コバルト市場 トレンド

コバルト市場は、主に電気自動車(EV)や充電式バッテリーの需要の急増によって、顕著なトレンドを経験しています。

世界中の国々が炭素排出量の削減を約束する中、持続可能な輸送ソリューションを促進する政策がEV技術への大規模な投資をもたらし、特に高性能リチウムイオンバッテリーにおけるコバルトの消費が増加しています。

クリーンエネルギー代替品への移行は、特に自動車メーカーが生産ラインを電気モデルに焦点を当てるように移行する中で、コバルト需要の重要な推進力となっています。

コバルト市場の機会は、代替バッテリー技術やリサイクル方法の急成長にあります。

企業は、供給チェーンの安定性と倫理性を確保するために、持続可能な採掘方法や古いバッテリーからのコバルトの回収に注目しています。

さらに、コバルトフリーの新しいバッテリー化学は、性能を損なうことなくコバルトの必要性を削減できる新しい革新の方法を開きます。

市場のトレンドは、コバルトの取得に伴う地政学的問題にも注目を集めています。なぜなら、世界のコバルトの多くは政治が不安定で、採掘に倫理的な問題がある地域から来ているからです。

これにより、利害関係者はコバルトの取得方法を多様化し、コバルトの取得に伴うリスクを低減するための他の方法を模索しています。

さらに、政府と産業間の協力が進んでおり、より責任あるコバルト市場の確立が進んでいます。全体として、コバルト市場は、技術の進歩と持続可能性および倫理的慣行への経済的優先事項の変化によって特徴づけられる動的な環境に適応しています。

コバルト市場 運転手

市場成長予測

グローバルコバルト市場は大幅な成長が見込まれており、2024年には122億米ドルの市場価値が予測され、2035年には300億米ドルに達する見込みです。この成長軌道は、2025年から2035年までの間に年平均成長率(CAGR)が8.52%に達することを示唆しており、電気自動車の需要の高まり、バッテリー技術の進歩、再生可能エネルギー源の統合など、さまざまな要因によって推進されています。このような予測は、グローバル経済におけるコバルトの重要性の高まりと、将来の技術革新を形作る可能性を強調しています。

電気自動車の需要の高まり

電気自動車への移行は、グローバルコバルト市場産業の主要な推進力です。世界中の政府が厳しい排出規制を実施し、持続可能な交通手段を促進する中、リチウムイオンバッテリーの重要な成分であるコバルトの需要は急増することが予想されています。2024年には市場が122億米ドルに達する見込みで、バッテリー生産におけるコバルトへの依存が高まっていることを反映しています。2035年までには市場が300億米ドルに拡大する可能性があり、堅調な成長軌道を示しています。この変化は、自動車部門におけるコバルトの重要性を強調するだけでなく、業界の革新と投資の可能性をも浮き彫りにしています。

再生可能エネルギーの統合の増加

再生可能エネルギー源の世界的なエネルギーミックスへの統合は、エネルギー貯蔵ソリューションの需要を促進し、グローバルコバルト市場産業に影響を与えています。コバルトは、太陽光や風力などの再生可能エネルギーから生成されたエネルギーを貯蔵するバッテリーに不可欠です。各国が再生可能エネルギー目標を達成しようとする中で、効率的なエネルギー貯蔵システムの必要性が極めて重要になります。この傾向は、特に定置型貯蔵アプリケーションにおいてコバルトの需要を高めると予想されています。2024年には市場が122億米ドルに達する見込みであり、コバルトがより持続可能なエネルギー未来への移行を促進する上での重要な役割を果たしていることを強調しています。

