Market Trends

Key Emerging Trends in the Wholesale Telecom Market

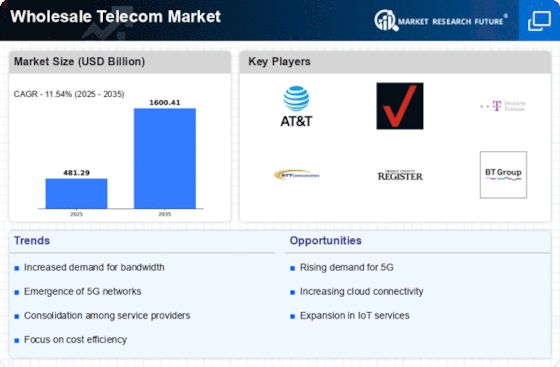

The wholesale telecom market goes thru massive modifications pushed through mechanical progressions, changing patron ways of behaving, and advancing administrative scenes. One unmistakable sample forming the market is the short reception of 5G innovation. As the 5th generation of flexible groups, 5G commitments faster speeds, lower inertness, and multiplied restrict, empowering first-rate many programs and administrations. This shift towards 5G is riding extensive hobbies in framework, setting out open doors and problems for wholesale telecom suppliers. To stay extreme, wholesalers need to regulate their groups and administrations to oblige the growing demand for immediate, low-dormancy availability. The growing commonness of cloud-based administrations is likewise impacting market factors. Wholesale telecom suppliers are developing their contributions to consistently incorporate cloud availability preparations, empowering organizations to get to and oversee statistics and packages. This pattern mirrors the developing significance of an associated organic gadget where agencies can use cloud administrations for advanced productivity, adaptability, and price-viability. Wholesale telecom gamers are decisively situating themselves to take unique care of this demand and support extensive community arrangements. Besides, the marketplace is seeing a flood within the demand for Programming SoftwareDefinedNetwork (SDN) and Network capabilities virtualization (NFV). These improvements empower the more adaptable and productive organization of the executive via virtualizing community works and incorporating management. Wholesale telecom suppliers are embracing SDN and NFV to enhance their agencies, diminish purposeful costs, and upgrade management conveyance. The execution of these improvements considers more noteworthy nimbleness in answering converting marketplace requests and purchaser necessities. Network protection has changed into a primary issue in the wholesale telecom marketplace. With the growing recurrence and refinement of virtual risks, making sure the safety and trustworthiness of telecommunications networks is essential. Wholesale suppliers are setting assets into reducing aspect network protection solutions to guard their framework and purchaser statistics. As the business turns out to be more interconnected, addressing network protection challenges is crucial to retaining acceptance as true and dependability within the wholesale telecom surroundings. The market is also seeing a shift in the direction of greater noteworthy, coordinated efforts and companies among wholesale telecom suppliers. This cooperative technique lets organizations pool assets, share basis, and deal with more whole solutions for their clients. Key coalitions empower suppliers to upgrade their management portfolios, grow their geographic attain, and stay cutthroat in a quickly developing market.

Leave a Comment