Growing Focus on Energy Efficiency

Energy efficiency has become a paramount concern in the Advanced Chip Packaging Market, as manufacturers strive to reduce power consumption in electronic devices. The increasing awareness of environmental sustainability and the need for energy-efficient solutions are prompting companies to invest in advanced packaging technologies that minimize energy loss. For example, the implementation of advanced thermal management techniques in chip packaging can lead to significant reductions in energy consumption, which is crucial for battery-operated devices. The market for energy-efficient packaging solutions is expected to witness a robust growth trajectory, with estimates suggesting a potential increase in demand by over 15% annually. This focus on energy efficiency not only aligns with The Advanced Chip Packaging Industry.

Expansion of Automotive Electronics

The expansion of automotive electronics is a key driver for the Advanced Chip Packaging Market, as the automotive sector increasingly incorporates advanced technologies to enhance vehicle performance and safety. With the rise of electric vehicles (EVs) and autonomous driving systems, the demand for sophisticated semiconductor solutions is escalating. Advanced chip packaging plays a vital role in enabling the integration of various electronic components, such as sensors, controllers, and communication systems, within vehicles. The automotive semiconductor market is projected to grow significantly, with estimates indicating a potential increase of over 20% in the next five years. This growth is likely to propel the Advanced Chip Packaging Market, as manufacturers seek innovative packaging solutions to meet the stringent requirements of automotive applications.

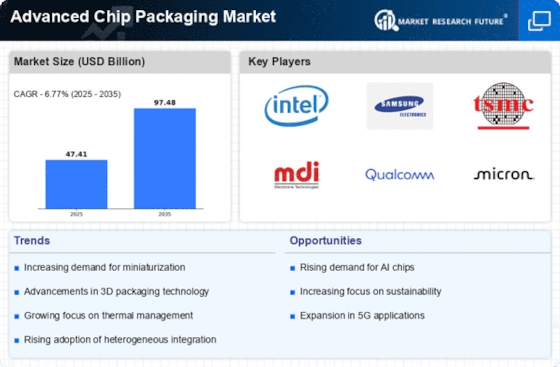

Rising Demand for High-Performance Electronics

The Advanced Chip Packaging Market is experiencing a surge in demand for high-performance electronics, driven by the proliferation of smart devices and the Internet of Things (IoT). As consumers increasingly seek faster and more efficient devices, manufacturers are compelled to adopt advanced packaging techniques that enhance performance while minimizing size. This trend is reflected in the projected growth of the semiconductor market, which is expected to reach USD 1 trillion by 2030. Advanced chip packaging plays a crucial role in meeting these performance requirements, as it allows for better thermal management and signal integrity, thereby supporting the development of next-generation electronics. Consequently, the Advanced Chip Packaging Market is poised for substantial growth as it aligns with the evolving needs of the electronics sector.

Increased Investment in Research and Development

Increased investment in research and development (R&D) is a driving force behind the growth of the Advanced Chip Packaging Market. As companies strive to maintain a competitive edge, they are allocating substantial resources to explore new packaging technologies and materials. This focus on R&D is essential for addressing the challenges posed by miniaturization and the demand for higher performance in semiconductor devices. Industry players are collaborating with research institutions and universities to foster innovation and accelerate the development of next-generation packaging solutions. The global investment in semiconductor R&D is expected to reach USD 100 billion by 2026, indicating a strong commitment to advancing the capabilities of the Advanced Chip Packaging Market. This trend not only enhances technological advancements but also supports the overall growth of the semiconductor ecosystem.

Technological Advancements in Packaging Solutions

Technological advancements are significantly influencing the Advanced Chip Packaging Market, as innovations in packaging solutions enable the development of more compact and efficient semiconductor devices. Techniques such as 3D packaging, system-in-package (SiP), and fan-out wafer-level packaging (FOWLP) are gaining traction due to their ability to enhance performance and reduce manufacturing costs. For instance, the adoption of 3D packaging is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. These advancements not only improve device performance but also facilitate the integration of multiple functionalities within a single package, thereby catering to the increasing complexity of modern electronic applications. As a result, the Advanced Chip Packaging Market is likely to benefit from these technological innovations, driving further investment and research in the field.