Growing Focus on Sustainable Practices

The Aerospace Sealant Market is increasingly influenced by a growing focus on sustainable practices within the aerospace sector. As environmental concerns gain prominence, manufacturers are seeking sealants that are not only effective but also environmentally friendly. This shift towards sustainability is prompting the development of bio-based and low-VOC (volatile organic compound) sealants, which align with global efforts to reduce the carbon footprint of aviation. The market for sustainable aerospace sealants is expected to expand as companies prioritize eco-friendly solutions in their production processes. Furthermore, regulatory bodies are beginning to favor products that adhere to sustainability standards, which could further drive demand for innovative sealants in the aerospace sealant market.

Increased Demand for Lightweight Materials

The Aerospace Sealant Market is experiencing a notable surge in demand for lightweight materials, driven by the aerospace sector's ongoing quest for fuel efficiency and performance enhancement. As manufacturers increasingly adopt composite materials, the need for specialized sealants that can effectively bond and seal these materials becomes paramount. Reports indicate that the use of lightweight materials can reduce aircraft weight by up to 20%, leading to significant fuel savings. This trend is likely to propel the aerospace sealant market, as companies seek innovative solutions to meet stringent regulatory standards while enhancing aircraft performance. Furthermore, the integration of advanced sealants in the production of lightweight structures is expected to foster growth in the aerospace sealant market, as manufacturers prioritize both safety and efficiency in their designs.

Regulatory Compliance and Safety Standards

The Aerospace Sealant Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate the use of high-performance sealants that can withstand extreme conditions, including temperature fluctuations and exposure to various chemicals. As the aerospace industry continues to evolve, manufacturers are compelled to invest in advanced sealant technologies that meet or exceed these regulatory requirements. The market for aerospace sealants is projected to grow as companies strive to ensure compliance with safety standards, which are becoming increasingly rigorous. This focus on safety not only enhances the reliability of aircraft but also drives innovation within the aerospace sealant market, as manufacturers develop new formulations to address emerging challenges.

Expansion of Aerospace Manufacturing Facilities

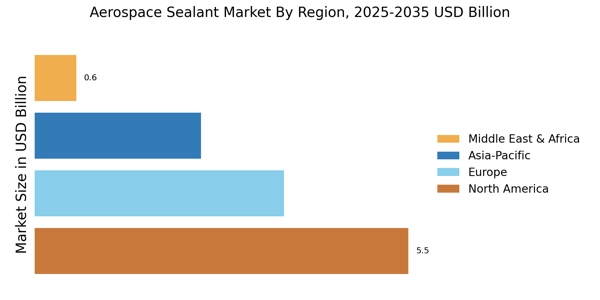

The Aerospace Sealant Market is poised for growth due to the expansion of aerospace manufacturing facilities across various regions. As countries invest in their aerospace sectors, the demand for sealants is expected to rise correspondingly. New manufacturing plants are being established to cater to the increasing production of aircraft, which in turn drives the need for high-quality sealants. For instance, recent data suggests that the aerospace manufacturing sector is projected to grow at a compound annual growth rate of over 5% in the coming years. This expansion not only creates opportunities for sealant manufacturers but also encourages collaboration between aerospace companies and sealant suppliers, fostering innovation and enhancing product offerings in the aerospace sealant market.

Technological Innovations in Sealant Formulations

The Aerospace Sealant Market is witnessing a wave of technological innovations in sealant formulations, which are enhancing performance and application efficiency. Advances in chemistry and material science are leading to the development of sealants that offer superior adhesion, flexibility, and resistance to environmental factors. These innovations are crucial as they enable manufacturers to create products that meet the evolving demands of the aerospace sector. For example, the introduction of new polymer-based sealants has shown promise in improving durability and reducing weight, which aligns with the industry's focus on efficiency. As these technological advancements continue to emerge, they are likely to reshape the aerospace sealant market, providing manufacturers with the tools necessary to meet the challenges of modern aerospace applications.