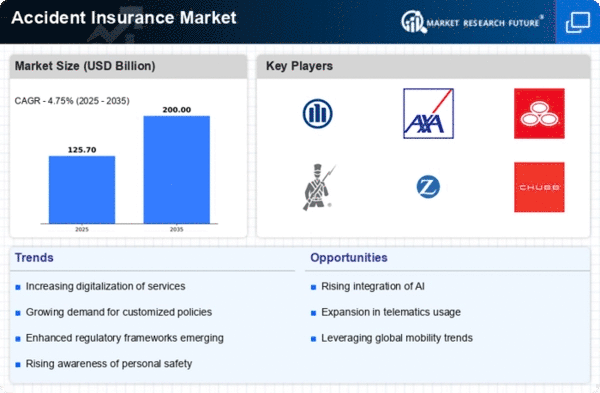

The Accident Insurance Market is currently experiencing a dynamic evolution, driven by various factors that shape consumer preferences and industry practices. As awareness regarding the importance of personal safety and financial protection grows, individuals are increasingly seeking comprehensive coverage options. This heightened demand is prompting insurers to innovate their offerings, tailoring policies to meet the diverse needs of clients. Moreover, advancements in technology are facilitating the development of more efficient claims processing systems, enhancing customer experience and satisfaction. Insurers are also leveraging data analytics to better understand risk profiles, which may lead to more personalized premium pricing and coverage options. In addition to technological advancements, regulatory changes are influencing the Accident Insurance Market landscape. Governments are implementing stricter safety regulations, which could potentially increase the demand for accident insurance as businesses and individuals strive to comply with these standards. Furthermore, the rise of the gig economy is reshaping the market, as more individuals engage in freelance work and require flexible insurance solutions. Overall, the Accident Insurance Market appears poised for growth, with evolving consumer needs and regulatory frameworks driving innovation and competition among providers.

Technological Integration

The integration of technology within the Accident Insurance Market is transforming how insurers operate and interact with clients. Digital platforms and mobile applications are becoming commonplace, allowing for seamless policy management and claims submission. This trend not only enhances customer convenience but also streamlines administrative processes, potentially reducing operational costs for insurers.

Regulatory Influences

Regulatory changes are playing a crucial role in shaping the Accident Insurance Market. Governments are increasingly focusing on safety standards and compliance measures, which may lead to heightened demand for accident insurance products. Insurers must adapt to these evolving regulations, ensuring that their offerings align with legal requirements while also addressing consumer needs.

Gig Economy Impact

The rise of the gig economy is significantly influencing the Accident Insurance Market. As more individuals engage in freelance and contract work, there is a growing need for flexible insurance solutions that cater to non-traditional employment. Insurers are likely to develop tailored products that address the unique risks associated with gig work, thereby expanding their market reach.