Emerging Markets and Regional Growth

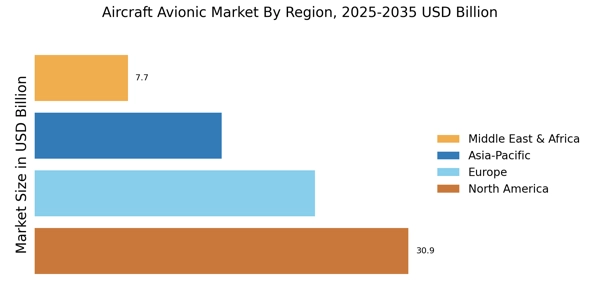

The aircraft avionic Market is poised for growth in emerging markets, where increasing air travel demand is driving investments in aviation infrastructure. Countries in Asia-Pacific, the Middle East, and Africa are experiencing a rise in air traffic, prompting airlines to expand their fleets and upgrade their avionics systems. This trend is supported by government initiatives aimed at enhancing aviation capabilities and safety standards. For instance, the International Air Transport Association (IATA) projects that air passenger numbers in Asia-Pacific will double by 2037, necessitating significant investments in avionics. Consequently, the Aircraft Avionic Market is likely to benefit from this regional growth, as manufacturers seek to capitalize on the expanding opportunities in these markets.

Technological Advancements in Avionics

The Aircraft Avionic Market is experiencing rapid technological advancements that are reshaping the landscape of aviation. Innovations such as fly-by-wire systems, advanced navigation technologies, and enhanced cockpit displays are becoming increasingly prevalent. These advancements not only improve aircraft safety and efficiency but also enhance pilot situational awareness. The integration of artificial intelligence and machine learning into avionics systems is expected to further streamline operations and reduce human error. According to industry estimates, the avionics market is projected to grow at a compound annual growth rate of approximately 5.5% over the next several years, driven by these technological innovations. As manufacturers invest in research and development, the Aircraft Avionic Market is likely to witness a surge in new product offerings, catering to the evolving needs of airlines and operators.

Regulatory Compliance and Safety Standards

The Aircraft Avionic Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations are designed to ensure the safety and reliability of avionics systems, which are critical for aircraft operation. Compliance with these standards often necessitates upgrades and retrofits of existing systems, thereby driving demand for new avionics technologies. The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) continuously update their regulations to incorporate the latest safety protocols, which in turn compels manufacturers to innovate. As a result, the Aircraft Avionic Market is expected to see a steady increase in investments aimed at meeting these regulatory requirements, fostering a culture of safety and reliability in aviation.

Increased Demand for Connectivity Solutions

The Aircraft Avionic Market is witnessing a surge in demand for connectivity solutions, driven by the need for enhanced passenger experience and operational efficiency. Airlines are increasingly adopting in-flight connectivity systems to provide passengers with internet access and entertainment options, which has become a competitive differentiator. The market for in-flight connectivity is projected to grow significantly, with estimates suggesting a potential increase of over 10% annually. This demand is not only limited to passenger services; operational connectivity solutions are also gaining traction, allowing airlines to monitor aircraft performance in real-time. As connectivity becomes a standard expectation among travelers, the Aircraft Avionic Market is likely to evolve, with manufacturers focusing on developing advanced communication systems that meet these growing demands.

Sustainability and Environmental Considerations

The Aircraft Avionic Market is increasingly influenced by sustainability and environmental considerations, as the aviation sector seeks to reduce its carbon footprint. There is a growing emphasis on developing avionics systems that support fuel-efficient operations and minimize environmental impact. Innovations such as advanced flight management systems and eco-friendly navigation technologies are being prioritized to enhance operational efficiency. Additionally, regulatory bodies are introducing incentives for airlines that adopt sustainable practices, further driving the demand for eco-friendly avionics solutions. As the industry moves towards a more sustainable future, the Aircraft Avionic Market is expected to see a shift in focus towards technologies that align with environmental goals, potentially reshaping product development and market strategies.