バッテリー生産における技術の進歩

バッテリー生産における技術革新は、世界コバルト市場産業に大きな影響を与えています。バッテリーの化学と製造プロセスの進歩により、コバルトを含むバッテリーの効率と性能が向上しています。例えば、コバルトを利用する固体電池の開発は、より高いエネルギー密度と長寿命をもたらす可能性があります。これらの技術が成熟するにつれて、コバルトの需要は増加する可能性が高く、2025年から2035年までの予測CAGRは8.52%に達すると見込まれています。この成長は、業界の適応力と、より良いエネルギー貯蔵ソリューションを求める継続的な探求を反映しており、進化するエネルギー環境におけるコバルトの役割をさらに強固なものにしています。

バッテリーを超えた新興アプリケーション

コバルトの従来のバッテリー用途を超えた新たな応用が、グローバルコバルト市場産業の視野を広げています。コバルトは、その高い耐腐食性や耐久性といった特性から、航空宇宙、電子機器、医療機器などさまざまな分野でますます利用されています。これらの応用は、業界が性能と耐久性を向上させる材料を求める中で、コバルトの全体的な需要に寄与する可能性があります。市場が進化するにつれて、コバルトの応用の多様化は、さらなる投資や革新を促進し、複数の分野におけるその重要性をさらに強固にするかもしれません。この傾向は、コバルトの従来の用途を超えた価値の広範な認識を示しています。

地政学的要因とサプライチェーンのダイナミクス

地政学的要因とサプライチェーンのダイナミクスは、グローバルコバルト市場産業を形成する上で重要です。特にコンゴ民主共和国におけるコバルト生産の集中は、供給の安定性に対する懸念を引き起こします。これらの地域における政治的不安定性や規制の変化は、コバルトの供給と価格に変動をもたらす可能性があります。その結果、企業はリスクを軽減するために代替供給源やリサイクル方法を模索しています。この戦略的なシフトは、市場の成長に影響を与える可能性があり、企業は2035年までに予測される需要を満たすためにコバルトの安定供給を確保しようとしています。このようなダイナミクスは、コバルトのサプライチェーンにおける戦略的計画の重要性を浮き彫りにしています。

市場セグメントの洞察

コバルト市場のアプリケーションインサイト

コバルト市場は、さまざまな分野での応用に対する関心の高まりとともに、堅調な成長が見込まれています。2024年には、このセグメントは12.2億米ドルの総評価額を占めると予想されており、技術革新と持続可能性の取り組みによって推進される需要の高まりを反映しています。

市場の重要な部分は電気自動車用バッテリーに起因しており、2024年には45億米ドルに達すると見込まれ、2035年までにさらに105億米ドルに拡大することが予測されています。この優位性は、コバルトが電化の推進と化石燃料への依存を減らす上で果たす重要な役割を強調しており、電気自動車が持続可能な交通手段に向けた先駆けとなっています。続いて、産業用バッテリーセグメントは2024年に32億米ドルを生み出すと予測され、2035年までに82億米ドルに成長する見込みです。

このアプリケーションは、エネルギー貯蔵ソリューションや、さまざまな産業プロセスを支えるバックアップ電源システムにおいて重要な役割を果たすため、重要です。

スーパーロイカテゴリーは、2024年に20億米ドルと評価され、2035年には50億米ドルに達すると予測されており、特に航空宇宙およびガスタービンエンジンにおいて、極限条件下での優れた性能と信頼性が求められる高温アプリケーションにおけるコバルトの重要な役割を強調しています。市場内の小規模ですが重要なアプリケーションである電解質は、2024年に15億米ドルと評価され、2035年までに35億米ドルに成長すると予測されています。この分野の成長は、性能とエネルギー効率を向上させる先進的なバッテリー技術への需要の高まりを反映しています。

最終的に、磁性材料セグメントは、2024年に現在の9億米ドルから、2035年までに28億米ドルに達する見込みであり、さまざまな電子機器における効率的な磁石の需要が高まるにつれて、著しい成長が期待されています。

コバルト市場の最終用途産業の洞察

コバルト市場は、電子機器、航空宇宙、電気自動車、エネルギー貯蔵、防衛などの多様な分野を含む最終用途産業に重点を置いています。2024年には、全体の市場が122億米ドルの評価に達することが予想されており、これは先進技術の急速な採用によって促進される強い需要を反映しています。

