Water Purifier Market Trends

Water Purifier Market Research Report Information By Product Type (RO Water Purifier, UV Water Purifier and Activated Carbon Filter), End-Use (Residential and Commercial), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) – Market Forecast Till 2035

Market Summary

As per Market Research Future Analysis, the Global Water Purifier Market was valued at USD 70754.90 billion in 2024 and is projected to grow to USD 295069.57 billion by 2035, with a CAGR of 13.86% from 2025 to 2035. Key drivers include government initiatives for clean water, rising population, and increased awareness of waterborne diseases. The market is witnessing a trend towards smart purifiers equipped with advanced technology, enhancing user experience and efficiency. The residential sector remains the largest end-user, driven by urbanization and health concerns related to water quality.

Key Market Trends & Highlights

The water purifier market is evolving with significant technological advancements and increasing consumer demand.

- Market Size in 2024: USD 70754.90 billion. Projected Market Size by 2035: USD 295069.57 billion. CAGR from 2025 to 2035: 13.86%. Asia Pacific held over 45.80% of the global market share in 2021.

Market Size & Forecast

| 2024 Market Size | USD 70754.90 billion |

| 2035 Market Size | USD 295069.57 billion |

| CAGR (2024-2035) | 13.86% |

| Largest Regional Market Share in 2021 | Asia Pacific. |

Major Players

<p>A. O. Smith, Unilever, EcoWater Systems LLC, Panasonic Corporation, Coway Co. Ltd., KENT RO Systems Ltd., Livpure Pvt. Ltd.</p>

Market Trends

Smart Purification's development and the numerous advantages of water filters drive market growth

The advent of smart purifiers with cutting-edge technologies is a recent trend seen in the industry. Smart cleaners are simple to use and have a multi-stage purifying system. These filters keep an eye on how much water is used and change the settings as needed. Additionally, smart cleaners are made to send warnings and messages to users when their maintenance cycle is complete. Customers increasingly request feature-rich purifiers as their living standards and purchasing power rise, particularly in developing nations in the Asia Pacific and the Middle East.

This is creating the Water Purifier market development potential. Therefore, it is anticipated that demand for these purifiers will increase throughout the projection period due to the quick development of such smart technology-based purifiers. Thus, this factor is driving the market CAGR.

Water purifiers provide safe drinking water by removing dangerous bacteria, viruses, and other pollutants. Giardia and cryptosporidium removal decreases the risk of gastrointestinal disease by 33%. Additionally, it removes chlorine and its metabolites and lessens the risk of rectal and bladder cancer. Additionally, drinking clean water helps to maintain an optimal energy level, enhance skin health, reduce weight, and strengthen the body's general immune system. Water flavor and taste are more valuable after purification.

As a result, using clean and safe water when cooking preserves the dish's flavor. Minerals are removed by household water filters, which might lower the water's overall quality. The purification at the water entry point extends the piping's life and greatly reduces maintenance costs.

Industries that manufacture and process things use a lot of water. A water crisis also has the greatest impact on these businesses. Thus, the necessity for water purifying systems in these industries is further fueled by the demand for water recycling. There is a rising demand for modern technology-enabled water treatment cleaners to tackle the problem of water pollution, which results from untreated water discharged by processing businesses. The expansion of food and beverage production facilities is anticipated to drive the water purifier market revenue throughout the anticipated time frame.

<p>The increasing prevalence of waterborne diseases and the growing awareness of water quality are driving a notable shift towards advanced water purification technologies across the globe.</p>

World Health Organization

Water Purifier Market Market Drivers

Rising Disposable Income

Rising disposable income levels across various demographics are contributing to the expansion of the Global Water Purifier Market Industry. As consumers gain more financial flexibility, they are increasingly willing to invest in high-quality water purification systems. This trend is particularly evident in emerging economies, where a growing middle class prioritizes health and wellness. The willingness to spend on advanced purification technologies is expected to drive market growth significantly. With a projected CAGR of 13.93% from 2025 to 2035, the industry is poised for substantial expansion, reflecting changing consumer priorities and economic conditions.

