Research Methodology on Emission Monitoring System Market

Abstract

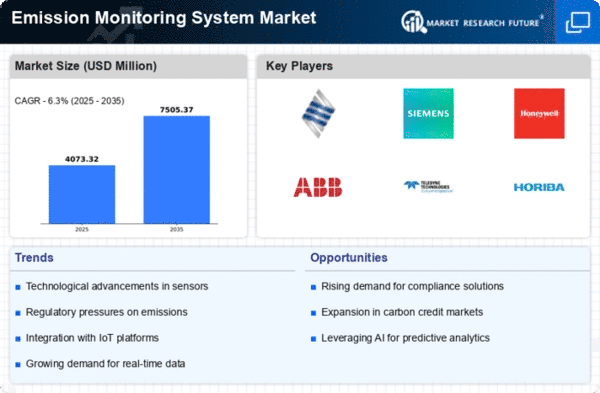

This research paper is dedicated to understanding the development and growth of the Global Emission Monitoring System Market. In addition, this research also attempts to evaluate and forecast the various factors that will impact the growth of the Emission Monitoring System Market from 2023 to 2030. Furthermore, this research also analyzes the key trends, growth opportunities, and strategic initiatives taken by the industry giants to gain an edge in the Global Emission Monitoring System Market.

Introduction

Researching and understanding the development and growth of the Global Emission Monitoring System Market is the primary objective of this research report. The emission monitoring system is comprised of various components such as air pollution monitoring and control equipment, photographic software, data logging and transmission software, and instruments. The emission monitoring system is essentially designed to regulate the level of air pollutants or air toxins and monitor environmental factors, such as wind direction, speed and flow rate.

The emission monitoring system not only helps to identify and monitor hazardous components present in the environment but also provides relevant data to regulatory agencies and facilitates precision control over the concentration and flow of pollutants from various sources. The emission monitoring systems market is hence, presently, considered to be one of the most important pillars of the global air pollution control policy.

The current accelerated growth in industrialization and urbanization has greatly increased the emission of pollutants globally, resulting in the need for accurate, reliable, and automated emission monitoring systems. The growing concern for maintaining ecological balance and achieving healthy economic progress is expected to bring about dynamic growth for the emission monitoring systems market over the forecast period 2023 to 2030.

Research Objectives

The objective of this research is to analyze the various aspects and factors that will impact the growth of the Global Emission Monitoring System Market from 2023 to 2030.

The objectives are as follows:

- To analyze and forecast the size of the Global Emission Monitoring System Market, in terms of revenue & volume.

- To provide insights into the competitive landscape, with detailed profiles of the key participants.

- To provide a detailed analysis of the growth drivers and key trends in the market.

- To analyze the growth opportunities, threats and restraints that may arise in the Global Emission Monitoring System Market.

Research Methodology

The research methodology used for this research involves collecting data from primary and secondary sources. The primary sources include various industry experts, trade associations, and government offices. Secondary sources include various trade journals, press releases, and online databases.

The analysis process comprises the following:

- Market size estimation: The overall size of the Global Emission Monitoring System Market is calculated by triangulating the data obtained from different sources.

