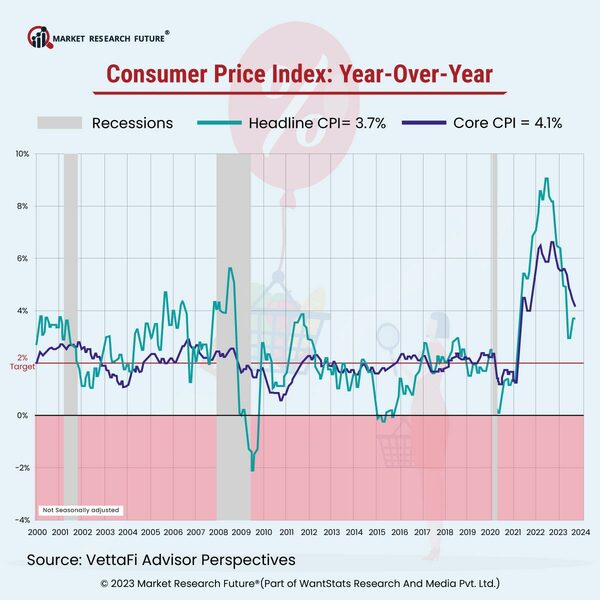

Consumer Price Index is Stable at 3.7 Percent in September 2023

Headline inflation remains unchanged in September 2023, while the core inflation continues to cool. The Bureau of Labor Statistics provided the data in October 2023 for the increased consumer price index in one year.

Based on the data provided by the Bureau of Labor Statistics, the urban consumer price index has noted that all items index has increased 3.7 percent year-over-year before seasonal adjustments in 12 months. This consumer price index increase is higher than a 3.6 percent annual increase. The core consumer price index reading remains constant at 4.1 percent but differs from August readings of 4.3 percent, a slowdown in the consumer price index. There is an increase of 0.4 percent in headline prices, and core prices increased 0.3 percent on a seasonal basis compared to August 2023. In contrast, headline and core prices increased by 0.3 and 0.2 percent on a non-seasonally adjusted basis, respectively, in September 2023. The core inflation does not include volatile food and energy prices and made its downfall to 4.1 percent in September 2023. The energy index in September 2023 also increased by 1.5 percent after a hike of 5.6 percent in August 2023. the gasoline index also rose 2.1 percent in September 2023, following 10.6 percent in August 2023, as per the Bureau of Labor Statistics data.

Consumer prices are evaluated against high commodity prices due to various factors, including geopolitical conflicts and others. These factors led to a surge in food and energy prices due to inflation dropping at the beginning of 2023. It is difficult to lessen the inflation reading due to the strong labor market, higher housing prices, and sturdy consumer spending in 2023.