Increasing Water Scarcity

The Global Water Purifier Market Industry is experiencing a surge in demand due to increasing water scarcity across various regions. As populations grow and urbanization accelerates, the availability of clean drinking water diminishes. For instance, regions like sub-Saharan Africa and parts of Asia face severe water shortages, prompting a shift towards water purification solutions. This trend is reflected in the market's projected growth, with the industry expected to reach 70754.9 USD Billion in 2024 and potentially 297081.2 USD Billion by 2035. The urgency to address water scarcity issues drives consumers and governments alike to invest in water purification technologies.

Market Growth Projections

The Global Water Purifier Market Industry is poised for remarkable growth, with projections indicating a market size of 70754.9 USD Billion in 2024 and an anticipated increase to 297081.2 USD Billion by 2035. This growth trajectory suggests a robust demand for water purification solutions driven by various factors, including health awareness, technological advancements, and government initiatives. The projected CAGR of 13.93% from 2025 to 2035 underscores the industry's potential for expansion. This upward trend in market size reflects the increasing recognition of the importance of clean drinking water and the necessity for effective purification systems.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Water Purifier Market Industry. Innovations in Industrial Filtration technologies, such as reverse osmosis and UV purification, enhance the efficiency and effectiveness of water purifiers. These advancements not only improve the quality of purified water but also make systems more user-friendly and accessible. As a result, consumers are increasingly adopting modern purification solutions, driving market growth. The integration of smart technologies, such as IoT-enabled purifiers, further enhances consumer engagement and satisfaction. This trend is expected to propel the market towards a valuation of 70754.9 USD Billion in 2024, with continued growth anticipated in the coming years.

Health Awareness and Safety Concerns

The Global Water Purifier Market Industry is significantly influenced by heightened health awareness and safety concerns among consumers. As individuals become increasingly cognizant of the potential contaminants in tap water, the demand for effective purification systems rises. Reports indicate that consumers are more inclined to purchase water purifiers that ensure the removal of harmful substances, such as lead and bacteria. This shift in consumer behavior is likely to contribute to the industry's robust growth, with a projected CAGR of 13.93% from 2025 to 2035. The focus on health and safety is reshaping the market landscape, encouraging innovation in purification technologies.

Government Initiatives and Regulations

Government initiatives and regulations aimed at ensuring safe drinking water significantly impact the Global Water Purifier Market Industry. Many governments are implementing stringent regulations regarding water quality, compelling households and businesses to invest in purification systems. For instance, initiatives promoting the use of water purifiers in rural areas are gaining traction, as they aim to reduce waterborne diseases. These regulatory frameworks not only enhance public health but also stimulate market demand. As the industry evolves, it is likely to witness substantial growth, with projections indicating a market size of 297081.2 USD Billion by 2035, driven by supportive government policies.

Market Segment Insights

Water Purifier Product Type Insights

<p>The Water Purifier market segmentation, based on product type, includes RO water purifier, UV water purifier and activated carbon filter. In 2022, the RO-based product sector led the water purification market revenue globally and was responsible for the highest revenue share of more than 38.00%. This was because it outperformed other products in terms of decontamination. In addition to eliminating microorganisms, RO-based purifiers also eliminate dissolved solids, heavy metals, and pesticides. Consumers are now more aware of the health concerns linked to tainted drinking water due to an increase in waterborne illness incidents. </p>

<p>Additionally, it is anticipated that over the next few years, demand for residential water purifiers will increase due to the increasing penetration of low-cost residential water purifiers, <a href="https://www.marketresearchfuture.com/reports/portable-water-purifier-market-11601">portable water purifier </a>like candle-filter purifiers, by local manufacturers like Rama in developing countries as well as the appearance of advanced and innovative water purifiers by firms like Kent and AO Smith.</p>

<p>Figure 2: Water Purifier Market, by Product Type, 2024 & 2030 (USD billion)</p>

Water Purifier End-user Insights

<p>The Water Purifier market segmentation, based on end-user, includes residential and commercial. The residential sector was the most popular application in 2022, and this trend is expected to continue throughout the projection period. Residential buildings use much more water for daily activities like cooking, cleaning, bathing, and other activities than commercial buildings. </p>

<p>Additionally, increased urbanization is anticipated throughout the forecast period to increase demand for water purification products. Over 55% of the world's population currently lives in urban areas. By the end of 2050, that percentage is projected to rise to 68%, according to the United Nations' 2018 Revision of World Urbanization Prospects.</p>

Get more detailed insights about Water Purifier Market Research Report—Global Forecast till 2032

