND ADVANCED AIR MOBILITY (AAM)

-

TRENDS

- ADVANCEMENTS IN MATERIALS

- ADDITIVE MANUFACTURING (3D PRINTING)

- FOCUS ON SUSTAINABILITY

- INTEGRATION OF DIGITAL TECHNOLOGIES

-

IMPACT ANALYSIS OF COVID - 19

- IMPACT ON OVERALL AEROSPACE & DEFENSE

- IMPACT ON GLOBAL AEROSTRUCTURES MARKET

- IMPACT ON SUPPLY CHAIN OF AEROSTRUCTURES MARKET

- IMPACT ON MARKET DEMAND OF AEROSTRUCTURES MARKET

- IMPACT ON PRICING OF AEROSTRUCTURES MARKET

-

MARKET FACTOR ANALYSIS

-

SUPPLY CHAIN ANALYSIS

- RAW MATERIAL AND COMPONENT MANUFACTURERS

- SYSTEM INTEGRATORS

- ORIGINAL EQUIPMENT MANUFACTURERS

- LOGISTICS AND DISTRIBUTION

- AFTERMARKET SERVICES (MRO)

-

PORTER’S FIVE FORCES MODEL

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- INTENSITY OF RIVALRY

-

SWOT ANALYSIS

-

PESTEL ANALYSIS

- POLITICAL FACTORS

- ECONOMIC FACTORS

- SOCIAL FACTORS

- TECHNOLOGICAL FACTORS

- ENVIRONMENTAL FACTORS

- LEGAL FACTORS

-

REGULATORY LANDSCAPE

-

CURRENT MARKET DEVELOPMENTS AND PROSPECTS

-

FUTURE INNOVATIONS AND IMPACT ON THE MARKET

-

OEMS DEMAND SIDE ANALYSIS

-

SAEROSTRUCTURES MARKET, BY COMPONENT

-

INTRODUCTION

-

FUSELAGE

-

WINGS

-

EMPENNAGES

-

FLIGHT CONTROL SURFACES

-

NACELLE AND PYLON

-

NOSE

-

DOORS AND SKIDS

-

AEROSTRUCTURES MARKET, BY MATERIAL

-

INTRODUCTION

-

COMPOSITES

-

ALLOYS

-

METALS

-

AEROSTRUCTURES MARKET, BY APPLICATION

-

INTRODUCTION

- COMMERCIAL AVIATION

- MILITARY AVIATION

- GENERAL & BUSINESS AVIATION

- ADVANCED AIR MOBILITY

-

AEROSTRUCTURES MAREKT, BY SALES CHANNEL

-

INTRODUCTION

- OEM

- AFTERMARKET

-

AEROSTRUCTURES MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- SWEDEN

- TURKEY

- RUSSIA

- REST OF EUROPE

-

ASIA PACIFIC

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- INDONESIA

- MALAYSIA

- AUSTRALIA

- REST OF ASIA PACIFIC

-

SOUTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

-

MIDDLE EAST AND AFRICA

- MIDDLE EAST & AFRICA

- GCC COUNTRIES

- SOUTH AFRICA

- REST OF MIDDLE EAST & AFRICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

COMPETITOR DASHBOARD

-

COMPANY MARKET SHARE ANALYSIS, 2024

-

PUBLIC PLAYERS STOCK SUMMARY

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANICAL

-

COMPETITOR'S PRODUCT INFORMATION/ PRODUCT BENCHMARKING ANALYSIS

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- NEW PRODUCT LAUNCH/ DEVELOPMENT

- PARTNERSHIP/COLLABORATION, AGREEMENT, CONTRACT, INVESTMENT, EXPANSION, AND OTHERS

-

COMPANY PROFILES

-

INDRAERO (AVIAGROUP INDUSTRIES)

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SPIRIT AEOROSYSTEMS, INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

GKN AEROSPACE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

FACC AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

RUAG INTERNATIONAL HOLDING AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

KAWASAKI HEAVY INDUSTRIES, LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LATECOERE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

TRIUMPH GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

KOREA AEROSPACE INDUSTRIES LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

TERMA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AERNNOVA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

KAMAN CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

COLLINS AEROSPACE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

PRIMUS AEROSPACE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

MAHINDRA AEROSPACE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

GLOBAL AEROSTRUCTURES MARKET, BY PRODUCT TYPE, 2019-2032 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY MATERIAL, 2019-2032 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY APPLICATION, 2019-2032 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY SALES CHANNEL, 2019-2032 (USD BILLION)

-

GLOBAL: AEROSTRUCTURE MARKET SHARE, BY REGION, 2019-2035 (USD BILLION)

-

NORTH AMERICA: AEROSTRUCTURE MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

