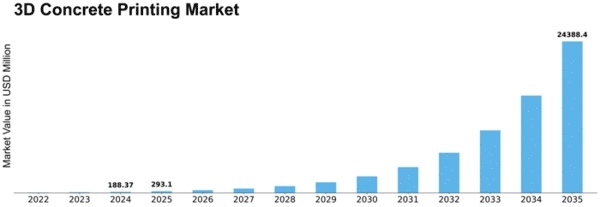

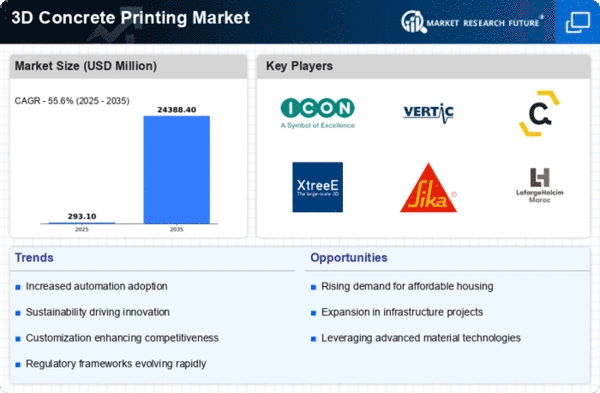

3d Concrete Printing Size

3D Concrete Printing Market Growth Projections and Opportunities

Multiple factors drive the 3D Concrete Printing market. A major driver is the construction industry's development, as 3D concrete printing revolutionizes building structures. This new technology allows layer-by-layer concrete deposition, increasing design freedom, building speed, and material waste reduction. As the building industry seeks more ecological and efficient solutions, 3D concrete printing becomes more popular, especially for complicated architectural designs and affordable homes.

Technological advances in 3D concrete printing affect market dynamics. Research and development aim to improve 3D concrete printing speed, scalability, and material diversity. 3D concrete printing is more useful in building projects thanks to advances in printing technology including robotic arms and gantry systems and printable concrete compositions.

Urbanization and population increase need creative construction technologies, making 3D concrete printing appealing. Fast urban expansion presents obstacles, but 3D printing can produce complicated structures precisely and efficiently. To meet urbanization trends, the industry offers 3D concrete printing solutions that are faster and more sustainable than traditional construction methods.

Government actions and construction laws greatly effect 3D Concrete Printing. 3D concrete printing draws attention for its potential to satisfy sustainable construction and affordable housing goals as governments globally prioritize them. The market grows due to regulatory support and 3D printing's inclusion into building codes, enabling its widespread use in construction projects.

Environmental factors shape the 3D Concrete Printing market. The industry's focus on sustainable construction includes reducing material waste, carbon emissions, and using eco-friendly concrete formulations. As traditional construction technologies' environmental impact is evaluated, 3D concrete printing becomes a potential answer.

Economic factors like construction spending and infrastructure developments affect 3D Concrete Printing. Economic stability and greater construction activity spur innovation in construction technologies. Economic downturns or construction spending changes may delay or scale down projects, hurting 3D concrete printing technology demand.

Construction technology competition impacts 3D Concrete Printing market dynamics. Research and development help companies produce 3D printing systems with higher speed, accuracy, and material options. Gaining market share and influencing 3D concrete printing uptake in construction applications requires smart relationships with construction firms and architects.

Consumer education on 3D Concrete Printing's benefits boosts the market. As construction experts and developers learn about 3D concrete printing, its popularity grows. Educational programs, demonstrations, and successful case studies help spread 3D concrete printing information and confidence.

Leave a Comment