Regulatory Changes and Compliance

Regulatory changes play a crucial role in shaping the personal accident-health-insurance market. In Germany, the government has implemented various reforms aimed at enhancing consumer protection and ensuring fair practices within the insurance industry. These regulations often require insurers to maintain higher levels of transparency and accountability, which can lead to increased operational costs. However, compliance with these regulations also fosters consumer trust, encouraging more individuals to invest in personal accident and health insurance. The market is expected to adapt to these regulatory frameworks, with insurers likely to innovate their product offerings to align with compliance requirements. As a result, the personal accident-health-insurance market may experience a shift towards more standardized and consumer-friendly policies.

Rising Awareness of Personal Safety

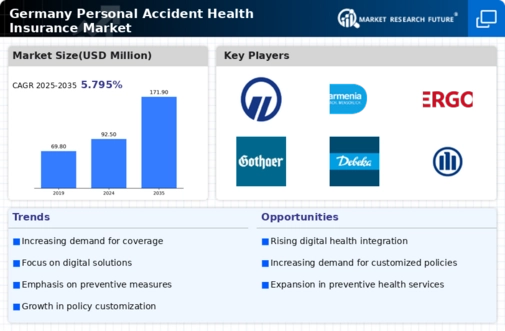

The increasing awareness of personal safety among the German population is a significant driver for the personal accident-health-insurance market. As individuals become more conscious of the risks associated with daily activities, there is a growing inclination to secure insurance coverage that protects against unforeseen accidents. This trend is reflected in the rising number of policyholders, with estimates suggesting that the market has seen a growth rate of approximately 5% annually. Furthermore, educational campaigns and public initiatives aimed at promoting safety practices contribute to this heightened awareness, leading to a greater demand for comprehensive accident and health insurance products. Consequently, insurers are adapting their offerings to meet the evolving needs of consumers, thereby enhancing the overall competitiveness of the personal accident-health-insurance market.

Aging Population and Health Concerns

The aging population in Germany is a significant driver of the personal accident-health-insurance market. As the demographic landscape shifts, there is an increasing prevalence of health-related issues among older adults, leading to a heightened demand for insurance products that cater to their specific needs. Statistics indicate that by 2030, approximately 25% of the German population will be over 65 years old, which underscores the necessity for tailored insurance solutions. Insurers are responding to this trend by developing specialized policies that address the unique risks associated with aging, such as falls and chronic illnesses. This demographic shift is likely to create new opportunities for growth within the personal accident-health-insurance market, as more individuals seek coverage to safeguard their health and financial well-being.

Economic Factors and Consumer Spending

Economic factors significantly influence the personal accident-health-insurance market in Germany. As the economy experiences fluctuations, consumer spending patterns shift, impacting the willingness to invest in insurance products. In times of economic growth, individuals are more likely to allocate funds towards personal accident and health insurance, viewing it as a necessary safeguard. Conversely, during economic downturns, there may be a tendency to prioritize essential expenses over insurance premiums. Current economic indicators suggest a stable growth trajectory, which could lead to increased disposable income for consumers. This economic stability may encourage more individuals to consider personal accident-health-insurance as a vital component of their financial planning, thereby driving demand in the market.

Technological Advancements in Insurance

Technological advancements are reshaping the landscape of the personal accident-health-insurance market in Germany. The integration of digital tools and platforms facilitates more efficient policy management and claims processing, which appeals to tech-savvy consumers. Innovations such as mobile applications and online portals enable customers to access their insurance information conveniently, leading to increased customer satisfaction. Moreover, data analytics allows insurers to better assess risk and tailor their products accordingly. Reports indicate that the adoption of technology in the insurance sector has the potential to reduce operational costs by up to 20%, thereby allowing companies to offer more competitive premiums. This technological evolution is likely to attract a broader customer base, further stimulating growth in the personal accident-health-insurance market.