Market Trends

Key Emerging Trends in the Wearable Display Device Materials Market

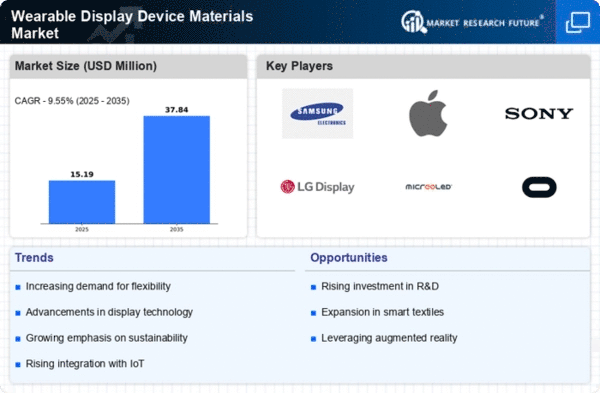

The Wearable Display Device Materials Market is witnessing a plethora of trends driven by advancements in technology, changing consumer lifestyles, and increasing adoption of wearable devices across various sectors.

Rapid Growth in Wearable Technology: The wearable technology market is experiencing rapid growth, fueled by innovations in smartwatches, fitness trackers, augmented reality (AR) glasses, and other wearable devices. This growth is driving the demand for advanced materials that can meet the performance requirements of wearable display devices, such as flexibility, durability, and lightweight properties.

Demand for Flexible Display Technologies: With the increasing popularity of flexible display technologies such as OLED (organic light-emitting diode) and AMOLED (active matrix organic light-emitting diode), there is a growing need for flexible substrate materials that can enable bendable and foldable displays in wearable devices. Materials like polyimide (PI), polyethylene terephthalate (PET), and transparent conductive films (TCFs) are gaining traction for their flexibility and compatibility with flexible display technologies.

Focus on Lightweight and Thin Materials: Wearable display devices are becoming increasingly compact and lightweight to enhance user comfort and portability. As a result, there is a growing demand for materials that are thin, lightweight, and have high strength-to-weight ratios. Materials like polymer films, glass substrates, and thin-film materials are being preferred for their lightweight properties and suitability for wearable applications.

Integration of Advanced Functionalities: Wearable display devices are evolving beyond basic functionalities to incorporate advanced features such as biometric monitoring, health tracking, augmented reality (AR), and virtual reality (VR). This trend is driving the demand for materials with specific properties such as biocompatibility, moisture resistance, and optical transparency to enable the integration of advanced functionalities in wearable devices.

Emphasis on Durability and Reliability: Wearable display devices are subjected to various environmental factors such as moisture, temperature fluctuations, mechanical stress, and impact during everyday use. As a result, there is a growing emphasis on materials that offer durability, reliability, and resistance to environmental degradation. Materials with protective coatings, scratch-resistant surfaces, and impact-resistant properties are in high demand for enhancing the durability of wearable display devices.

Advancements in Transparent Conductive Materials: Transparent conductive materials play a crucial role in enabling touch-sensitive displays and interactive functionalities in wearable devices. With the increasing demand for larger and more responsive displays, there is a focus on advancements in transparent conductive materials such as indium tin oxide (ITO) alternatives, graphene-based materials, and silver nanowires (AgNWs) for their improved conductivity, transparency, and flexibility.

Integration of Energy Harvesting Technologies: Energy harvesting technologies such as solar cells, thermoelectric generators, and kinetic energy harvesters are being integrated into wearable devices to enable self-powering capabilities and extend battery life. This trend is driving the demand for materials that are compatible with energy harvesting technologies and can efficiently convert ambient energy into electrical power for wearable display devices.

Customization and Personalization: Consumers are increasingly seeking customizable and personalized wearable devices that reflect their individual preferences, styles, and needs. This trend is driving the demand for materials that allow for customization and personalization, such as customizable display covers, interchangeable bands, and customizable interface designs, to enhance the user experience and cater to diverse consumer preferences.

Focus on Health and Safety: With growing concerns about health and safety, there is a focus on materials that are non-toxic, hypoallergenic, and compliant with safety regulations for use in wearable display devices. Materials with antimicrobial coatings, skin-friendly adhesives, and biocompatible properties are gaining traction for their ability to ensure user safety and comfort in wearable applications.

Collaboration and Partnerships for Innovation: Collaboration and partnerships between material suppliers, display manufacturers, technology providers, and wearable device OEMs (original equipment manufacturers) are driving innovation and fostering the development of materials tailored for wearable display devices. These collaborations enable knowledge sharing, technology transfer, and joint research and development initiatives to address evolving market needs and accelerate the adoption of materials in wearable applications.

Leave a Comment