Market Trends

Key Emerging Trends in the 4K TV Market

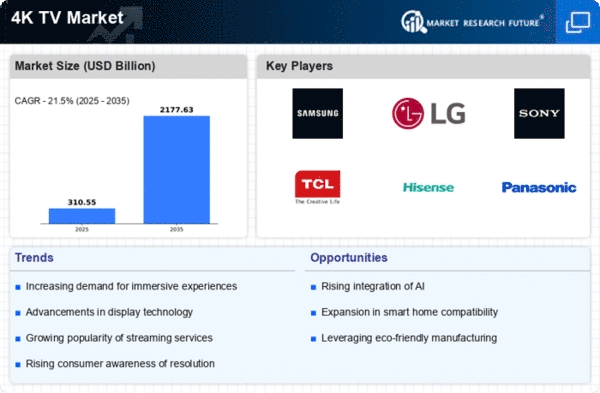

The worldwide 4K TV marketplace has been experiencing super trends that might be shaping the panorama of the TV industry. One of the most enormous traits is the increasing purchaser demand for better-resolution displays. As generation advances, visitors are looking for extra immersive and visually lovely stories, using the adoption of 4K TVs. The demand for extremely excessive-definition (UHD) content, including streaming services, gaming, and extremely good video production, has contributed to the boom of the 4K TV marketplace. A critical component of the market trend is the combination of smart functions in 4K TVs. As connectivity and smart domestic ecosystems end up fundamental elements of current residing, clients are increasingly inclined toward clever TVs that offer a range of online streaming services, apps, and seamless integration with other smart devices. Another notable trend within the global 4K TV market is continuous price discounts. As manufacturing approaches emerge as more efficient and production scales up, the price of 4K TVs has been steadily lowering. This rate discount has made 4K TVs more reachable to a broader customer base, fostering increased adoption across diverse demographics. The marketplace trend additionally reflects a shift towards large display screen sizes. With clients in search of a greater cinematic and immersive viewing experience at home, there is a developing desire for large 4K TVs. The market is witnessing the advent of large display screen alternatives, ranging from fifty-five inches to properly over seventy-five inches, as manufacturers intend to cater to the demand for expansive displays that can mirror the feel of a movie theater within the consolation of one's living room. Furthermore, the global 4K TV market is witnessing advancements in show technology. Manufacturers are incorporating features together with high dynamic variety (HDR) and extensive shade gamut (WCG) to decorate the general visual enjoyment. HDR generation permits a broader range of contrast and brightness, resulting in extra vivid and practical images. At the same time, WCG expands the spectrum of colors, contributing to a greater immersive viewing reveal.

Leave a Comment