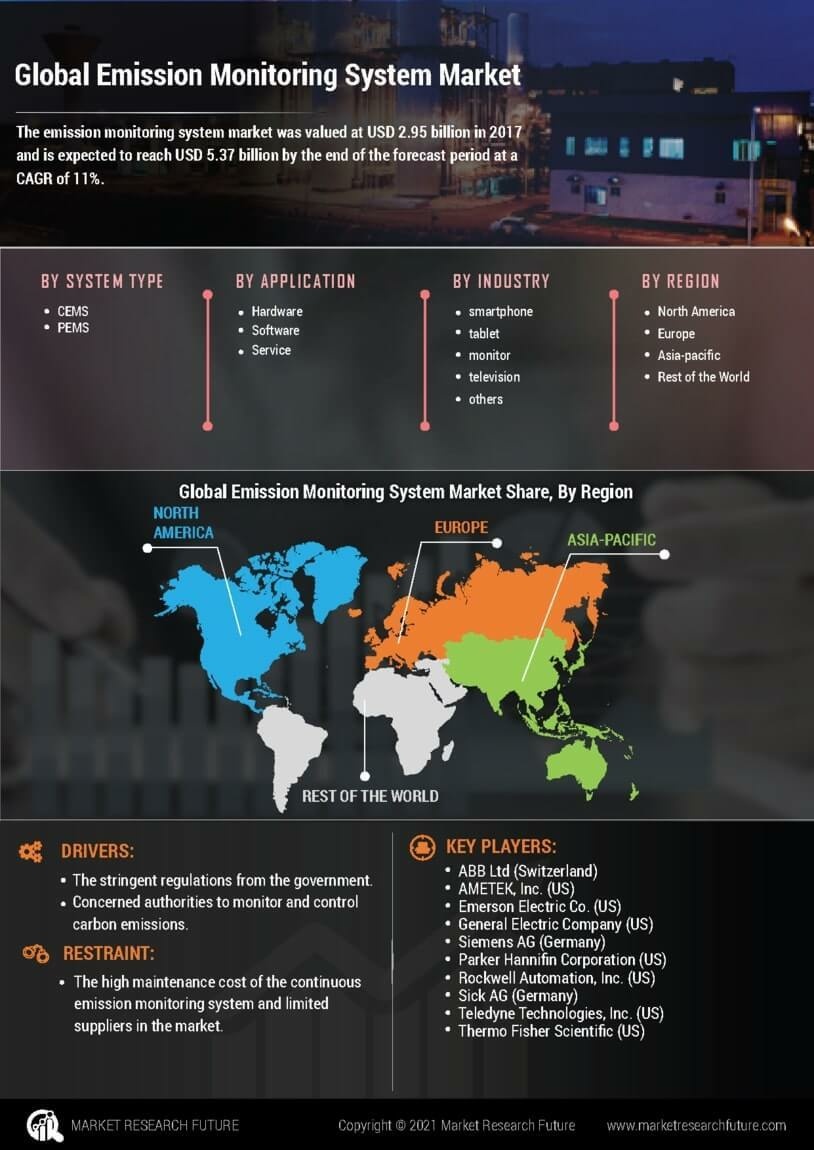

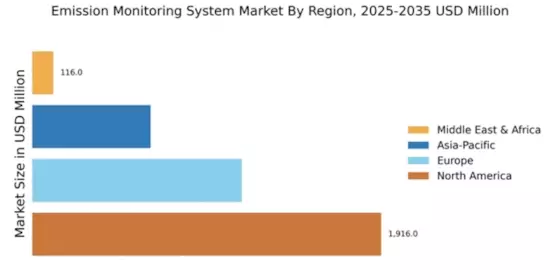

- Market Segmentation: The market is segmented based on region (North America, Europe, Asia-Pacific, Middle East & Africa and Latin America); type (Photographic Software, Data Logging and Transmission Software, Air Pollution Monitoring and Control Equipment. and Instruments); end-user (Power Plants, Vehicles), and various others.

- Market Forecasting: The market is forecasted based on the previous years’ data and the current market trends.

- Projected Outputs: The projected outputs are studied by analyzing the key trends in the current market by interviewing industry experts.

- Market Drivers: The drivers and restraints are studied by evaluating the drivers and restraint factors for the market.

- Market Scenario: The market scenario is derived by considering the various drivers and restraints for the Global Emission Monitoring System Market.

Data Collected and Analysis Approach

The data collected in this research is diverse and comprehensive, comprising statistical information and qualitative information. Statistical information is gathered from insightful documents and reports published by industry experts and organizations such as the World Trade Organization (WTO), the International Energy Agency (IEA), the International Organization for Standardization (ISO), The Bureau of Economic Analysis (BEA), and National Institute of Statistics and Economic Studies (INSEE).

The qualitative information is collected through semi-structured interviews, informal discussions, surveys and reviews. The primary participants of the research comprise key opinion leaders, such as CEOs, Chief Regulatory Officers and other executive officers from industry participants.

The data analysis approach used in this research includes a combination of analytical techniques such as exploratory analysis, predictive analysis, omission and imputation techniques. The resulting data is processed and analysed in a variety of ways to generate useful insights for the market.

Data Validation

To ensure the accuracy and reliability of the data collected, an extensive list of data validation is carried out. The data is thoroughly reviewed by primary and secondary sources and peer-reviewed by industry leaders. The valid data points are then analysed by the research team and a market scenario was generated.

Finally, the market scenario is triangulated with different sets of data sources (such as published reports and annual reports of the organizations) to generate the final data. The report is then written based on the data and insights thus collected, analysed and validated.

Result

The findings of this research include a detailed analysis of the Global Emission Monitoring System Market, its growth drivers and key trends, and the strategic initiatives taken by the industry players to gain an edge in the Emission Monitoring System Market.

Conclusion

The increasing demand for air pollutant monitoring systems across various end-users is expected to be the key factor driving the growth of the Emission Monitoring System Market. Furthermore, the surging trend towards adopting energy-saving automation systems and the increasing focus on green energy are expected to fuel the growth of the Emission Monitoring System Market in the coming years.