エレクトロニクスセグメントは、スマートフォンやノートパソコンに不可欠な高性能バッテリーや部品に対するコバルトの依存度が高まっているため、特に重要です。

さらに、電気自動車セグメントは、持続可能な輸送ソリューションへの世界的なシフトによって支えられ、コバルトのバッテリー生産における重要性が大幅に高まっています。エネルギー貯蔵アプリケーションも成長しており、特に再生可能エネルギー源からの信頼性の高い電力ソリューションの必要性によって支えられています。航空宇宙分野では、コバルトの耐久性と極限条件への耐性が高性能合金に適しており、航空の安全性と効率性に貢献しています。

防衛セクターは、さまざまな軍事用途にコバルトを利用しており、その戦略的重要性を強調しています。全体として、コバルト市場の統計は、技術およびエネルギーセクターにおける革新と持続可能性への関心の高まりによって、これらのセクター全体で強い成長を示しています。

コバルト市場の化学形態の洞察

コバルト市場、特に化学製品セグメント内では、いくつかの重要な要素が参加する多様な景観が見られます。市場は2024年に122億米ドルの価値があり、堅調な成長軌道にあります。

このセグメントでは、コバルト化合物、コバルト硫酸塩、コバルト水酸化物、コバルト酸化物がそれぞれ、バッテリー製造や触媒などのさまざまな用途で重要な役割を果たしています。

コバルト硫酸塩は、リチウムイオン電池での使用により注目を集めており、エネルギー転換において重要な要素となっています。コバルト酸化物は、電子機器への応用が特に重要であり、市場での地位を強化しています。広範な市場のダイナミクスは、持続可能な調達とリサイクル技術の進展に焦点を当てており、成長する電気自動車市場と再生可能エネルギー分野に対応することを目指しています。

国々がより環境に優しい技術にシフトする中で、これらの化学的形態のコバルトの需要は引き続き増加しており、全体のコバルト市場の収益に対する重要な貢献を確認しています。

市場の成長は、産業用途の増加とさまざまな分野での電化へのシフトによって支えられており、このセグメントは新たな機会を活用しようとする利害関係者にとって重要な関心領域となっています。

コバルト市場の採掘インサイト

コバルト市場は、抽出源に重点を置き、コバルトの需要の高まりに応じた多様な手法を示しています。このセグメントから得られる収益は、業界内でのその重要性の増加を反映しています。

一次採掘は、特にバッテリーや電気自動車におけるコバルトの強い需要に支えられ、主要な貢献者としての地位を維持しています。

リサイクルは、使用済み製品からコバルトを取り出すための重要なアプローチとして浮上しており、持続可能性と循環型経済の実践を促進し、新たに採掘されたコバルトへの依存を減少させています。さらに、ニッケル抽出の副産物は重要な役割を果たしており、特にステンレス鋼やバッテリー市場でニッケルの需要が高まる中で、コバルトを効率的に調達する手段を提供しています。この抽出方法間の相乗効果は、コバルトの継続的な供給を支えるだけでなく、世界的な持続可能性の目標にも合致しています。

コバルト市場のセグメンテーションは、これらの重要な採掘源を強調し、それらの相互依存的な性質と市場のダイナミクスに対する集合的な影響を浮き彫りにしています。

コバルトの需要が急増し、特に電化が進む中で、これらの採掘源を理解することは、変化するコバルト市場の状況を把握しようとする利害関係者にとって不可欠です。

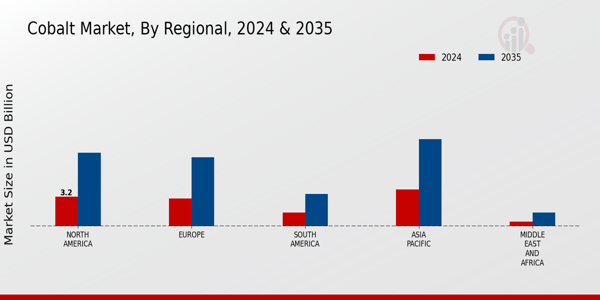

地域の洞察

コバルト市場は、さまざまな地域セグメントで多様な成長が見込まれており、投資と利用の広範な景観を提供しています。2024年には、北米の価値は32億米ドルであり、電気自動車および再生可能エネルギー部門の強力な潜在能力を示しており、コバルトの需要を大きく推進しています。

