Enhanced Diagnostic Techniques

The development of enhanced diagnostic techniques is playing a crucial role in the Acute Intermittent Porphyria Market. Improved methods for diagnosing AIP, such as advanced genetic testing and biomarker identification, are facilitating earlier and more accurate detection of the disease. This advancement is essential, as timely diagnosis can significantly impact patient management and treatment outcomes. The increased accuracy of diagnostic tools is likely to lead to a higher rate of confirmed cases, thereby expanding the patient population in need of treatment. Furthermore, as diagnostic technologies evolve, they may also contribute to the understanding of AIP pathophysiology, potentially leading to new therapeutic targets and strategies.

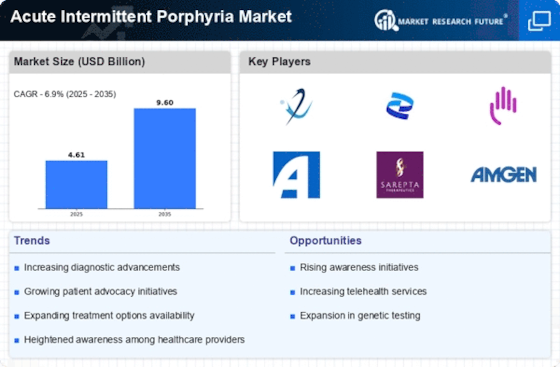

Innovative Therapeutic Developments

The Acute Intermittent Porphyria Market is witnessing a surge in innovative therapeutic developments. Recent advancements in gene therapy and small molecule drugs are showing promise in managing AIP symptoms and reducing attack frequency. For instance, therapies targeting the heme biosynthesis pathway are under investigation, which could potentially transform treatment paradigms. The introduction of novel therapies not only enhances patient outcomes but also attracts investment and research funding, further propelling market growth. As pharmaceutical companies invest in research and development, the pipeline for new treatments is expanding, indicating a robust future for the market. This innovation is crucial, as existing treatment options may not be effective for all patients, highlighting the need for diverse therapeutic strategies.

Rising Patient Advocacy and Support Groups

The emergence of patient advocacy and support groups is influencing the Acute Intermittent Porphyria Market positively. These organizations play a vital role in raising awareness about AIP, educating patients and healthcare providers, and advocating for better treatment options. Their efforts are likely to lead to increased recognition of the disease, which could result in more individuals seeking diagnosis and treatment. Additionally, these groups often collaborate with researchers and pharmaceutical companies to promote clinical trials and research initiatives, thereby enhancing the overall landscape of AIP management. As patient voices become more prominent, the market may see a shift towards more patient-centered care approaches, ultimately benefiting those affected by AIP.

Growing Investment in Rare Disease Research

Investment in research focused on rare diseases, including Acute Intermittent Porphyria Market, is a significant driver for the Acute Intermittent Porphyria Market. Governments and private entities are increasingly recognizing the importance of funding research initiatives aimed at understanding and treating rare conditions. This trend is evidenced by the allocation of substantial grants and resources to AIP research, which could lead to breakthroughs in treatment and management. The financial backing not only supports clinical trials but also fosters collaboration among academic institutions, pharmaceutical companies, and healthcare providers. As a result, the market is likely to benefit from enhanced research output, leading to improved diagnostic tools and therapeutic options for AIP patients.

Increasing Prevalence of Acute Intermittent Porphyria

The rising incidence of Acute Intermittent Porphyria Market (AIP) is a notable driver for the Acute Intermittent Porphyria Market. Recent estimates suggest that AIP affects approximately 1 in 20,000 individuals, with a higher prevalence in certain populations. This increasing prevalence is likely to lead to a greater demand for diagnostic and therapeutic options, thereby expanding the market. As awareness grows among healthcare professionals and patients, more individuals are being diagnosed, which could further stimulate market growth. The need for specialized care and management of AIP symptoms is becoming increasingly recognized, indicating a potential for new treatment modalities and healthcare services tailored to this condition. Consequently, the market is poised for expansion as healthcare systems adapt to meet the needs of this patient population.