特殊化学品市場は、2030年までに9000億米ドルの価値があると予測されており、予測期間(2021年から2030年)に4%のCAGRを記録しています。

COVID19 分析

COVID19パンデミックの全体的な広がりは、企業とその組み立ておよび生産ユニットに影響を与えました。スペシャリティケミカル市場の主な参加者は、現在、ビジネスの強化をもたらすことによって機能規模を拡大することに注目しています。このステップは、危険因子とリスクを制限し、さらに、新しいコロナウイルスのパンデミックによって導入された動的性に耐えるために取られています。ショッピングセンター、小売プラザ、および市場の製品やサービスを利用してビジネスを運営するさまざまな組織は、熟練した労働力にアクセスできず、不完全および完全なロックダウンやその他の機能制限の両方の負担によって作業できないために停止されました。

スペシャリティケミカル市場動向の対象読者と著名な参加者は、COVID19パンデミックの影響を受けています。これらの傾向は、パンデミックが到来して以来、成長と需要の減少という形で大きな影響を目の当たりにしています。同様に、理想的な市場オーディエンスは、市場製品と国際ポートフォリオの拡大を目の当たりにする可能性があります。オンラインポータルの利用の増加は、市場が高まるニーズと拡大する需要を満たすのに役立っています。政府と世界市場のプレーヤーは、2030年に終了する予測期間の市場のプラス成長に影響を与える投資と開発の拡大の結果である市場サービスと製品を拡大しています。

マーケットダイナミクス

ドライバー

特殊化学品市場は、APAC、中東、アフリカ地域で収縮活動が力強い成長を遂げているため、パンデミック後、好調な成長と需要で回復する可能性があります。農薬は、市場の一部として、増加する人口のニーズを満たす能力と、世界のさまざまな地域で食料需要の増加に対応する能力のために、主要なゲームチェンジャーとして浮上する可能性があります。

拘束

2020年のCOVID-19の発生は、特殊化学品市場の収益に打撃を与えました。いくつかの国が封鎖されていました。OICAによると、世界の自動車生産は第2四半期に3,110万台に減少し、第3四半期には52.1台に減少しました。中国やヨーロッパなどの著名な国での自動車販売も非常に低かった。これらの要因により、2021-2030年の予測期間中の市場の成長が抑制されています。

テクノロジー分析

技術は市場の拡大において重要な役割を果たすため、優れた信頼性の高い技術の利用可能性に対する市場の依存性は、特殊化学品市場にとって前向きな特徴を持っています。市場動向は、研究開発活動が大幅に増加していると予測しています。この背後にある動機は、2030年に終了する予測期間中に有名な市場動向を推進し、浸透するための主要な機会を市場に提供するのに役立つ新しい市場製品の開発に対する突然の衝動です。

研究目標

- スペシャリティケミカル市場レポートは、グローバルなターゲットオーディエンスの高まるニーズに応えるのに役立つグローバル市場の機能の基礎を理解し、さらに、推進力のような市場のダイナミクスについて議論するのに役立ちます。市場に続いて、期間中の市場の成長を抑制する課題が続きます。レポートは、2028年の予測期間の終わりまでに市場の範囲を拡大する市場の側面をカバーしています。

- 市場レポートは、地域および国際市場の両方の市場動向に蔓延している特殊化学品市場の動向を強調し、さらに、ターゲットオーディエンスの高まるニーズを満たすのに役立つグローバル市場の細分化について議論し、その後に収益の可能性を判断します。セグメントと市場の成長能力を強化します。

- 市場レポートは、予測期間中に新しい市場競争を引き起こしている世界的な要因を理解するのにさらに役立ちます。市場レポートは、2028年に終了する予測期間中に国内および国際的な市場プレーヤーが行った合併と買収に基づいて、競争の激しい市場の状況を描いています。

セグメントの概要

スペシャリティケミカルズ市場の収益は、市場セグメントの素晴らしいパフォーマンスのため、2021年から208年の予測期間中に予測どおりに増加する可能性があります。市場セグメントは、期間中の市場製品に対する巨大な需要を満たし、生み出すのに役立ちます。市場セグメントは次のとおりです。