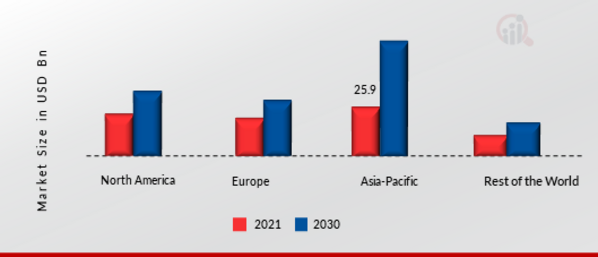

Regional Insights

The analysis offers market information for North America, Europe, Asia-Pacific, and the rest of the world, organized by Region. The Asia Pacific water purifiers market, which had sales of USD 25.9 billion in 2022, is anticipated to increase at a substantial CAGR over the research period. In 2021, the Asia Pacific region held the largest Water Purifier market share, accounting for more than 45.80% worldwide revenue. With more market participants and significant expenditures in R & D, product demand would pick up steam in this area. Businesses like Eureka Forbes have a sizable customer base, which helps the sector develop.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: WATER PURIFIER MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

The Europe water purifiers market held the second-largest revenue share in the market. Europe's largest market share belongs to Germany, followed by the United Kingdom. Germany has the greatest market share in Europe, followed by the United Kingdom. The main element fueling the market's expansion in Europe is the rise in tap water usage. The Germany Water Purifier market had the biggest market share, while the UK's Water Purifier market had the quickest growth rate on Europe's region.

In 2022, North America Water Purifier market held the third-largest proportion of the market. Due to the existence of Water and Wastewater Treatment Equipment manufacturers in the area and the developed market for them, the U.S. is the main contributor to the growth of the North American market, followed by Canada.

The majority of Americans are aware of how important clean water is. Most homes employ these purifying devices to have access to clean water. The US Water Purifier market had the biggest market share, while the Canada Water Purifier market had the quickest growth rate on Europe's continent.

Key Players and Competitive Insights

The Water Purifier business will continue to develop as a result of major market players spending a lot of money on R&D to diversify their product lines. Participants in the market are also engaging in a number of strategic initiatives to improve their worldwide footprint in conjunction with key industry developments, such as new product releases, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To grow and remain in a market that is becoming more and more competitive, Water Purifier industry competitors must provide affordable products.

One of the primary business strategies utilized by the water purifier industry to service consumers and expand the market is local manufacturing to reduce operational costs. The Water Purifier industry has recently given medicine some of the most important advantages. The Home Water Filtration Unit Market major players such as A. O. Smith, Unilever, Panasonic Corporation Coway Co. Ltd., KENT RO Systems Ltd., Livpure Pvt. Ltd., EcoWater Systems LLC, and Others are investing in research and development initiatives in an effort to increase market demand.

Discover a variety of modern home devices from Samsung, including smartphones, tablets, TVs, home appliances, and more. The customizable, NSF-certified water filtration devices from Samsung with multi-facet, ambient, and hot-cold options were released in March 2021. With this launch, the corporation wanted to capitalize on the pandemic-encouraged stay-at-home trend and penetrate the South Korean market.

Global private equity firm Advent International specializes in taking over businesses in Western and Central Europe, North America, Latin America, and Asia. The company focuses on global buyouts, expansion, and strategic restructuring in five key industries. Advent International and Shapoorji Pallonji Group signed a legally binding agreement in September 2021 for Advent International to buy the majority stake—more than 72%—in Eureka Forbes Ltd. The deal had a value of around USD 582 million. Together, the two businesses will use their combined experience to expand their local and international water treatment sector market share.

Key Companies in the Water Purifier Market market include

Industry Developments

- Q1 2024: A. O. Smith Corporation Completes Acquisition of Pureit from Unilever PLC A. O. Smith Corporation announced the completion of its acquisition of Pureit, Unilever's water purification business, for approximately $120 million. The deal expands A. O. Smith’s residential water purifier portfolio, especially in India.[1]

- Q2 2024: Pentair Launches New Smart Water Purifier Line in North America Pentair introduced a new range of smart water purifiers featuring IoT-enabled monitoring and real-time water quality analytics, targeting residential and commercial customers in the U.S.[3]

- Q2 2024: Brita Unveils Advanced Filter Technology for PFAS Removal Brita launched a new water filter product line designed to remove PFAS contaminants, responding to heightened regulatory scrutiny and consumer demand for safer drinking water.[3]

