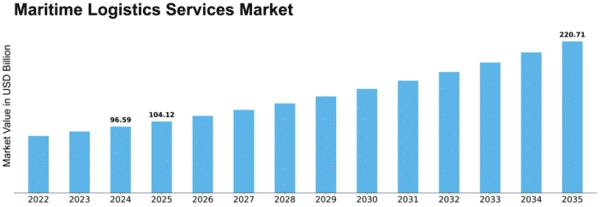

Maritime Logistics Services Size

Maritime Logistics Services Market Growth Projections and Opportunities

The Maritime Logistics and Services Market exhibit dynamic characteristics shaped by a myriad of factors influencing the global shipping and maritime industry. Central to this dynamic is the expansive nature of international trade, where maritime logistics play a pivotal role in the movement of goods across the globe. The market dynamics are significantly influenced by the increasing volume of global trade, driven by the interconnectedness of economies and the constant demand for efficient transportation of goods by sea. As international trade continues to expand, the maritime logistics and services sector responds with innovative solutions to meet the escalating demand for reliable and efficient shipping services.

Technological advancements contribute significantly to the dynamics of the Maritime Logistics and Services Market. The industry is undergoing a digital transformation with the integration of technologies like blockchain, Internet of Things (IoT), and advanced analytics. These technologies enhance supply chain visibility, optimize route planning, and improve overall operational efficiency. Automation in port operations, smart container tracking systems, and digital documentation processes are reshaping the landscape, making maritime logistics more streamlined and responsive to the demands of modern trade.

The impact of environmental sustainability is a critical factor influencing the dynamics of the Maritime Logistics and Services Market. The industry faces increasing pressure to reduce its carbon footprint and adopt eco-friendly practices. Consequently, there is a growing emphasis on green shipping solutions, including the use of cleaner fuels, energy-efficient vessels, and sustainable port operations. Environmental regulations and initiatives to mitigate the ecological impact of maritime activities are reshaping market dynamics, driving innovation in green technologies within the sector.

Geopolitical factors significantly shape the dynamics of the Maritime Logistics and Services Market. Political tensions, trade agreements, and international relations impact shipping routes, port operations, and maritime regulations. Changes in geopolitical landscapes, such as shifts in trade alliances or the opening of new shipping routes, influence market dynamics by creating opportunities or challenges for maritime logistics providers. Companies operating in the sector need to navigate and adapt to geopolitical changes, as they can have profound effects on the efficiency and cost-effectiveness of maritime logistics.

The resilience and adaptability of the market are demonstrated through responses to global disruptions, such as the COVID-19 pandemic. The pandemic highlighted vulnerabilities in global supply chains, prompting the maritime logistics and services sector to reassess and reconfigure its operations. The market dynamics saw an increased focus on supply chain resilience, contingency planning, and the adoption of digital technologies to ensure smoother operations even during disruptions.

Collaboration and alliances within the maritime industry contribute to market dynamics. Shipping lines, port operators, logistics providers, and technology companies forge partnerships to create integrated solutions. Such collaborations foster synergies, streamline operations, and enhance the overall efficiency of maritime logistics services. The dynamics of the market are influenced by the ability of stakeholders to collaborate effectively, creating an ecosystem that responds cohesively to the demands and challenges of the global shipping industry.

Regulatory frameworks and compliance requirements also play a significant role in shaping the dynamics of the Maritime Logistics and Services Market. International maritime regulations, safety standards, and environmental mandates influence operational practices and investment decisions. Adherence to regulations ensures the sustainability and safety of maritime logistics operations, but compliance efforts also impact the cost structures and strategies adopted by industry players, thereby influencing market dynamics.

Leave a Comment