ヨーロッパは、30億米ドルの評価で続いており、持続可能なエネルギーイニシアチブとバッテリー生産へのコミットメントを強調しており、コバルト市場業界において重要な市場となっています。

アジア太平洋地域は、2024年に40億米ドルの評価で際立っており、主に大規模な製造基盤と電気自動車の採用の増加により、ボリュームの面で支配的です。

南米は15億米ドルの評価で、豊富なコバルト鉱鉱の埋蔵量により重要な役割を果たしています。一方、中東およびアフリカは5億米ドルの評価で、地域が鉱業能力を強化し、コバルト取引を探求する中で新たな機会を提供しています。

コバルト市場のセグメンテーションは、これらの異なる特性と成長ドライバーを反映しており、各地域が全体の市場ダイナミクスに独自に貢献しており、アジア太平洋地域と北米において大部分の保有が明らかである複雑でありながら有望な産業の景観を描いています。

出典:一次調査、二次調査、市場調査の未来データベース、およびアナリストレビュー

主要企業と競争の洞察

コバルト市場はその動的な性質が特徴であり、電気自動車セクター、電子機器、エネルギー貯蔵システムからの需要を含むさまざまな要因に影響されています。競争環境は、急成長するこの市場のシェアを争ういくつかの主要プレーヤーの存在によって形成されています。

企業は、世界的な消費の増加に対応するために、生産能力の向上、サプライチェーンの効率化、持続可能な採掘慣行の開発を継続的に模索しています。

さらに、コバルト価格の変動、地政学的な考慮事項、採掘業務に関する規制の枠組みが競争環境の複雑さに寄与しています。市場の需要が加速する中で、イノベーションと戦略的パートナーシップは、コバルトセクターにおける企業の競争ポジショニングを決定する上で重要な役割を果たします。

グレンコアは、さまざまな地域での広範な採掘業務と垂直統合型ビジネスモデルにより、コバルト市場における著名なプレーヤーとして際立っています。同社は重要な市場プレゼンスを確立しており、規模の経済と効率的な生産プロセスを活用することができます。

グレンコアの強みは、豊富なコバルト埋蔵量だけでなく、材料の戦略的調達にもあり、市場の変動に対して競争優位を維持することができます。

さらに、強力な財務基盤により、グレンコアは技術のアップグレードや持続可能性イニシアチブに投資することができ、責任ある採掘慣行へのコミットメントを強化しています。

同社はまた、コバルト分野における運営能力を強化するパートナーシップやジョイントベンチャーの探索に積極的であり、この急成長する市場における重要なプレーヤーとしての地位を固めています。

eCobalt Solutionsは、持続可能性とイノベーションに重点を置いたコバルトプロジェクトの開発に特化したニッチを確立しています。

同社は、高純度コバルトの生産で知られており、信頼性が高く倫理的に調達された材料を求めるバッテリー製造業者や技術企業の増大する需要に応えています。eCobalt Solutionsは、持続可能な製品に対する消費者の需要の高まりに共鳴する環境に配慮した慣行を誇りに思っています。

市場プレゼンスに関して、同社は資源基盤と生産能力を強化することを目的とした戦略的な買収やパートナーシップを積極的に追求しています。

その強みは、研究開発への強いコミットメントに根ざしており、抽出プロセスと全体的な効率を改善する最先端技術の実装を実現しています。同社は、厳格な環境基準を遵守しながら高品質な製品を提供することに焦点を当て、コバルト市場において重要な役割を果たすことを目指しています。

