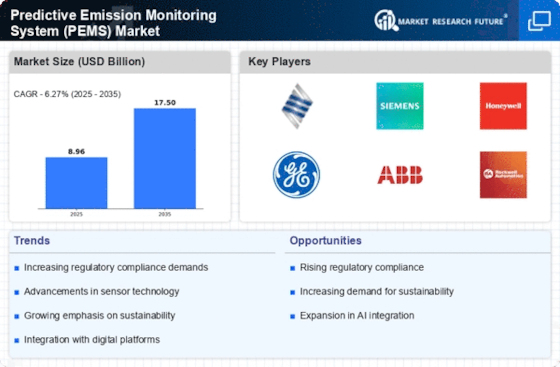

予測排出モニタリングシステム(PEMS)市場は、現在、規制圧力の高まりと環境持続可能性への関心の高まりによって推進される動的な競争環境に特徴づけられています。エマーソン(米国)、シーメンス(ドイツ)、ハネウェル(米国)などの主要企業は、革新と技術の進歩を通じて戦略的に自らを位置づけています。エマーソン(米国)は、高度な分析と機械学習機能を統合することでPEMSの提供を強化することに注力しており、これにより排出量の追跡が改善されるだけでなく、運用効率も最適化されます。シーメンス(ドイツ)は、自社の自動化とデジタル化に関する豊富な経験を活かして、厳しい規制要件を満たす包括的なソリューションを提供しています。一方、ハネウェル(米国)は、環境に優しいモニタリング技術の開発を通じて持続可能性へのコミットメントを強調しています。これらの戦略は、技術革新と環境基準の遵守を優先する競争環境を形成しています。

ビジネス戦略に関しては、企業は市場の需要に応じた反応性を高めるために製造のローカライズとサプライチェーンの最適化を進めています。PEMS市場は中程度に分散しているようで、いくつかの主要プレーヤーが戦略的パートナーシップやコラボレーションを通じて影響を及ぼしています。この構造は、さまざまな業界のニーズに応える多様なソリューションを可能にし、確立された企業と新興企業の間で競争を促進しています。

2025年8月、エマーソン(米国)は、リアルタイムデータ分析を統合したクラウドベースのPEMSソリューションを開発するために、主要なソフトウェア企業とのパートナーシップを発表しました。この戦略的な動きは、エマーソンが排出モニタリングにおけるデジタルソリューションの需要の高まりを活用する位置にあることを示しており、市場シェアと運用効率の向上が期待されています。このコラボレーションは、データ収集と分析を効率化し、環境規制の遵守を改善することが期待されています。

2025年9月、シーメンス(ドイツ)は、過去のデータと運用パラメータに基づいて排出量を予測する人工知能を利用した新しいPEMSプラットフォームを発表しました。この革新は、予測能力を向上させるだけでなく、データ駆動型の意思決定への業界のシフトにも合致しているため、重要です。AIを取り入れることで、シーメンスはクライアントにより正確な予測を提供し、非遵守のリスクとそれに伴う罰則を軽減することを目指しています。

2025年7月、ハネウェル(米国)は、センサー技術を専門とする小規模なテクノロジー企業を買収することでPEMSポートフォリオを拡大しました。この買収は、ハネウェルの技術能力を強化し、製品提供を広げる戦略を示しています。高度なセンサー技術を統合することで、ハネウェルは排出モニタリングシステムの精度と信頼性を向上させ、市場での競争力を強化することが期待されます。

2025年10月現在、PEMS市場はデジタル化、持続可能性、人工知能の統合を強調するトレンドを目撃しています。主要プレーヤー間の戦略的提携は、競争環境を形成し、革新を促進し、製品提供を強化しています。今後、競争の差別化が進化し、価格競争から技術革新、サプライチェーンの信頼性、厳しい環境規制の遵守能力への焦点へのシフトが予想されます。この進化は、PEMS市場で競争優位を維持するための適応性と先見的な戦略の重要性を強調しています。