世界の海上物流およびサービス市場の概要

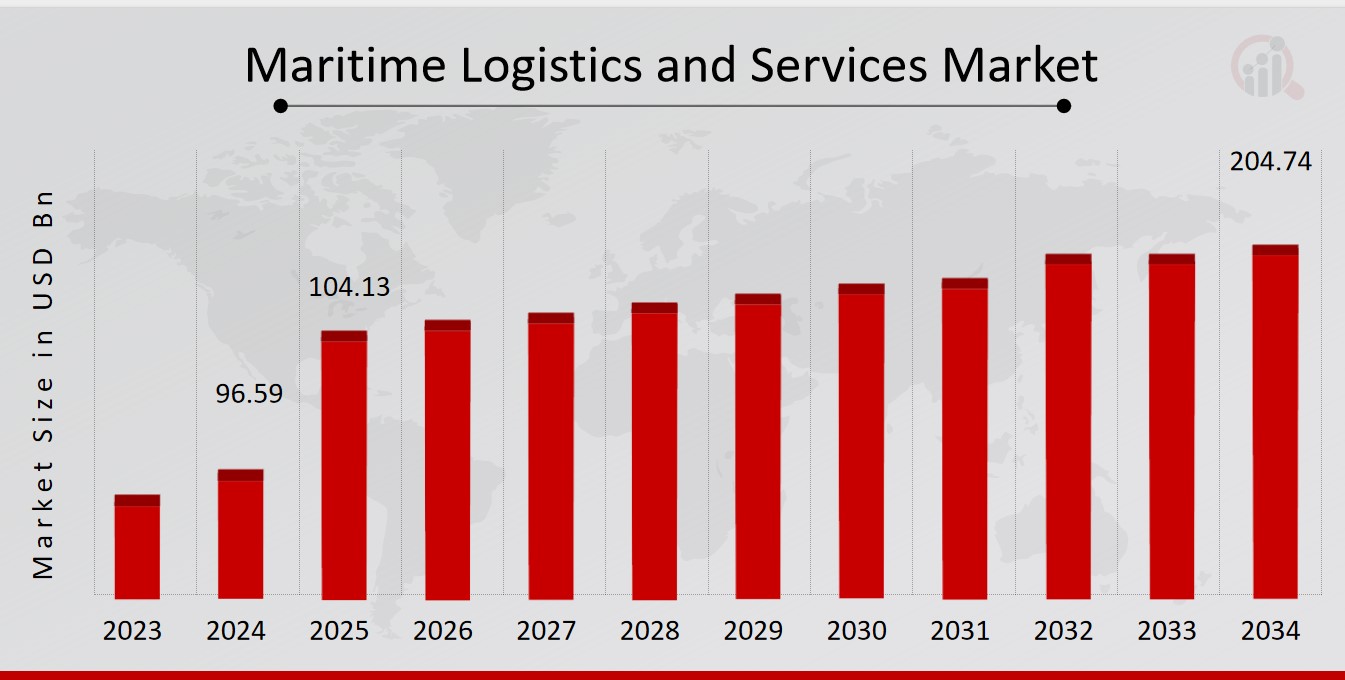

p海上物流およびサービス市場規模は、2024年に965.9億米ドルと評価されました。海上物流およびサービス業界は、2025年の1041.3億米ドルから2034年には2047.4億米ドルに成長すると予測されており、予測期間(2025~2034年)中に7.80%の複合年間成長率(CAGR)を示します。各国の経済状況の改善、経済間の輸出入の増加、低コストで安全な輸送ニーズの高まり、新技術の急速な導入は、市場の成長を促進する主要な市場ドライバーです。

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

海事物流およびサービス市場の動向

pデジタル変革によるキャパシティ最適化が市場の成長を牽引しています。

海事物流およびサービスの市場CAGRは、貨物活動や船舶のデータ表示に注力する海運業界の新興企業と、さまざまな運送業者がますます提携し、最適な貨物経路の確保や改善を促進できるようにしていることから、牽引されています。船舶の配置など、他の利点もあります。たとえば、トランスメトリクスなどのスタートアップ企業は、貨物の位置データを調査して貨物量を正確に予測し、運送業者が空の帰港を回避するのに役立つようにすることに重点を置いています。したがって、配備された船舶の全体的な最適化により、海上物流およびサービス市場の収益が増加すると予想されます。

可処分所得の増加、海上輸送を支援するためのインフラ整備、海上貿易の増加は、市場を牽引する主要な要因です。消費者の可処分所得の増加とグローバル化が相まって、国際的な商品の需要が増加しています。これにより、さまざまな国内の輸出入が増加しました。ルートを短縮するための運河の開発と貿易協定により、海上貨物輸送を支援するためのインフラと条件が強化されました。

