3D Animation Market Summary

As per Market Research Future analysis, the 3D Animation Market Size was estimated at 24.11 USD Billion in 2024. The 3D Animation industry is projected to grow from 26.93 USD Billion in 2025 to 81.41 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The 3D Animation Market is experiencing robust growth driven by technological advancements and increasing consumer engagement.

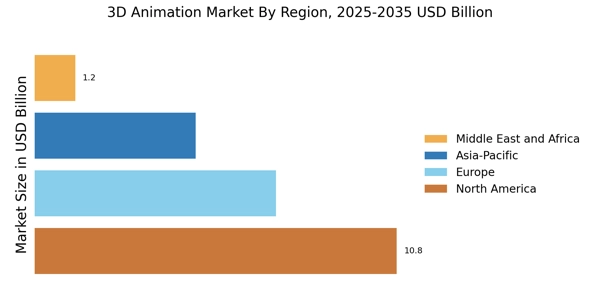

- North America remains the largest market for 3D animation, driven by high demand in entertainment and media.

- Asia-Pacific is the fastest-growing region, reflecting a surge in digital content creation and consumption.

- The software segment dominates the market, while the services segment is witnessing rapid growth due to evolving consumer needs.

- Rising demand in entertainment and media, along with advancements in technology, are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 24.11 (USD Billion) |

| 2035 Market Size | 81.41 (USD Billion) |

| CAGR (2025 - 2035) | 11.7% |

Major Players

Autodesk (US), Adobe (US), Blender Foundation (NL), Unity Technologies (US), Epic Games (US), NVIDIA (US), Pixar Animation Studios (US), Walt Disney Animation Studios (US), DreamWorks Animation (US)