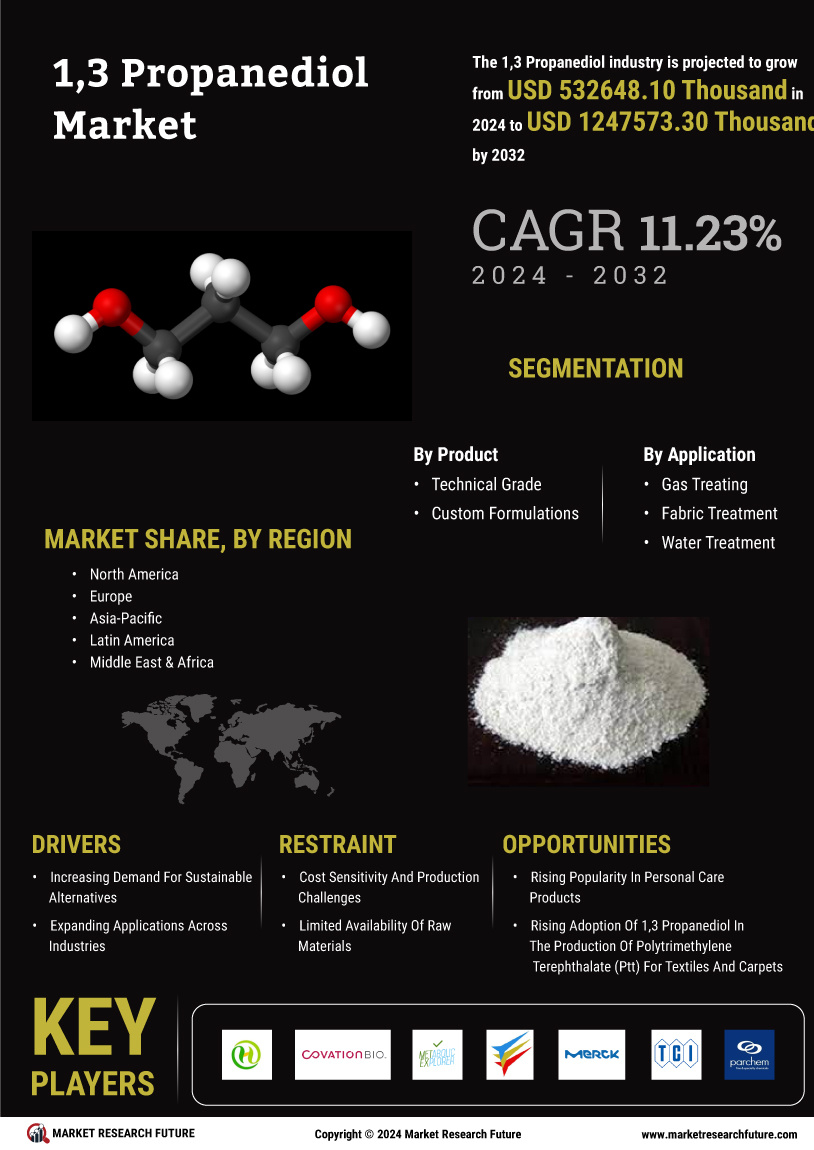

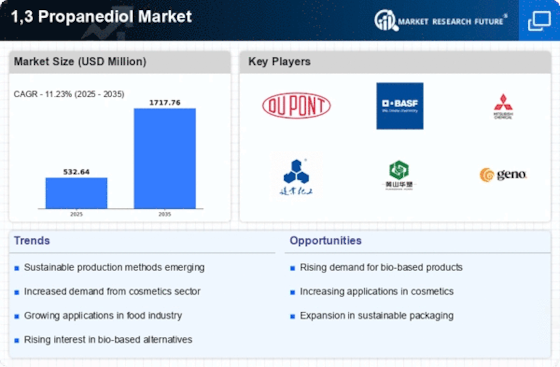

The global 1,3-propanediol market is characterized by a competitive landscape shaped by several key players vying for market share. These players are engaged in various strategies such as product innovation, partnerships, and acquisitions to gain a competitive edge in the market. Some of the prominent companies operating in the global 1,3-propanediol market include Haihang Industries Co., Ltd., Primient Covation LLC, Metabolic Explorer, Zhangjiagang Glory Biomaterial Co., Ltd., Zouping Mingxing Chemical Co., Ltd., Merck KGaA, Tokyo Chemical Industry Co., Ltd. (TCI), Otto Chemie Pvt Ltd., Parchem Fine & Specialty Chemicals, Suzhou Springchem International Co., Ltd., and Primient Covation LLC.The top 5 key players in the market are Merck KGaA, Haihang Industries Co., Ltd., Zhangjiagang Glory Biomaterial Co., Ltd., Metabolic Explorer, and Primient Covation LLC. These companies are constantly striving to enhance their product offerings and improve their market presence through various initiatives. Product innovation is a key focus area for these players, as they aim to develop advanced 1,3-propanediol products that align with the growing sustainability trends and environmental regulations. The global 1,3-propanediol market is geographically diverse, with significant opportunities across various regions.Market players are focusing on expanding their regional presence through investments in production facilities, distribution networks, and sales and marketing activities. This strategic approach enables companies to strengthen their market position, cater to local demand, and effectively compete with regional playersHAIHANG INDUSTRY: Haihang Industries Co., Ltd. is a chemical manufacturing company and is recognized as a chemical exporter, supply chain solution provider, and more. Haihang Industries Co., Ltd. is a wholly owned subsidiary of Haihang Group and has a quality management system certification of ISO 9001:2005. Haihang Industries Co., Ltd. has its products distributed across North America, Asia-Pacific, South America, Europe, and South Africa in the Middle East & Africa region. The company shelves its products at competitive prices to sustain itself in the global market space.The company has its major businesses across the following domains: Catalysts & Chemical Auxiliary Agents, Additives, cosmetic raw materials, daily chemicals, organic intermediates, pigments & dyes, basic organic chemicals, flavors & fragrances, inorganic chemicals, chemical pesticides, health & medical, food & beverages, admixtures and more.METABOLIC EXPLORER: Metabolic Explorer is a biotechnology company founded in 1999, with its headquarters located in Clermont-Ferrand, France. The company specializes in the development and production of bio-based chemicals and ingredients through the utilization of its unique metabolic engineering and fermentation technologies. Metabolic Explorer is renowned for its commitment to sustainability and green chemistry, offering a range of innovative, eco-friendly solutions to meet various industrial and consumer demands. Over the years, the company has achieved significant milestones, including the successful commercialization of PDO (1,3-Propanediol) and PDO/BO (Butanediol) products, which are used in applications such as cosmetics, plastics, and textiles.Metabolic Explorer is actively involved in research and development to expand its product portfolio and address emerging market needs.

