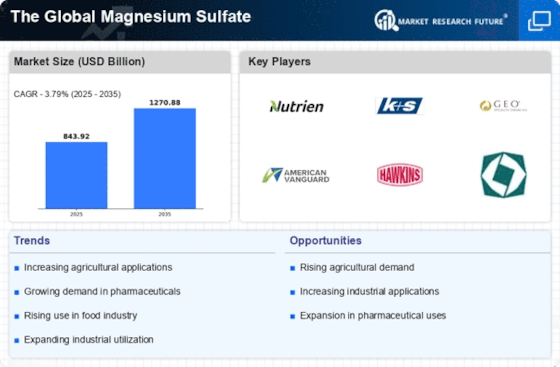

グローバルな硫酸マグネシウム市場は、農業、製薬、食品加工などのさまざまな分野での需要の増加により、動的な競争環境が特徴です。Nutrien Ltd(カナダ)、K+S AG(ドイツ)、Yara International ASA(ノルウェー)などの主要プレーヤーは、革新と地域拡大を通じて戦略的にポジショニングを図っています。Nutrien Ltd(カナダ)は、農業部門に対応するために製品の提供を強化することに注力しており、K+S AG(ドイツ)は市場での存在感を高めるために持続可能な採掘慣行を強調しています。Yara International ASA(ノルウェー)は、サプライチェーンの効率を向上させるためにパートナーシップを積極的に追求しており、持続可能性と運営の卓越性を優先する競争環境を形成しています。

ビジネス戦略に関して、企業は地域の需要に効果的に応えるために製造のローカライズとサプライチェーンの最適化を進めています。市場は中程度に分散しているようで、複数のプレーヤーが市場シェアを争っています。この分散は多様な製品とサービスを可能にしますが、Nutrien Ltd(カナダ)やK+S AG(ドイツ)などの主要プレーヤーの集団的影響力は重要であり、業界基準を設定し、革新を推進しています。

2025年8月、Nutrien Ltd(カナダ)は、先進的な硫酸マグネシウム肥料を開発するために、主要な農業技術企業との戦略的パートナーシップを発表しました。このコラボレーションは、最先端の技術を活用して作物の収量と持続可能性を向上させることを目的としています。このパートナーシップの戦略的重要性は、Nutrienの革新へのコミットメントにあり、肥料の適用方法を再定義し、農業生産性を向上させる可能性があります。

2025年9月、K+S AG(ドイツ)は、硫酸マグネシウムの生産プロセスにおける炭素排出量を削減することを目的とした新しい持続可能性イニシアチブを発表しました。このイニシアチブは、同社の環境的な信頼性を高めるだけでなく、グローバルな持続可能性のトレンドにも合致することが期待されています。この動きの戦略的重要性は、環境に優しい製品に対する消費者の好みが高まっていることに裏打ちされており、K+S AGの市場ポジショニングを強化する可能性があります。

2025年7月、Yara International ASA(ノルウェー)は、世界的な需要の高まりに応じて硫酸マグネシウムの生産能力を拡大しました。この拡大は、Yaraが顧客基盤により良くサービスを提供し、さまざまな用途における硫酸マグネシウムの需要の増加を活用するために戦略的に重要です。この動きは、市場のダイナミクスに対するYaraの積極的なアプローチと競争優位性を維持するためのコミットメントを反映しています。

2025年10月現在、グローバルな硫酸マグネシウム市場の競争トレンドは、デジタル化、持続可能性、そして生産プロセスにおける人工知能の統合によってますます影響を受けています。戦略的アライアンスがますます普及しており、企業は運営効率と革新を高めるためのコラボレーションの価値を認識しています。今後、競争の差別化は従来の価格競争から技術革新、持続可能な慣行、信頼できるサプライチェーンへの焦点に進化する可能性が高く、この市場における企業の競争方法に変革的なシフトを示しています。