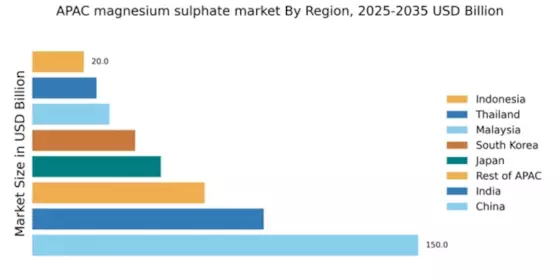

China : Strong Demand and Production Capacity

China holds a commanding market share of 150.0, representing a significant portion of the APAC magnesium sulphate market. Key growth drivers include the booming agricultural sector, which increasingly utilizes magnesium sulphate as a fertilizer. Demand trends indicate a shift towards sustainable farming practices, supported by government initiatives promoting eco-friendly agricultural inputs. Infrastructure development, particularly in logistics and transportation, further enhances market accessibility and distribution efficiency.

India : Agricultural Growth Fuels Demand

Key markets include states like Punjab, Haryana, and Maharashtra, where agriculture is a primary economic driver. The competitive landscape features major players like Nutrien Ltd and K+S AG, which have established a strong presence. Local dynamics are characterized by a mix of traditional and modern farming practices, with increasing awareness of the benefits of magnesium sulphate in crop yield and quality.

Japan : Technological Advancements in Agriculture

Key markets include regions like Hokkaido and Kumamoto, known for their agricultural output. The competitive landscape features local players alongside international firms like Mosaic Company. The business environment is conducive to innovation, with a strong emphasis on research and development in agricultural inputs. Magnesium sulphate is widely used in horticulture and specialty crops, enhancing overall productivity.

South Korea : Focus on Sustainable Agriculture

Key markets include Gyeonggi-do and Jeollanam-do, where agriculture plays a vital role in the economy. The competitive landscape includes major players like Gulf Coast Chemical and American Vanguard Corporation, which are adapting to local market needs. The business environment is dynamic, with increasing collaboration between farmers and agricultural technology firms. Magnesium sulphate is particularly valued in the cultivation of fruits and vegetables, contributing to higher yields.

Malaysia : Strategic Location for Distribution

Key markets include states like Selangor and Johor, where agriculture is a significant economic contributor. The competitive landscape features both local and international players, including Yara International ASA. The business environment is favorable for investment, with increasing awareness of the benefits of magnesium sulphate in crop production. Its applications extend to various crops, including oil palm and rubber, which are vital to Malaysia's economy.

Thailand : Strengthening Agricultural Practices

Key markets include provinces like Chachoengsao and Nakhon Ratchasima, where agriculture is a primary economic activity. The competitive landscape features local producers alongside international firms, creating a dynamic market environment. The business climate is characterized by collaboration between farmers and agricultural cooperatives. Magnesium sulphate is widely used in the cultivation of fruits, vegetables, and ornamental plants, contributing to improved crop quality.

Indonesia : Focus on Sustainable Farming Practices

Key markets include regions like West Java and Central Java, where agriculture is a significant economic driver. The competitive landscape includes both local and international players, with increasing investments in the sector. The business environment is evolving, with a growing emphasis on research and development in agricultural inputs. Magnesium sulphate is particularly valued in rice and palm oil cultivation, contributing to higher yields and better crop quality.

Rest of APAC : Varied Applications Across Regions

Key markets include emerging economies like Vietnam and the Philippines, where agriculture plays a crucial role. The competitive landscape features a mix of local and international players, adapting to regional needs. The business environment is dynamic, with increasing collaboration between agricultural sectors and technology providers. Magnesium sulphate is used in various applications, including agriculture, food processing, and pharmaceuticals, highlighting its versatility.