1, 3-Propanediol Market Industry Developments

- Q2 2024: DuPont Announces Expansion of 1,3-Propanediol Production Facility in Tennessee DuPont revealed plans to expand its Tennessee facility to increase production capacity for bio-based 1,3-propanediol, aiming to meet rising demand in the personal care and polymer sectors.

- Q2 2024: Metabolic Explorer Secures Major Supply Contract for Bio-Based 1,3-Propanediol Metabolic Explorer announced a multi-year supply agreement with a leading European cosmetics manufacturer for its bio-based 1,3-propanediol, strengthening its position in the sustainable ingredients market.

- Q3 2024: Zhangjiagang Glory Biomaterial Opens New 1,3-Propanediol Production Plant in China Zhangjiagang Glory Biomaterial inaugurated a new manufacturing facility dedicated to 1,3-propanediol, expanding its production capacity to serve growing demand in Asia’s bioplastics industry.

- Q3 2024: Shell Chemicals LP Announces Strategic Partnership for Bio-Based 1,3-Propanediol Development Shell Chemicals LP entered a strategic partnership with a biotechnology firm to co-develop advanced bio-based 1,3-propanediol production technologies, targeting lower carbon footprints for industrial customers.

- Q4 2024: Primient Launches New Bio-Based 1,3-Propanediol Product Line for Personal Care Applications Primient introduced a new product line of bio-based 1,3-propanediol specifically formulated for use in personal care and cosmetic products, responding to increased market demand for sustainable ingredients.

- Q1 2025: DuPont Receives Regulatory Approval for Expanded 1,3-Propanediol Production in U.S. DuPont obtained regulatory clearance to expand its 1,3-propanediol production operations in the United States, enabling the company to scale up output for domestic and international markets.

- Q1 2025: Shenghong Group Holdings Signs Long-Term Supply Agreement for 1,3-Propanediol Shenghong Group Holdings entered into a long-term supply contract with a major global polymer manufacturer, securing stable demand for its 1,3-propanediol output.

- Q2 2025: Merck KGaA Announces Investment in 1,3-Propanediol R&D for Pharmaceutical Applications Merck KGaA committed new funding to research and development of 1,3-propanediol for use in pharmaceutical formulations, aiming to expand its specialty chemicals portfolio.

- Q2 2025: Haihang Industry Expands 1,3-Propanediol Export Operations to North America Haihang Industry announced the expansion of its export operations for 1,3-propanediol to North America, targeting new customers in the polymer and personal care sectors.

- Q2 2025: Tokyo Chemical Industry Co., Ltd. Appoints New CEO to Lead 1,3-Propanediol Business Growth Tokyo Chemical Industry Co., Ltd. named a new CEO tasked with accelerating growth in its 1,3-propanediol business, focusing on innovation and global market expansion.

- Q3 2025: Zouping Mingxing Chemical Co., Ltd. Announces New 1,3-Propanediol Production Line Zouping Mingxing Chemical Co., Ltd. launched a new production line for 1,3-propanediol, increasing its manufacturing capacity to meet rising demand in the coatings and adhesives market.

- Q3 2025: DuPont Signs Partnership Agreement for Sustainable 1,3-Propanediol Supply Chain DuPont entered a partnership with a logistics provider to develop a more sustainable supply chain for its bio-based 1,3-propanediol products, aiming to reduce environmental impact and improve delivery efficiency.