NORTH AMERICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

NORTH AMERICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

NORTH AMERICA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

NORTH AMERICA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

US AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

US AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

US AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

US AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

CANADA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

CANADA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

CANADA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

CANADA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

MEXICO AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

MEXICO AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

MEXICO AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

MEXICO AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

EUROPE: AEROSTRUCTURE MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

EUROPE AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

EUROPE AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

EUROPE AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

EUROPE AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

GERMANY AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

GERMANY AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

GERMANY AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

GERMANY AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

UK AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

UK AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

UK AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

UK AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

FRANCE AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

FRANCE AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

FRANCE AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

FRANCE AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

ITALY AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

ITALY AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

ITALY AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

ITALY AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

SPAIN AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SPAIN AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SPAIN AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SPAIN AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

SWEDEN AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SWEDEN AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SWEDEN AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SWEDEN AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

TURKEY AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

TURKEY AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

TURKEY AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TURKEY AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

RUSSIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

RUSSIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

RUSSIA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

RUSSIA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

REST OF EUROPE AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF EUROPE AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF EUROPE AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF EUROPE AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

ASIA PACIFIC: AEROSTRUCTURE MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

ASIA PACIFIC AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

ASIA PACIFIC AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

ASIA PACIFIC AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

ASIA PACIFIC AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

CHINA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

CHINA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

CHINA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

CHINA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

INDIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

INDIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

INDIA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

INDIA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

JAPAN AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

JAPAN AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

JAPAN AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

JAPAN AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

SOUTH KOREA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SOUTH KOREA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SOUTH KOREA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SOUTH KOREA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

INDONESIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

INDONESIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

INDONESIA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

INDONESIA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

MALAYSIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

MALAYSIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

MALAYSIA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

MALAYSIA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

AUSTRALIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

AUSTRALIA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

AUSTRALIA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

AUSTRALIA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

SOUTH AMERICA: AEROSTRUCTURE MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

SOUTH AMERICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SOUTH AMERICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SOUTH AMERICA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SOUTH AMERICA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

BRAZIL AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

BRAZIL AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

BRAZIL AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

BRAZIL AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

ARGENTINA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

ARGENTINA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

ARGENTINA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

ARGENTINA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA: AEROSTRUCTURE MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

GCC COUNTRIES AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

GCC COUNTRIES AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

GCC COUNTRIES AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

GCC COUNTRIES AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

SOUTH AFRICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SOUTH AFRICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

SOUTH AFRICA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SOUTH AFRICA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY COMPONENT, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA AEROSTRUCTURE MARKET, BY SALES CHANNEL, 2019-2035 (USD BILLION)

-

PUBLIC PLAYERS STOCK SUMMARY

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANICAL

-

COMPETITOR'S PRODUCT INFORMATION/ PRODUCT BENCHMARKING ANALYSIS

-

NEW PRODUCT LAUNCH

-

PARTNERSHIP/COLLABORATION, AGREEMENT, CONTRACT, INVESTMENT, EXPANSION, AND OTHERS

-

INDRAERO (AVIAGROUP INDUSTRIES): PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

SPIRIT AEROSYSTEMS, INC.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

SPIRIT AEROSYSTEMS, INC.: KEY DEVELOPMENTS

-

GKN AEROSPACE: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

GKN AEROSPACE: KEY DEVELOPMENTS

-

FACC AG: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

FACC AG: KEY DEVELOPMENTS

-

RUAG INTERNATIONAL HOLDING AG: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

KAWASAKI HEAVY INDUSTRIES LTD.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

KAWASAKI HEAVY INDUSTRIES LTD.: KEY DEVELOPMENTS

-

LATECOERE: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

LATECOERE: KEY DEVELOPMENTS

-

TRIUMPH GROUP INC : PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

KOREA AEROSPACE INDUSTRIES LTD: KEY DEVELOPMENTS

-

TERMA: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

AERNNOVA: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

AERNNOVA: KEY DEVELOPMENTS

-

KAMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

KAMAN CORPORATION: KEY DEVELOPMENTS

-

COLLINS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

COLLINS AEROSPACE: KEY DEVELOPMENTS

-

PRIMUS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

PRIMUS AEROSPACE: KEY DEVELOPMENTS

-

MAHINDRA AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

MAHINDRA AEROSPACE: KEY DEVELOPMENTS

-

-

LIST OF FIGURES

-

GLOBAL AEROSTRUCTURES MARKET: STRUCTURE

-

AEROSTRUCTURES: MARKET GROWTH FACTOR ANALYSIS (2023-2032)

-

DRIVER IMPACT ANALYSIS (2024-2035)

-

RESTRAINT IMPACT ANALYSIS (2024-2035)