海上輸送は国際貿易と経済の柱です。世界的な海上貿易の増加は、海洋船舶業界の予測期間中に市場の成長を促進すると予想されます。 Maritime Publicationsによると、国際貿易の約80%、世界貿易の70%以上は海上輸送によって行われ、世界中の港湾によって管理されています。グローバル化と、中国や韓国といったアジア経済の急速な発展は、海上貿易の成長に大きな役割を果たすでしょう。

企業が効率性の向上とコスト削減を目指す中、海運業界では、より効率的で持続可能な海運業務への需要が高まり、IoT、AI、ブロックチェーンなどの技術を活用した取り組みが広がっています。さらに、物流業務の透明性と効率性を向上させるサプライチェーン管理のためのデジタルプラットフォームの導入は、今後も拡大すると予想されます。持続可能性の重要性が高まる中、海運業界は二酸化炭素排出量の削減と持続可能なエネルギー源の使用に重点を置いています。

海事物流およびサービス市場セグメントの洞察

p海事物流およびサービス貨物タイプに関する洞察

貨物タイプに基づく海事物流およびサービス市場の区分には、一般貨物{ブレークバルク[ドラム、バッグ、パレット、バレル、ボックス]、ネオバルク[木材、紙、鋼鉄、車両]、コンテナ}、バルク貨物{液体バルク[石油、LNG、化学薬品、植物油]、ドライバルク[石炭、鉄鉱石、穀物、ボーキサイト、砂]}が含まれます。一般貨物セグメントが市場を支配し、市場収益の35%(290億9000万ドル)を占めました。発展途上国では、一般貨物が食事、機械、化学薬品、衣料品などの輸送に使用されているため、このカテゴリーの成長が牽引されています。しかし、海上貿易の増加と、製薬、工業、農業、石油化学、自動車産業の顕著な拡大により、ネオバルクは最も急速に成長しているカテゴリーです。

海上物流およびサービスに関する洞察

サービスに基づく海上物流およびサービス市場の区分には、港湾および貨物取扱、航路調査、複合輸送、吊り上げ設備管理、梱包および木箱詰め、船舶チャーター、保険および法的サポート、および乗組員管理が含まれます。港湾および貨物取扱カテゴリーが最も大きな収益(70.4%)を生み出しました。これは、コンテナ貨物輸送量の増加によるものです。しかし、海事部門のデジタル化、サプライチェーン、物流ソリューションサービスへのトレンドの転換により、クルー管理は最も急速に成長しているカテゴリーとなっています。

海事物流およびサービスソリューションの洞察

ソリューションに基づく海事物流およびサービス市場の区分には、サプライチェーン管理、倉庫管理、港湾設備トレーニングなどが含まれます。サプライチェーン管理カテゴリーは、需要の増加と海事物流ソリューションの利点に対する認識の高まりにより、最も多くの収益を生み出しました。しかし、倉庫管理は、オンライン購入のトレンドの高まりにより、最も急速に成長しているカテゴリーです。

図 1: 海事物流およびサービス市場、ソリューション別、2022 年 2032年(10億米ドル)

出典:一次調査、MRFRデータベース、二次調査、アナリストレビュー

海事物流およびサービス地域別洞察

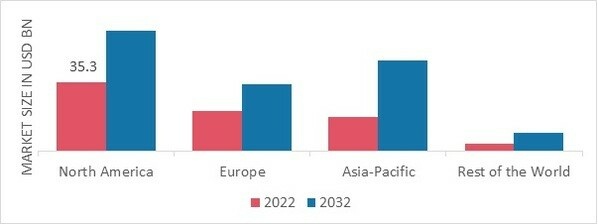

地域別に、この調査では、北米、ヨーロッパ、アジア太平洋、その他の世界の市場洞察を提供しています。北米の海事物流およびサービス市場は、港湾寄港の最適化と、インフラへの多額の投資により、この地域の市場成長が促進される国々での商品の積み下ろしが迅速化されるため、市場を席巻するでしょう。さらに、ドイツの海上物流およびサービス市場は最大の市場シェアを占め、英国の海上物流およびサービス市場はヨーロッパ地域で最も急速に成長している市場でした。

さらに、市場レポートで調査された主要国は、米国、カナダ、ドイツ、フランス、英国、イタリア、スペイン、中国、日本、インド、オーストラリア、韓国、ブラジルです。

図2:2022年の地域別海上物流およびサービス市場シェア(10億米ドル)

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

ヨーロッパの海上物流・サービス市場は、既存の港湾の近代化と拡張に重点が置かれたことで、この地域の貿易量が増加し、2番目に大きな市場シェアを占めています。さらに、ドイツの海上物流・サービス市場は最大の市場シェアを占め、英国の海上物流・サービス市場はヨーロッパ地域で最も急速に成長している市場でした。

