農業用トラクター市場 概要

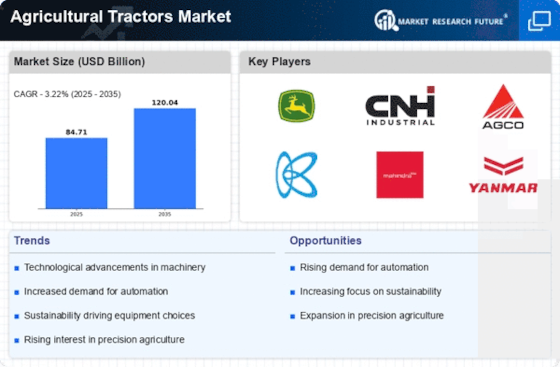

MRFRの分析によると、農業用トラクター市場の規模は2024年に847.1億米ドルと推定されています。農業用トラクター業界は、2025年に874.4億米ドルから2035年には1,200.4億米ドルに成長する見込みで、2025年から2035年の予測期間中に年平均成長率(CAGR)は3.22を示します。

主要な市場動向とハイライト

農業用トラクター市場は、技術の進歩と機械化の進展により、堅調な成長を遂げています。

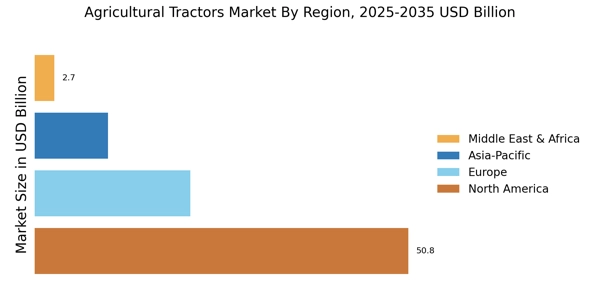

- 北米は農業用トラクターの最大市場であり、高度な技術の採用率が高いことが特徴です。

- アジア太平洋地域は、農業の機械化の進展と効率的な農業ソリューションへの需要の高まりにより、最も成長が著しい市場として浮上しています。

- 四輪駆動トラクターが市場を支配している一方で、コンパクトトラクターはその多用途性と効率性により最も急速な成長を遂げています。

- 食品生産の需要の高まりと政府の支援施策が、農業用トラクター市場を前進させる主要な要因です。

市場規模と予測

| 2024 Market Size | 8471億ドル |

| 2035 Market Size | 120.04 (米ドル十億) |

| CAGR (2025 - 2035) | 3.22% |

主要なプレーヤー

ジョン・ディア(米国)、CNHインダストリアル(英国)、AGCOコーポレーション(米国)、クボタ株式会社(日本)、マヒンドラ&マヒンドラ(インド)、ヤンマー株式会社(日本)、SDFグループ(イタリア)、ドイツ・ファール(ドイツ)、タフェ(インド)