Growth in End-Use Industries

The Acetyls Market is significantly influenced by the growth of end-use industries such as automotive, construction, and pharmaceuticals. The automotive sector, in particular, is increasingly utilizing acetyls in the production of lightweight materials and coatings, which enhance fuel efficiency and reduce emissions. In 2023, the automotive industry accounted for nearly 30% of the total acetyls consumption, reflecting a robust demand for innovative materials. Additionally, the construction industry is adopting acetyls for adhesives and sealants, further driving market growth. The pharmaceutical sector also contributes to this trend, as acetyls are essential in the synthesis of various active pharmaceutical ingredients. This diverse application across multiple industries indicates a promising trajectory for the Acetyls Market.

Rising Demand for Acetic Acid

The Acetyls Market is experiencing a notable increase in demand for acetic acid, a primary derivative of acetyls. This surge is largely driven by its extensive use in the production of various chemicals, including vinyl acetate monomer and acetic anhydride. In 2023, the consumption of acetic acid reached approximately 16 million metric tons, with projections indicating a steady growth rate of around 4% annually. This trend suggests that the Acetyls Market is poised for expansion, as acetic acid serves as a critical feedstock in the manufacturing of plastics, textiles, and food additives. Furthermore, the rising demand for eco-friendly products is likely to bolster the market, as manufacturers seek sustainable alternatives that utilize acetic acid in their formulations.

Technological Advancements in Production

Technological advancements in the production processes of acetyls are playing a pivotal role in shaping the Acetyls Market. Innovations such as improved catalytic processes and energy-efficient methods are enhancing production efficiency and reducing costs. For instance, the development of new catalysts has led to higher yields of acetic acid, which is a key component in the acetyls market. In 2023, several major producers reported a 15% increase in production efficiency due to these advancements. This not only supports the growing demand but also aligns with sustainability goals by minimizing waste and energy consumption. As these technologies continue to evolve, they are likely to further propel the Acetyls Market into a new era of productivity and environmental responsibility.

Expanding Applications in Emerging Markets

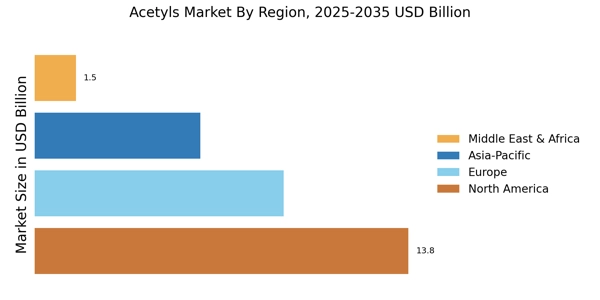

The Acetyls Market is witnessing an expansion of applications in emerging markets, particularly in Asia-Pacific and Latin America. These regions are experiencing rapid industrialization and urbanization, leading to increased demand for acetyls in various sectors. For instance, the rise of the consumer goods industry in these areas is driving the need for acetyl-based products in packaging and textiles. In 2023, the Asia-Pacific region accounted for over 40% of the total acetyls consumption, highlighting its significance in the global market. This trend suggests that as emerging markets continue to develop, the Acetyls Market will likely see substantial growth opportunities, driven by the diversification of applications and rising consumer demand.

Regulatory Support for Sustainable Practices

The Acetyls Market is benefiting from increasing regulatory support aimed at promoting sustainable production practices. Governments are implementing stringent regulations that encourage the use of renewable resources and environmentally friendly processes in chemical manufacturing. In 2023, several countries introduced incentives for companies that adopt green technologies in the production of acetyls. This regulatory landscape is fostering innovation and investment in sustainable practices, which are becoming essential for market competitiveness. As companies strive to comply with these regulations, the Acetyls Market is likely to witness a shift towards more sustainable production methods, ultimately enhancing its reputation and market appeal.