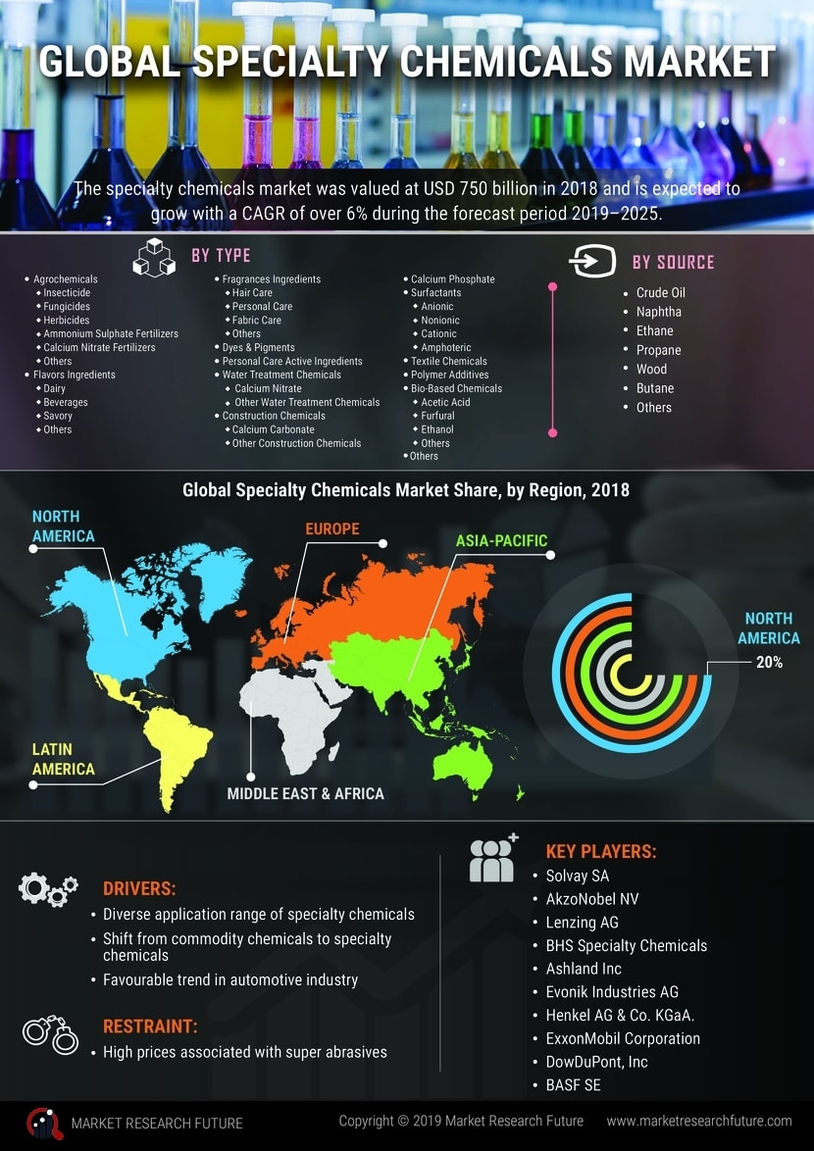

市場タイプに基づく

市場タイプに基づいてセグメント化される世界市場は、印刷インキ、農薬、高度なセラミック材料、特殊紙、繊維化学品、特殊ポリマー、水管理化学品、特殊界面活性剤、ポリマーなどの高まる需要に対応するのに役立ちます。

機能に基づく

市場機能に基づく市場細分化には、抗酸化物質、酵素、分離膜、特殊顔料、殺生物剤、特殊コーティング、酸化防止剤などが含まれます。

地域に基づく

市場運営は現在、北米地域、APAC地域、ヨーロッパ、その他の地域(ROW)の4つの主要地域で機能しています。

地域分析

市場の地理的区分に基づくと、APAC地域は最大の収益シェアを達成する可能性が高く、したがって、2021-2028年の予測期間の特殊化学品市場の動向を支配する可能性があります。ただし、最大の市場規模ステータスは、北米地域、次にヨーロッパ地域が保持しています。

競争環境

スペシャリティケミカルズ市場の収益は、次の市場関係者の機能により、2021年から2028年の継続的な予測期間中にかなりの市場金額に達する可能性があります。

- BASF (ドイツ)

- Ashland Inc. (米国)

- クラリアントAG(スイス)

- ダウケミカル (米国)

- エボニック・インダストリーズ (ドイツ)

- アクゾノーベルN.V. (オランダ)

- バイエル社 (ドイツ)

最近の動向

- 北米地域では、既存人口の一人当たりの所得が大幅に増加し、続いて米国、カナダ、メキシコなどの参加地域の人口レベルが大幅に上昇しています。また、これにより餌を与える口の数が増え、その結果、食用作物や換金作物の需要が高まっています。これらの傾向は、2028年に進行中の予測期間の終わりまでに世界的に推進されると予想されます。FAOが発表した統計によると、米国市場だけで食料と換金作物の需要は、2050年末までに50〜90%増加する可能性があります。

- スペシャリティケミカルズ市場の動向は、主にeによって推進されている建設セクターの需要の出現を目の当たりにする可能性があります。

FAQs

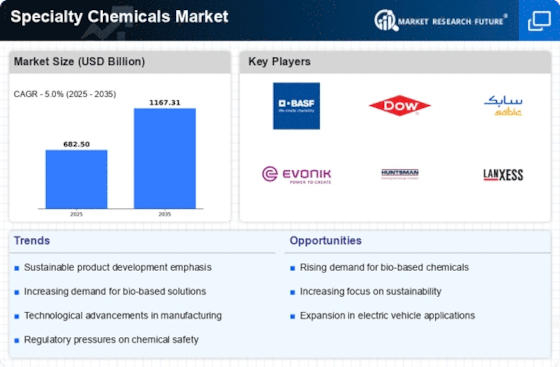

What is the projected market valuation of the Specialty Chemicals Market by 2035?

The Specialty Chemicals Market is projected to reach a valuation of 1167.31 USD Billion by 2035.

What was the market valuation of the Specialty Chemicals Market in 2024?

In 2024, the Specialty Chemicals Market was valued at 682.5 USD Billion.

What is the expected CAGR for the Specialty Chemicals Market from 2025 to 2035?

The expected CAGR for the Specialty Chemicals Market during the forecast period 2025 - 2035 is 5.0%.

Which companies are considered key players in the Specialty Chemicals Market?

Key players in the specialty chemicals market include BASF, Dow, SABIC, Evonik Industries, Huntsman Corporation, Lanxess, Solvay, Mitsubishi Chemical, and Eastman Chemical Company.

What are the projected values for Agrochemicals in the Specialty Chemicals Market by 2035?

Agrochemicals are projected to reach a value of 170.0 USD billion by 2035.

How much is the market for Personal Care Active Ingredients expected to grow by 2035?

The market for personal care active ingredients is expected to grow to 120.0 USD Billion by 2035.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”