コバルト市場市場の主要企業には以下が含まれます

業界の動向

- 2024年第2四半期:グレンコア、テスラとの長期コバルト供給契約を締結 グレンコアは、コンゴ民主共和国の事業からテスラにコバルトを供給する数年にわたる契約を発表し、テスラのバッテリー供給チェーンを強化しました。

- 2024年第2四半期:ユーラシア資源グループ、コバルトと銅の拡張のために8億ドルの資金調達を確保 ユーラシア資源グループは、コンゴ民主共和国のメタルコルRTRコバルトおよび銅プロジェクトの拡張のために8億ドルの資金を確保し、EVバッテリー市場向けの生産を増加させることを目指しています。

- 2024年第1四半期:ウミコアとフォルクスワーゲン、バッテリー材料のパートナーシップを締結 ウミコアとフォルクスワーゲン・グループは、ヨーロッパでの電気自動車バッテリー用のカソード材料(コバルトを含む)を生産するための合弁事業を発表しました。

- 2024年第2四半期:中国の華友コバルト、インドネシアに新しい加工工場を開設 華友コバルトは、インドネシアに新しいコバルト加工施設を開設し、電気自動車セクターからの需要の増加に対応するために精製能力を拡大しました。

- 2024年第1四半期:グレンコア、新しいコバルトマーケティング責任者を任命 グレンコアは、バッテリー材料市場での地位を強化することを目指して、グローバルコバルトマーケティング部門を率いる新しい幹部を任命したと発表しました。

- 2024年第3四半期:ファーストコバルト、エレクトラバッテリーマテリアルにブランド変更し、オンタリオの精製所を開設 ファーストコバルトは正式にエレクトラバッテリーマテリアルにブランド変更し、北米初のコバルト精製所をカナダのオンタリオに開設しました。

- 2024年第2四半期:フォード、バーレとの数年にわたるコバルト供給契約を締結 フォード・モーター・カンパニーは、電気自動車バッテリー生産のためのコバルト供給を確保するために、バーレとの数年にわたる契約を締結しました。

- 2024年第1四半期:トラフィグラ、ザンビアに新しいコバルト加工施設に2億ドルを投資 商品トレーダーのトラフィグラは、グローバルバッテリーメーカー向けの供給を増加させることを目指して、ザンビアに新しいコバルト加工工場を建設するために2億ドルの投資を発表しました。

- 2024年第4四半期:パナソニックエナジーと金川集団、コバルト精製のための合弁事業を設立 パナソニックエナジーと中国の金川集団は、バッテリー生産を支援するための新しいコバルト精製施設を開発するための合弁事業を設立しました。

- 2025年第2四半期:テスラ、Gécaminesからの直接コバルト供給を確保する新契約を締結 テスラは、コンゴ民主共和国の国営鉱山会社Gécaminesとの直接供給契約を締結し、バッテリー製造業務のためのコバルトを調達します。

- 2025年第1四半期:BMW、マネジェムグループとのコバルト供給契約を締結 BMWグループは、モロッコのマネジェムグループとの新しい契約を締結し、電気自動車バッテリー用の持続可能なコバルト供給を確保しました。

- 2024年第3四半期:エレクトラバッテリーマテリアル、コバルト精製所拡張のためにカナダ政府からの資金を受け取る エレクトラバッテリーマテリアルは、北米のEV供給チェーンを支援するために、オンタリオのコバルト精製所を拡張するための資金をカナダ政府から受け取ったと発表しました。

今後の見通し

コバルト市場 今後の見通し

グローバルコバルト市場は、2025年から2035年までの間に8.52%のCAGRで成長すると予測されており、電気自動車のバッテリー、再生可能エネルギーの蓄電、先進的な電子機器に対する需要の高まりがその要因です。

新しい機会は以下にあります:

