Rising Business Travel Activities

The Business Travel Accident Insurance Market is experiencing a notable surge in demand due to the increasing frequency of business travel activities. As companies expand their operations internationally, the need for comprehensive insurance coverage for employees traveling abroad becomes paramount. In 2025, it is estimated that business travel expenditures will reach approximately 1.5 trillion USD, reflecting a robust growth trajectory. This trend indicates that organizations are prioritizing the safety and security of their workforce, thereby driving the demand for business travel accident insurance. Companies are recognizing that providing adequate insurance not only protects employees but also enhances their overall travel experience, which is likely to foster loyalty and productivity. Consequently, this rising trend in business travel activities is a significant driver for the Business Travel Accident Insurance Market.

Increased Awareness of Employee Safety

The Business Travel Accident Insurance Market is witnessing a heightened awareness of employee safety and well-being among organizations. As businesses recognize the potential risks associated with travel, there is a growing commitment to ensuring the safety of their employees. This awareness is reflected in the increasing allocation of resources towards comprehensive insurance coverage. In 2025, it is estimated that companies will invest over 200 billion USD in employee safety initiatives, including business travel accident insurance. This trend indicates a shift in corporate culture, where employee welfare is prioritized, and adequate insurance coverage is viewed as a fundamental component of travel policies. Consequently, this increased awareness of employee safety is a significant driver for the Business Travel Accident Insurance Market, as organizations strive to protect their most valuable asset—their workforce.

Technological Advancements in Insurance

The Business Travel Accident Insurance Market is being propelled by rapid technological advancements that enhance the efficiency and accessibility of insurance products. Innovations such as artificial intelligence, machine learning, and data analytics are transforming how insurance providers assess risks and tailor policies. In 2025, it is anticipated that the integration of technology in insurance solutions will lead to a 15% increase in policy uptake among businesses. These advancements enable insurers to offer more personalized coverage options, streamline claims processing, and improve customer service. As companies increasingly seek to leverage technology to optimize their operations, the demand for technologically integrated business travel accident insurance solutions is likely to grow. This trend not only benefits insurers but also enhances the overall experience for businesses and their traveling employees.

Regulatory Compliance and Risk Management

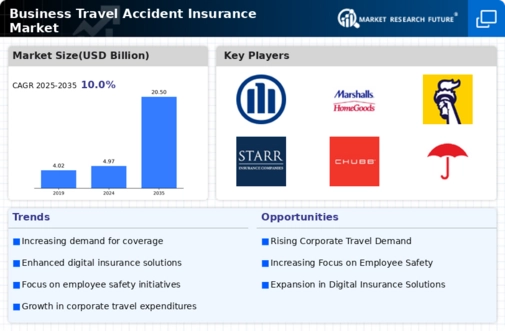

The Business Travel Accident Insurance Market is significantly influenced by the increasing emphasis on regulatory compliance and risk management. Organizations are becoming more aware of their legal obligations to protect employees during business travel. In many jurisdictions, there are stringent regulations mandating that employers provide adequate insurance coverage for their traveling employees. This regulatory landscape compels companies to invest in business travel accident insurance to mitigate potential liabilities. Furthermore, as businesses face heightened scrutiny regarding their risk management practices, the demand for comprehensive insurance solutions is likely to rise. In 2025, it is projected that the market for business travel accident insurance will grow by approximately 8% annually, driven by the need for compliance and effective risk management strategies. This trend underscores the critical role of insurance in safeguarding both employees and organizations.

Customization and Flexibility in Insurance Products

The Business Travel Accident Insurance Market is evolving towards greater customization and flexibility in insurance products. As businesses operate in diverse environments, the one-size-fits-all approach to insurance is becoming less viable. Companies are increasingly seeking tailored insurance solutions that address their specific needs and risks associated with business travel. In 2025, it is projected that the demand for customizable insurance products will grow by approximately 12%, as organizations aim to align their insurance coverage with their unique travel policies. This trend is indicative of a broader shift towards personalized services in the insurance sector, where flexibility and adaptability are paramount. As a result, the Business Travel Accident Insurance Market is likely to benefit from this demand for customized solutions, enabling insurers to cater to a wider range of client requirements.