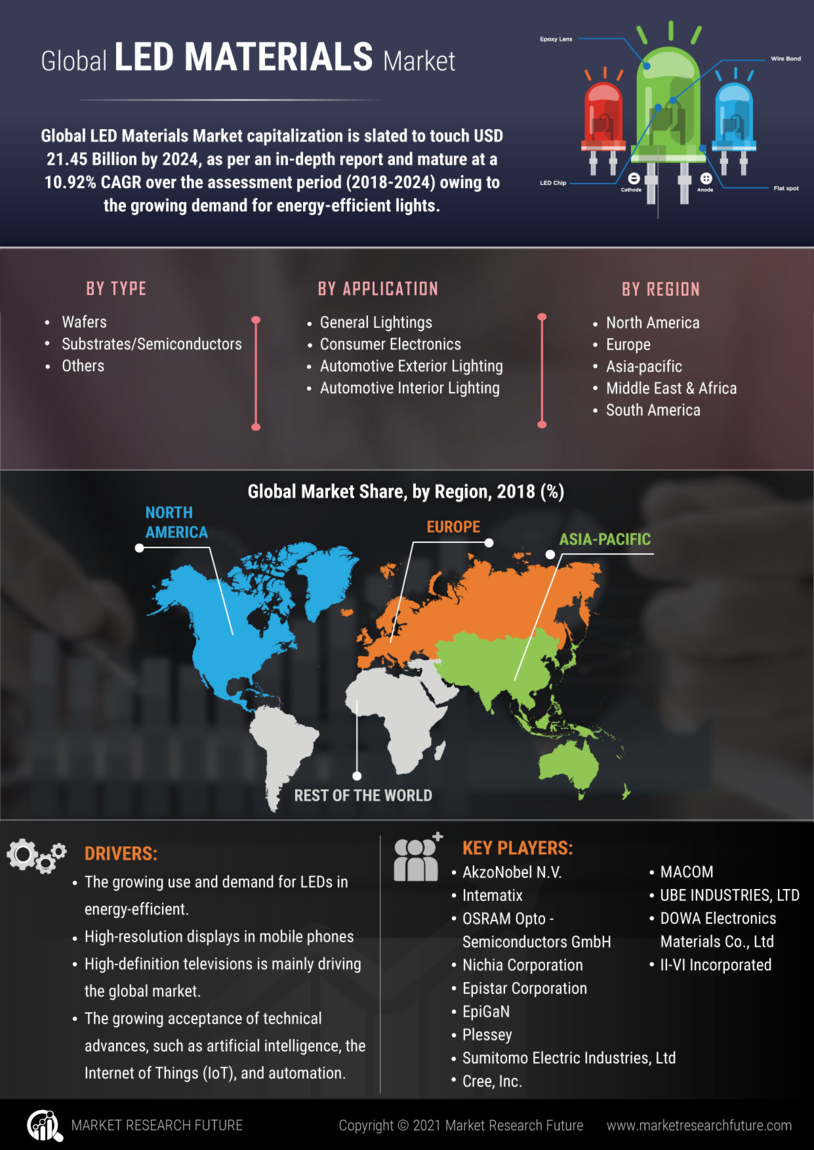

Market Growth Projections

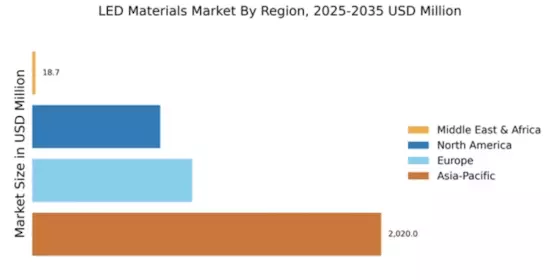

The Global LED Materials Market Industry is poised for substantial growth, with projections indicating a market size of 33.7 USD Billion by 2035. The anticipated compound annual growth rate (CAGR) of 12.04% from 2025 to 2035 reflects the increasing adoption of LED technology across various applications. This growth is underpinned by factors such as rising energy costs, advancements in LED manufacturing, and supportive government policies. The market's expansion is expected to create numerous opportunities for stakeholders, including manufacturers, suppliers, and end-users, as the demand for LED materials continues to rise globally.

Rising Demand for Energy Efficiency

The Global LED Materials Market Industry experiences a notable surge in demand driven by the increasing emphasis on energy efficiency. Governments worldwide are implementing stringent regulations aimed at reducing energy consumption, which propels the adoption of LED technology. For instance, the transition from traditional lighting solutions to LED alternatives is projected to save approximately 50% of energy usage. As a result, the Global LED Materials Market is expected to reach 9.65 USD Billion in 2024, reflecting a growing recognition of the environmental and economic benefits associated with LED materials.

Government Initiatives and Incentives

Government initiatives and incentives play a crucial role in fostering the growth of the Global LED Materials Market Industry. Various countries are introducing subsidies and tax incentives to encourage the adoption of LED technology in residential, commercial, and industrial sectors. For instance, programs aimed at retrofitting existing lighting systems with LED solutions are gaining traction, thereby enhancing market penetration. These supportive measures not only stimulate demand but also align with broader sustainability goals, indicating a favorable environment for the LED materials market to flourish in the coming years.

Growing Applications in Diverse Sectors

The versatility of LED materials leads to their growing applications across various sectors, which significantly drives the Global LED Materials Market Industry. From automotive lighting to consumer electronics and architectural lighting, the adaptability of LED technology caters to a wide range of needs. The increasing integration of LED solutions in smart city initiatives further amplifies this trend, as urban planners seek energy-efficient lighting solutions. This diversification of applications is expected to contribute to a compound annual growth rate (CAGR) of 12.04% from 2025 to 2035, underscoring the market's potential for sustained growth.

Technological Advancements in LED Manufacturing

Technological innovations in the manufacturing processes of LED materials significantly contribute to the growth of the Global LED Materials Market Industry. Advances such as improved semiconductor materials and enhanced production techniques lead to higher efficiency and lower costs. For example, the development of quantum dot technology has the potential to revolutionize LED performance, offering brighter and more vibrant colors. This ongoing evolution in manufacturing capabilities is likely to sustain a robust growth trajectory, with projections indicating a market expansion to 33.7 USD Billion by 2035, highlighting the importance of continuous innovation in this sector.

Consumer Awareness and Preference for Sustainable Products

There is a marked increase in consumer awareness regarding sustainability, which positively influences the Global LED Materials Market Industry. As consumers become more environmentally conscious, their preference for sustainable products drives the demand for LED lighting solutions. This shift in consumer behavior is evident in the rising sales of energy-efficient lighting options, as individuals seek to reduce their carbon footprint. Retailers are responding by expanding their LED product offerings, further enhancing market accessibility. This growing consumer inclination towards sustainability is likely to bolster the market's growth trajectory in the foreseeable future.