アジア太平洋の海上物流・サービス市場は、2023年から2032年にかけて最も高いCAGRで成長すると予想されています。これは、国の巨大な人口と大規模な製造拠点の存在によるものです。さらに、中国の海上物流・サービス市場は最大の市場シェアを占め、インドの海上物流・サービス市場はアジア太平洋地域で最も急速に成長している市場でした。

海上物流とサービスの主要市場プレーヤー競合に関する洞察

p大手の市場プレーヤーは、製品ラインを拡大するために研究開発に多額の投資を行っており、これが海上物流・サービス市場のさらなる成長につながるでしょう。市場参加者はまた、新製品の発売、契約上の合意、合併や買収、投資の増加、他の組織とのコラボレーションなど、重要な市場動向に合わせて、自社のプレゼンスを拡大するためのさまざまな戦略的活動を行っています。競争が激化し成長著しい市場環境で拡大し生き残るために、海上物流・サービス業界は費用対効果の高い製品を提供しなければなりません。

運用コストを最小限に抑えるために現地で製造することは、メーカーが海上物流・サービス業界で顧客に利益をもたらし、市場セクターを拡大するために使用する重要なビジネス戦術の 1 つです。Evergreen Marine Corp.、Ocean Network Express Pte など、海上物流・サービス市場の主要プレーヤーは、現地での製造に注力しています。 Ltd、Pacific International Lines Pte Ltd、CMA CGM LOG、A.P. Moller-Maersk、Hapag-Lloyd AGなどは、研究開発業務に投資することで市場の需要を拡大しようとしています。

Maersk ASは、輸送および物流サービスのプロバイダーです。子会社と関連会社を通じて、輸送コンテナと港湾を運営しています。同社はドライ貨物、冷蔵貨物、特殊貨物の輸送、中古コンテナの販売、複合輸送をサポートしています。Maersk ASの主要ブランドには、Maersk Line、Damco、APM Terminals、Svitzer、Twill、Sealand、Hamburg Sud、Alianca、Maersk Container Industry、Maersk Trainingなどがあります。同社はまた、ドライコンテナと冷蔵コンテナの製造も行っています。同社は、エネルギー、造船、小売、物流、製造業にサービスを提供しています。 2021年2月、マースクは、温室効果ガス排出量の削減にLNGなどの移行期の船舶燃料を利用せず、代わりにネットゼロ燃料であるバイオディーゼル、バイオメタノール、e-メタノール、リグニン燃料、グリーンアンモニアに直接移行すると発表しました。

エバーグリーン・マリン・コーポレーション・台湾は国際海運会社です。貨物の積み下ろしサービス、埠頭での荷役、貨物の追跡、ターミナルやコンテナ輸送サービスなど、さまざまなサービスを提供しています。EMCは輸送関連事業、コンテナヤード、港湾ターミナルに投資しています。同社はドライスチールコンテナとコンテナ部品を製造しています。また、コンテナの保管、検査、修理、清掃、メンテナンスサービスも提供しています。EMCは、製造、貨物輸送、サービス提供、小売、物流など、さまざまな業界にサービスを提供しています。 2022年1月、Evergreen Marine Corpは、南北アメリカ大陸におけるプレゼンスを強化し、競争力を高めるため、パナマのターミナルの全株式を取得しました。海上物流・サービス市場の主要企業には、 ul

- Evergreen Marine Corp が含まれます。

- Ocean Network Express Pte. Ltd

- Pacific International Lines Pte Ltd

- CMA CGM LOG

- P.モラー・マースク

- ハパグ・ロイドAG

- 現代商船インド有限公司

- 地中海海運会社

- 陽明グループ

h2海上物流・サービス業界の動向 p例えば、2020年6月ヒューストンに本社を置くOSV所有者のSeacor Marine Holdingsは、COSCO Shipping Groupと契約を締結し、同社が保有するSeacosco Offshoreの株式50%を取得しました。

海上物流・サービス市場セグメンテーション

p海上物流・サービスにおける貨物種別の見通し

- 一般貨物

- ばら積み貨物

- ドラム缶

- バッグ

- パレット

- バレル

- 箱

- ばら積み貨物

- ネオバルク

- 木材

- 紙

- スチール

- 乗り物

- コンテナ化

ul

- バルク貨物

- 液体バルク

- 石油

- LNG

- 化学物質

- 植物油

- 液体バルク

- ドライバルク

- 石炭

- 鉄鉱石

- 穀物

- ボーキサイト

- 砂

h3海上物流およびサービス展望 ul

- 港湾・貨物取扱

- 航路調査

- 複合輸送

- 揚重機管理

- 梱包・木箱詰め

- 船舶チャーター

- 保険・法務サポート

- クルーマネジメント

h3海事物流・サービスソリューションの展望 ul

- サプライチェーンマネジメント

- 倉庫管理

- 港湾設備トレーニング

- その他

h3海事物流・サービス地域展望 ul

- 北アメリカ

- アメリカ

- カナダ

- ヨーロッパ

- ドイツ

- フランス

- イギリス

- イタリア

- スペイン

- ヨーロッパのその他の地域

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- オーストラリア

- 残りの部分アジア太平洋

- 世界のその他の地域

- 中東

- アフリカ

- ラテンアメリカ

FAQs

How much is the maritime logistics and services market?

