Emergence of Smart Cities

The development of smart cities is emerging as a significant driver for the 4G Equipment Market. As urban areas evolve to incorporate advanced technologies for improved efficiency and sustainability, the demand for reliable communication networks becomes paramount. Smart city initiatives often rely on 4G connectivity to support various applications, including traffic management, public safety, and environmental monitoring. The integration of these technologies necessitates a robust 4G infrastructure, which in turn fuels the growth of the 4G Equipment Market. As more cities adopt smart technologies, the demand for 4G equipment is expected to rise correspondingly.

Expansion of IoT Applications

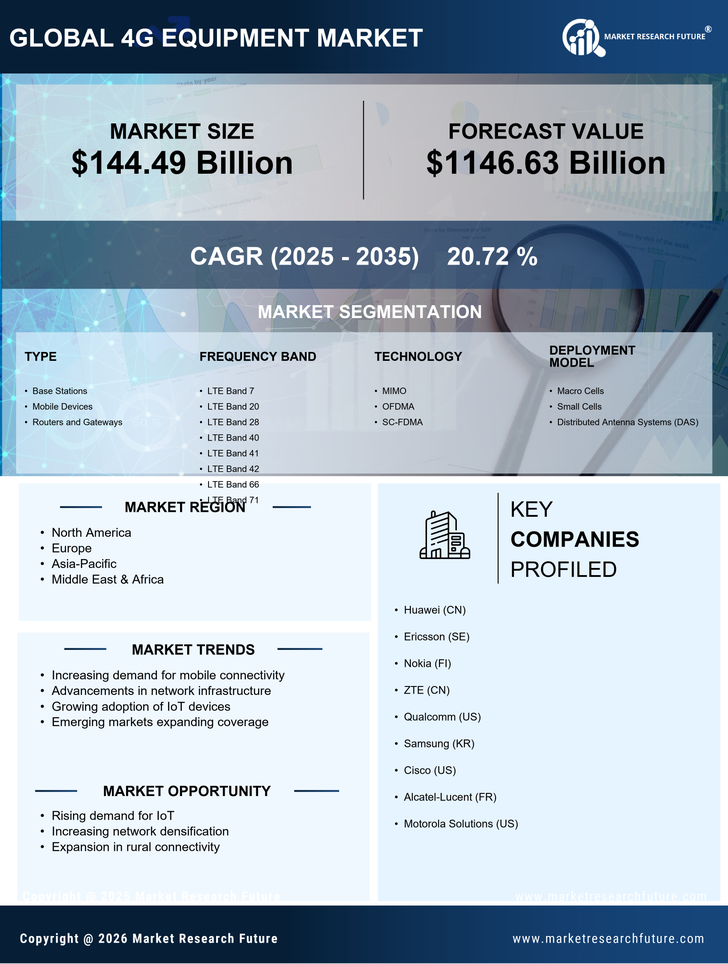

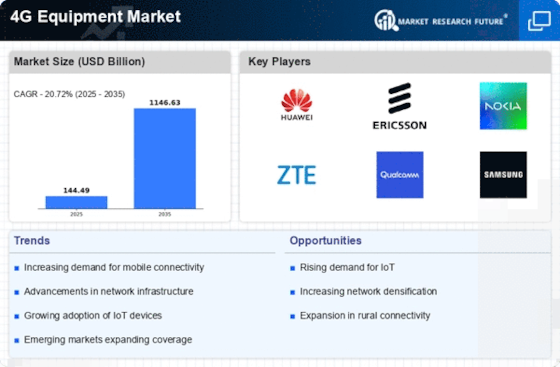

The proliferation of Internet of Things (IoT) devices is significantly influencing the 4G Equipment Market. As more devices become interconnected, the demand for reliable and fast mobile networks intensifies. It is projected that the number of IoT devices will reach billions in the next few years, creating a substantial need for 4G connectivity. This expansion not only drives the demand for 4G equipment but also encourages innovation in network technologies. The 4G Equipment Market must adapt to support the unique requirements of IoT applications, which often require low latency and high reliability, further stimulating market growth.

Rising Mobile Data Consumption

The increasing reliance on mobile devices for internet access is a primary driver of the 4G Equipment Market. As consumers and businesses alike demand higher data speeds and more reliable connections, the need for advanced 4G equipment becomes evident. Reports indicate that mobile data traffic is expected to grow exponentially, with estimates suggesting a compound annual growth rate of over 30% in the coming years. This surge in data consumption necessitates the deployment of robust 4G infrastructure, thereby propelling the market forward. The 4G Equipment Market is thus positioned to benefit from this trend, as service providers invest in upgrading their networks to meet consumer expectations.

Competitive Landscape and Market Dynamics

The competitive landscape within the telecommunications sector is a driving force for the 4G Equipment Market. As service providers strive to differentiate themselves, there is a heightened focus on enhancing network capabilities and customer experience. This competition encourages innovation and investment in advanced 4G technologies, as companies seek to offer superior services. Market dynamics, including pricing strategies and service offerings, play a crucial role in shaping the 4G Equipment Market. The ongoing rivalry among providers is likely to lead to further advancements in equipment and infrastructure, ultimately benefiting consumers and businesses alike.

Increased Investment in Telecommunications Infrastructure

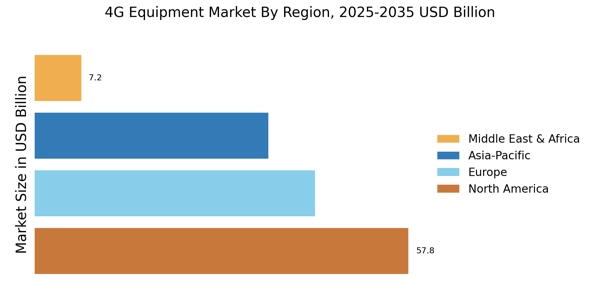

Investment in telecommunications infrastructure is a crucial factor driving the 4G Equipment Market. Governments and private entities are recognizing the importance of robust communication networks for economic development. Recent data indicates that investments in telecommunications are projected to exceed several billion dollars annually, as countries strive to enhance their connectivity. This influx of capital is likely to facilitate the deployment of advanced 4G equipment, ensuring that networks can handle the growing demand for mobile services. The 4G Equipment Market stands to gain from these investments, as they enable service providers to upgrade and expand their networks.