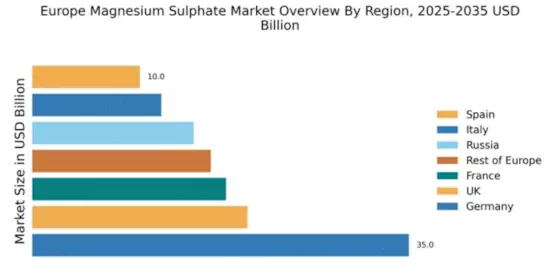

Germany : Strong Demand and Infrastructure Growth

Germany holds a commanding 35.0% market share in the magnesium sulphate sector, valued at approximately €500 million. Key growth drivers include a robust agricultural sector, increasing demand for fertilizers, and government initiatives promoting sustainable farming practices. Regulatory policies favoring eco-friendly products further enhance market potential. The country’s advanced infrastructure supports efficient distribution and production, making it a pivotal player in the European market.

UK : Sustainable Agriculture Initiatives Drive Growth

The UK accounts for 20.0% of the European magnesium sulphate market, valued at around €300 million. Growth is fueled by rising awareness of sustainable agriculture and the need for soil health improvement. Demand trends indicate a shift towards organic farming, supported by government incentives for eco-friendly practices. The UK’s regulatory framework encourages the use of magnesium sulphate in various agricultural applications, enhancing its market appeal.

France : Agricultural and Industrial Applications Flourish

France holds an 18.0% market share in the magnesium sulphate market, valued at approximately €250 million. The growth is driven by diverse applications in agriculture and industry, particularly in the production of fertilizers and pharmaceuticals. Demand is bolstered by government support for agricultural innovation and sustainability. The regulatory environment is conducive to the use of magnesium sulphate, promoting its adoption across various sectors.

Russia : Natural Resources and Industrial Growth

With a 15.0% market share, Russia's magnesium sulphate market is valued at around €200 million. Key growth drivers include abundant natural resources and increasing industrial applications, particularly in agriculture and construction. Demand trends reflect a growing focus on enhancing crop yields and soil quality. Government initiatives aimed at boosting agricultural productivity further support market expansion, alongside favorable regulatory policies.

Italy : Agricultural Focus and Regional Variability

Italy represents 12.0% of the magnesium sulphate market, valued at approximately €150 million. The market is driven by a strong agricultural sector, particularly in regions like Emilia-Romagna and Puglia, where magnesium sulphate is essential for crop production. Demand trends indicate a shift towards organic farming practices, supported by government incentives. The competitive landscape features local and international players, enhancing market dynamics.

Spain : Irrigation and Fertilization Needs Rise

Spain accounts for 10.0% of the magnesium sulphate market, valued at around €120 million. The growth is primarily driven by the need for effective irrigation and fertilization in agriculture, particularly in regions like Andalusia. Demand trends show an increasing reliance on magnesium sulphate for improving soil quality. The competitive landscape includes both local and international companies, fostering a dynamic business environment.

Rest of Europe : Diverse Applications Across Regions

The Rest of Europe holds a 16.59% market share in magnesium sulphate, valued at approximately €200 million. Growth is driven by diverse applications in agriculture, pharmaceuticals, and industrial sectors. Demand trends indicate a rising interest in eco-friendly products, supported by regional regulatory frameworks. The competitive landscape features a mix of local and international players, enhancing market dynamics across various countries.