Focus on Cybersecurity in Avionics

The aerospace avionic Market is increasingly prioritizing cybersecurity measures as the threat landscape evolves. With the growing reliance on digital systems and connectivity, the risk of cyberattacks on avionics systems has become a pressing concern. Regulatory bodies are now mandating stringent cybersecurity protocols to protect sensitive data and ensure the integrity of avionics systems. This focus on cybersecurity is likely to drive investments in advanced security solutions, which could lead to a market growth rate of around 6% in the coming years. As manufacturers adapt to these requirements, the emphasis on robust cybersecurity frameworks will play a crucial role in shaping the future of the Aerospace Avionic Market.

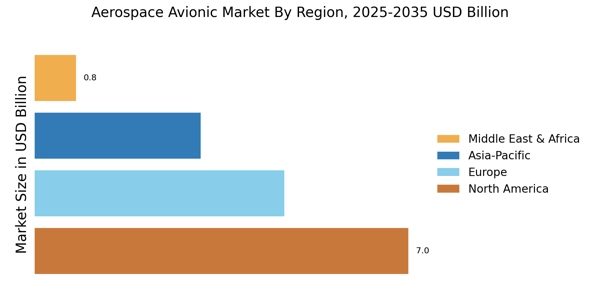

Emerging Markets and Regional Expansion

The Aerospace Avionic Market is witnessing significant growth in emerging markets, where increasing air travel demand is prompting investments in aviation infrastructure. Countries in Asia-Pacific and the Middle East are particularly notable for their rapid expansion of commercial aviation. The International Air Transport Association has reported that passenger numbers in these regions are expected to double in the next two decades. This trend is likely to drive the demand for advanced avionics systems, as new aircraft are equipped with state-of-the-art technologies to ensure safety and efficiency. Consequently, manufacturers are focusing on regional partnerships to capitalize on these opportunities, thereby enhancing their market presence.

Sustainability and Environmental Regulations

The Aerospace Avionic Market is increasingly influenced by sustainability initiatives and environmental regulations. As the aviation sector faces mounting pressure to reduce its carbon footprint, there is a growing emphasis on developing eco-friendly avionics systems. This includes the integration of technologies that enhance fuel efficiency and reduce emissions. Regulatory frameworks are evolving to support these initiatives, with many countries implementing stricter environmental standards for aircraft operations. Consequently, the market for sustainable avionics solutions is expected to expand, with projections indicating a growth rate of approximately 5% over the next several years. This shift towards sustainability is likely to redefine the competitive landscape of the Aerospace Avionic Market.

Increased Demand for Advanced Avionics Systems

The Aerospace Avionic Market is experiencing a notable surge in demand for advanced avionics systems. This demand is primarily driven by the need for enhanced safety, efficiency, and operational capabilities in modern aircraft. As airlines and operators seek to improve their fleet performance, the integration of sophisticated avionics technologies becomes paramount. According to recent data, the market for avionics systems is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This growth is indicative of the industry's shift towards more automated and intelligent systems, which are essential for meeting the evolving requirements of air travel and regulatory standards.

Integration of Artificial Intelligence and Automation

The Aerospace Avionic Market is increasingly integrating artificial intelligence (AI) and automation into avionics systems. This integration is aimed at improving decision-making processes, enhancing situational awareness, and optimizing flight operations. AI technologies are being utilized for predictive maintenance, which can significantly reduce operational costs and downtime. Furthermore, automation in cockpit systems is expected to enhance pilot efficiency and safety. As a result, the market for AI-driven avionics is projected to grow substantially, with estimates suggesting a potential increase of over 7% annually. This trend reflects the industry's commitment to leveraging cutting-edge technologies to meet the demands of modern aviation.