Rising Applications in Oil and Gas Sector

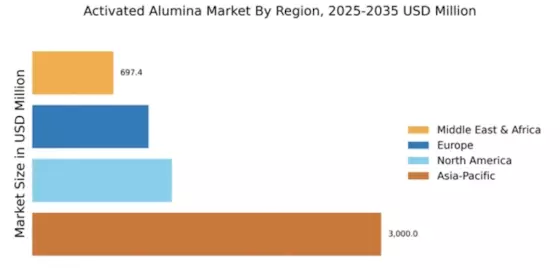

The Global Activated Alumina Market Industry is witnessing a notable rise in applications within the oil and gas sector. Activated alumina is employed as a desiccant and adsorbent in the refining process, where it aids in the removal of impurities and moisture from hydrocarbons. This application is particularly critical as the industry seeks to enhance efficiency and reduce operational costs. The anticipated growth of the oil and gas sector, coupled with the increasing emphasis on sustainability, suggests a promising future for activated alumina. As the market evolves, it is expected to contribute significantly to the projected market value of 2.56 USD Billion by 2035.

Expanding Use in Pharmaceutical Applications

The Global Activated Alumina Market Industry is experiencing an expansion in the use of activated alumina within pharmaceutical applications. Its properties as an adsorbent make it suitable for various processes, including drug formulation and purification. The pharmaceutical sector's continuous growth, driven by increasing healthcare needs and innovation, is likely to enhance the demand for activated alumina. As regulatory bodies enforce stricter quality control measures, the reliance on high-purity activated alumina is expected to rise. This trend may further solidify the market's position, contributing to the overall growth and development of the industry.

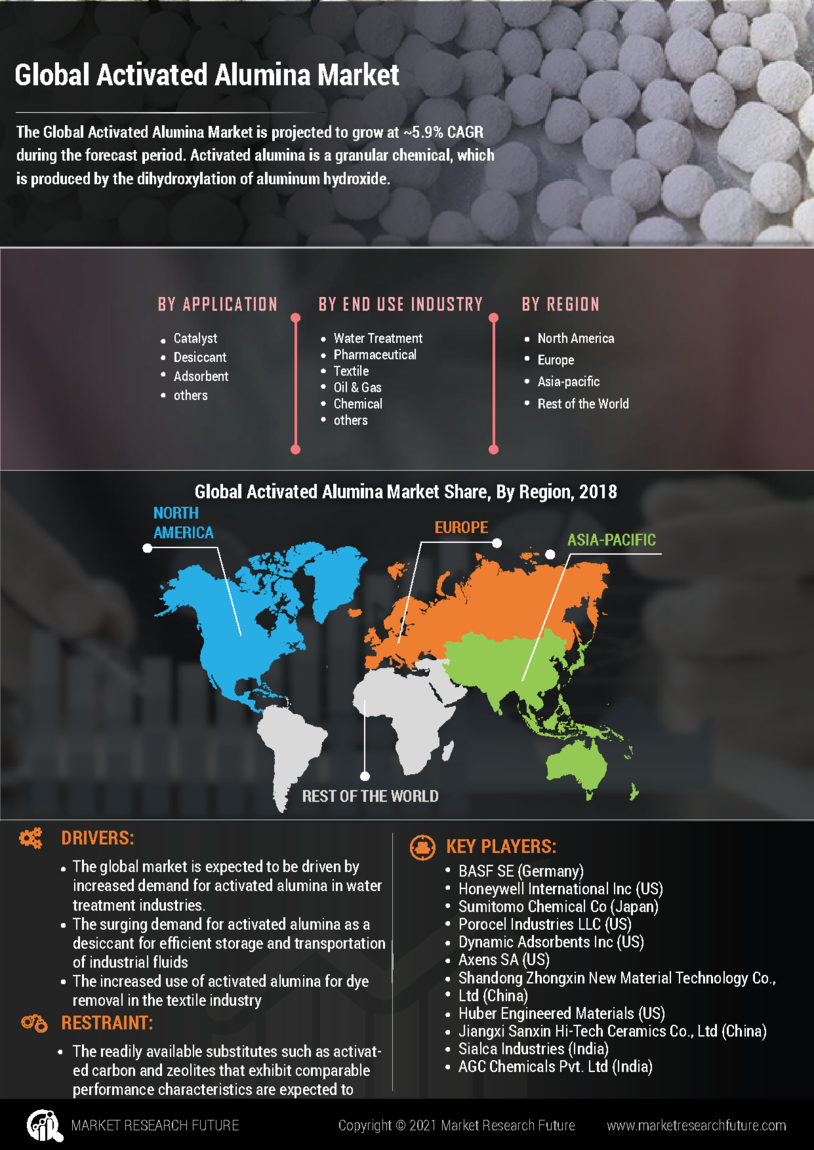

Increasing Demand for Water Treatment Solutions

The Global Activated Alumina Market Industry is experiencing a surge in demand for water treatment solutions, driven by the growing need for clean and safe drinking water. Activated alumina is widely utilized in the removal of fluoride, arsenic, and other contaminants from water. As urbanization progresses and industrial activities expand, the pressure on water resources intensifies. This trend is reflected in the projected market value of 1.29 USD Billion in 2024, indicating a robust growth trajectory. Furthermore, the increasing regulatory focus on water quality standards is likely to propel the adoption of activated alumina in various regions, enhancing its market presence.

Technological Advancements in Production Methods

Technological advancements in the production methods of activated alumina are playing a pivotal role in shaping the Global Activated Alumina Market Industry. Innovations in manufacturing processes are enhancing the quality and efficiency of activated alumina, making it more accessible for various applications. For instance, the development of more efficient calcination techniques is likely to reduce energy consumption and production costs. This improvement not only benefits manufacturers but also encourages wider adoption across industries. As these advancements continue to unfold, they may contribute to the expected compound annual growth rate of 6.44% from 2025 to 2035, reflecting a dynamic market landscape.

Growing Awareness of Environmental Sustainability

The Global Activated Alumina Market Industry is increasingly influenced by the growing awareness of environmental sustainability. As industries and consumers alike prioritize eco-friendly solutions, activated alumina emerges as a viable option due to its recyclable nature and minimal environmental impact. This trend is particularly evident in sectors such as pharmaceuticals and food processing, where stringent regulations on waste management are in place. The shift towards sustainable practices is likely to drive demand for activated alumina, as companies seek to align with environmental standards. Consequently, this heightened awareness may bolster the market's growth trajectory in the coming years.