-

OPPORTUNITY IMPACT FORECAST

-

GLOBAL AEROSTRUCTURE MARKET: SUPPLY CHAIN

-

PORTER’S FIVE FORCES MODEL: AEROSTRUCTURES

-

MARKET SWOT ANALYSIS OF THE GLOBAL AEROSTRUCTURE MARKET

-

GLOBAL AEROSTRUCTURES MARKET, BY PRODUCT TYPE, 2024 & 2035 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY PRODUCT TYPE, 2024 (% SHARE)

-

GLOBAL AEROSTRUCTURES MARKET, BY MATERIAL, 2024 & 2035 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY MATERIAL, 2024 (% SHARE)

-

GLOBAL AEROSTRUCTURES MARKET, BY APPLICATION, 2024 & 2035 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY APPLICATION, 2024 (% SHARE)

-

GLOBAL AEROSTRUCTURES MARKET, BY SALES CHANNEL, 2024 & 2035 (USD BILLION)

-

GLOBAL AEROSTRUCTURES MARKET, BY SALES CHANNEL, 2024 (% SHARE)

-

GLOBAL: AEROSTRUCTURE MARKET SHARE, BY REGION, 2024 (% SHARE)

-

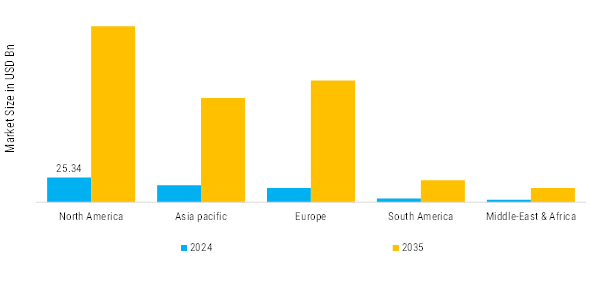

GLOBAL: AEROSTRUCTURE MARKET SHARE, BY REGION, 2024 & 2035 (USD BILLION)

-

NORTH AMERICA: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 (% SHARE)

-

NORTH AMERICA: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

EUROPE: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 (% SHARE)

-

EUROPE: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

ASIA PACIFIC: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 (% SHARE)

-

ASIA PACIFIC: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

SOUTH AMERICA: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 (% SHARE)

-

SOUTH AMERICA: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

MIDDLE EAST & AFRICA: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 (% SHARE)

-

MIDDLE EAST & AFRICA: AEROSTRUCTURE MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

COMPETITOR DASHBOARD: AUTOMOTIVE BATTERIES MARKET

-

GLOBAL AEROSTRUCTURE PLAYERS: COMPETITIVE ANALSIS, 2024 (USD BILLION) (% SHARE)

-

INDRAERO (AVIAGROUP INDUSTRIES): SWOT ANALYSIS

-

SPIRIT AEROSYSTEMS, INC.: FINANCIAL OVERVIEW SNAPSHOT

-

SPIRIT AEROSYSTEMS, INC.: SWOT ANALYSIS

-

GKN AEROSPACE: FINANCIAL OVERVIEW SNAPSHOT

-

GKN AEROSPACE: SWOT ANALYSIS

-

FACC AG: FINANCIAL OVERVIEW SNAPSHOT

-

FACC AG: SWOT ANALYSIS

-

RUAG INTERNATIONAL HOLDING AG: FINANCIAL OVERVIEW SNAPSHOT

-

RUAG INTERNATIONAL HOLDING AG: SWOT ANALYSIS

-

KAWASAKI HEAVY INDUSTRIES LTD.: FINANCIAL OVERVIEW SNAPSHOT

-

KAWASAKI HEAVY INDUSTRIES LTD.: SWOT ANALYSIS

-

LATECOERE: FINANCIAL OVERVIEW SNAPSHOT

-

LATECOERE: SWOT ANALYSIS

-

TRIUMPH GROUP INC: FINANCIAL OVERVIEW SNAPSHOT

-

TRIUMPH GROUP INC: SWOT ANALYSIS

-

KOREA AEROSPACE INDUSTRIES LTD: FINANCIAL OVERVIEW SNAPSHOT

-

KOREA AEROSPACE INDUSTRIES LTD: SWOT ANALYSIS

-

TERMA: FINANCIAL OVERVIEW SNAPSHOT

-

TERMA: SWOT ANALYSIS

-

AERNNOVA: SWOT ANALYSIS

-

KAMAN CORPORATION: SWOT ANALYSIS

-

COLLINS AEROSPACE (RTX CORPORATION): FINANCIAL OVERVIEW SNAPSHOT

-

COLLINS AEROSPACE: SWOT ANALYSIS

-

PRIMUS AEROSPACE: SWOT ANALYSIS

-

MAHINDRA AEROSPACE: SWOT ANALYSIS

Leave a Comment