The maritime logistics and services market size was valued at USD 77.1 Billion in 2022.

What is the growth rate of the maritime logistics and services market?

Maritime Logistics Services Market is projected to register a CAGR of 7.8% from 2025-2035

Which region held the most extensive market share in the maritime logistics and services market?

North America had the largest share in the maritime logistics and services market.

Who are the key players in the maritime logistics and services market?

The key players in the market are General Mills Inc., Amway, Conagra Brands Inc., Cargill Incorporated, Abbott Laboratories, Kraft Foods Group Inc., and The Coca-Cola Company.

Which cargo type led the maritime logistics and services market?

The general cargo category dominated the market in 2022.

Which services had the largest market share in the maritime logistics and services market?

The port & cargo handling had the largest share in the maritime logistics and services market.

Which solutions had the largest market share in the maritime logistics and services market?

Supply chain management had the most extensive share of the market.

Research Approach

Maritime Logistics and Services Market

Introduction

The maritime logistics services market is anticipated to have exponential growth by 2030, at a healthy CAGR during the forecast period 2023 to 2030. Maritime logistics refers to the coordination of efficient movement of goods and services throughout the supply chain by utilising sea transportation. This service provides a variety of years to utilize international waters for both transporting goods and locally within a country’s territorial waters.

The increasing trade volumes, growing cross-border activities, and progressive government initiatives have facilitated the growth opportunity for maritime logistics services across the world. Companies are majorly adopting advanced technologies such as big data analytics, the Internet of Things (IoT), and blockchain to provide efficient solutions and enhance their track & trace capabilities and shipment visibility process.

Considering the present scenario in the maritime logistics market, the research tries to answer to answer the following questions:

- What are the drivers and restraints of the maritime logistics services market?

- What is the expected growth rate during the forecast period, 2023-2030?

- Who are the major players in the maritime logistics services market?

Research Objectives

The main objectives of this research are framed as follows:

- To analyse and study the market size, value and market shares of the key players.

- To analyse and study the maritime logistics services market competitive developments such as joint ventures, expansions, new product launches, and acquisitions in the market.

- To track and analyse the competitive developments such as joint ventures, expansions, new product launches, and acquisitions in the maritime logistics services market.

- To track and analyse the market in terms of its dynamics in different regions/countries.

- To classify and forecast the market based on service type, segment size, and region.

- To identify the opportunities and challenges that are influencing the maritime logistics services market growth.

- To evaluate the impact of government policies on the maritime logistics services market.

Research Methodology

The research methodology adopted to analyse the maritime logistics services market is a mix of primary and secondary research. The data collection has been done through various primary and secondary sources. Primary research has been conducted in the form of questionnaire surveys. A detailed secondary research process has been conducted using various reliable sources such as company websites. The picture of the maritime logistics industry has been derived through secondary sources such as WTO, IMF, Dow Jones, Bloomberg, and Ocean Freight Exchange Ltd.

The secondary source research includes Government and industry reports, the US Census Bureau Report, Government Reports, Regional Reports, and other Statistical Reports. The primary research includes surveys and interviews of industry leaders.

The market data has been gathered from both primary and secondary sources. The secondary sources include various sources such as company websites, research papers, monthly magazines, government reports, and newspaper articles. The primary research involves interviews with experts from the industry and surveys.

Approaches Used

Two approaches have been used in the research to determine the dynamics of the maritime logistics services market:

Bottom-up approach: This approach has been used to identify the potential market size and share of the business aspects of the maritime logistics services market.

Top-down approach: This approach is used to validate the current position of the maritime logistics services market in comparison with the total market size.

The market sizing has been done based on forecast using survey data, current trends, and estimations. The factor-based analysis method was used to check the driver’s impact on the maritime logistics services market. The demand and supply sides of the market have been triangulated through the factor analysis and a time-series approach is used to build the historical data set.

Conclusion

The maritime logistics services market is rapidly increasing due to increasing international trade, rising cross-border activities, and progressive government initiatives. The research aims to analyse the drivers, restraints, growth opportunities, and competitive landscape in the maritime logistics services market. The research methodology adopted for this research is a mix of primary and secondary sources such as surveys and interviews with industry experts. The market sizing and potential market size have been determined on the basis of forecasts using survey data, current trends, and estimations. The factor-based analysis method and a time-series approach were used to check the driver’s impact on the maritime logistics services market. The demand and supply sides of the market were triangulated through the factor analysis.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”