- [ "持続可能なコバルト調達に投資して、サプライチェーンのレジリエンスを高める。", "バッテリーからのコバルト回収のための革新的なリサイクル技術を開発する。", "成長する電気自動車インフラを持つ新興市場に進出する。" ]

2035年までに、グローバルコバルト市場は、進化する技術の進歩と需要の増加を反映して、堅調な成長を遂げると予想されています。

市場セグメンテーション

コバルト市場の採掘見通し

- [ "一次鉱採掘", "リサイクル", "ニッケル抽出の副産物" ]

コバルト市場の化学形態の展望

- [ "コバルト化合物", "コバルト硫酸塩", "コバルト水酸化物", "コバルト酸化物" ]

コバルト市場のアプリケーション展望

- [ "電気自動車用バッテリー", "産業用バッテリー", "超合金", "電解質", "磁性材料" ]

コバルト市場の最終用途産業の見通し

- [ "電子機器", "航空宇宙", "電気自動車", "エネルギー貯蔵", "防衛" ]

レポートの範囲

| レポート属性/指標 | 詳細 |

| 市場規模 2024 | 12.2 (億米ドル) |

| 市場規模 2035 | 40.25 (億米ドル) |

| 年平均成長率 (CAGR) | 6.00% (2025 - 2035) |

| レポートの範囲 | 収益予測、競争環境、成長要因、トレンド |

| 基準年 | 2024 |

| 市場予測期間 | 2025 - 2035 |

| 過去データ | 2019 - 2024 |

| 市場予測単位 | 億米ドル |

| 主要企業プロフィール | グレンコア、eCobaltソリューション、ファーストコバルト、中国モリブデン、オーストラリアンマインズ、ルンディンマイニング、ノリリスクニッケル、コバルトブルーホールディングス、ユミコア、陝西J&Rコバルト、ADBRI、鳳春コバルト、インペリアルマイニンググループ |

| カバーされるセグメント | アプリケーション、最終用途産業、化学形態、抽出源、地域 |

| 主要市場機会 | 電気自動車バッテリー需要、再生可能エネルギー貯蔵ソリューション、航空宇宙部品製造、医療機器用途、持続可能な採掘慣行 |

| 主要市場ダイナミクス | サプライチェーンの混乱、電気自動車需要の増加、再生可能エネルギー用途の拡大、変動する採掘規制、バッテリー技術への投資の増加 |

| カバーされる国 | 北米、ヨーロッパ、APAC、南米、MEA |

| 市場規模 2025 | 22.47 (億米ドル) |

市場のハイライト

FAQs

2024年のコバルト市場の推定価値はどれくらいですか?

コバルト市場は2024年に約122億USDの価値があると予想されています。

2025年から2035年までのコバルト市場の予想複合年間成長率(CAGR)はどのくらいですか?

コバルト市場は2025年から2035年までの間に6%のCAGRを記録する見込みです。

2035年までにコバルト市場を支配すると予想される地域はどこですか?

2035年までに、アジア太平洋地域は95億USDの価値を持つ支配的な市場として浮上することが期待されています。

2035年の電気自動車バッテリーにおけるコバルト市場の価値はどのくらいになるでしょうか?

電気自動車用バッテリーの市場価値は、2035年までに105億USDに達すると予想されています。

2035年までのコバルト市場における産業用バッテリーの価値予測は何ですか?

産業用バッテリーセグメントの価値は、2035年までに82億USDに達すると予測されています。

コバルト市場の主要なプレーヤーは誰ですか?

市場の主要なプレーヤーには、グレンコア、中国モリブデン、ファーストコバルト、ノリリスクニッケルなどが含まれます。

2035年までに北米におけるコバルトの市場規模はどのくらいになりますか?

北米におけるコバルトの市場規模は、2035年までに約80億USDになると予想されています。

2035年までに中東およびアフリカにおけるコバルト市場の期待値はどのくらいですか?

中東およびアフリカの市場価値は、2035年までに約15億USDになると予想されています。

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”