- Q2 2024: A. O. Smith Appoints New President for Global Water Purification Division A. O. Smith named a new president to lead its global water purification division, aiming to accelerate innovation and international expansion following the Pureit acquisition.[1]

- Q3 2024: Culligan International Announces Partnership with Samsung for Smart Home Water Purification Culligan International entered a strategic partnership with Samsung to integrate Culligan’s water purification technology into Samsung’s smart home ecosystem, enhancing connected water safety solutions.[4]

- Q3 2024: Xylem Opens New Water Purifier Manufacturing Facility in Vietnam Xylem inaugurated a new manufacturing plant in Vietnam dedicated to producing advanced water purifiers for Southeast Asian markets, supporting regional growth and supply chain resilience.

- Q4 2024: Pentair Wins Major Contract to Supply Water Purification Systems to U.S. School Districts Pentair secured a multi-million dollar contract to provide water purification systems to several large U.S. school districts, addressing concerns over lead and other contaminants in drinking water.[3]

- Q4 2024: Eureka Forbes Launches Solar-Powered Water Purifier for Rural India Eureka Forbes introduced a solar-powered water purifier designed for off-grid rural communities in India, aiming to improve access to safe drinking water in underserved regions.

- Q1 2025: Aquasana Raises $40 Million in Series C Funding to Expand U.S. Water Purifier Operations Aquasana, a leading U.S. water purifier brand, closed a $40 million Series C funding round to scale manufacturing and accelerate product innovation in smart filtration technologies.

- Q1 2025: LG Chem Receives EPA Approval for New Reverse Osmosis Membrane LG Chem obtained U.S. EPA approval for its latest reverse osmosis membrane, enabling the launch of new high-efficiency water purifiers in the American market.

- Q2 2025: Tata Group Announces Joint Venture with Grundfos for Water Purification Solutions Tata Group and Grundfos formed a joint venture to develop and market advanced water purification systems for industrial and residential use across Asia.

- Q2 2025: Waterdrop Launches Direct-to-Consumer Subscription Model for Filter Replacement Waterdrop, a U.S. water purifier startup, launched a subscription service for filter replacements, aiming to improve customer retention and ensure consistent water quality.

Future Outlook

Water Purifier Market Future Outlook

<p>The Global Water Purifier Market is projected to grow at a 13.86% CAGR from 2025 to 2035, driven by increasing water scarcity, technological advancements, and rising health awareness.</p>

New opportunities lie in:

- <p>Develop smart water purification systems integrating IoT for real-time monitoring. Expand product lines to include portable water purifiers targeting outdoor enthusiasts. Invest in sustainable materials for eco-friendly water purification solutions.</p>

<p>By 2035, the market is expected to achieve substantial growth, reflecting evolving consumer needs and technological innovations.</p>

Market Segmentation

Water Purifier End User Outlook

- Residential

- Commercial

Water Purifier Regional Outlook

- {"North America"=>["US"

- "Canada"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Water Purifier Product Type Outlook

- RO Water Purifier

- UV Water Purifier

- Activated Carbon Filters

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 70,754.9 billion |

| Market Size 2035 | 295069.57 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 13.86% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018 & 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Operating Platforms, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | A. O. Smith, Unilever, EcoWater Systems LLC, Panasonic Corporation Coway Co. Ltd., KENT RO Systems Ltd., and Livpure Pvt. Ltd. |

| Key Market Opportunities | Increase in per capita disposable income of Asia-pacific countries |

| Key Market Dynamics | Rapidly developing economy Government initiatives for pure water Growing population |

| Market Size 2025 | 80562.96 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Water Purifier market?

In 2023, the market for water purifiers was estimated to be worth USD 63,075.3 billion.

What is the market growth rate for water purifiers?

The market for water purifiers is anticipated to expand at a CAGR of 13.86% from 2024 to 2032.

Which Region accounted for the highest proportion of the market for water purifiers?

The Region with the biggest market share for water purifiers was Asia Pacific.

Who are the key players in the Water Purifier market?

Smith, Unilever, EcoWater Systems LLC, Panasonic Corporation Coway Co. Ltd., KENT RO Systems Ltd., and Livpure Pvt. Ltd. are the major companies in the water purifier industry

Which Product type led the Water Purifier market?

The RO Water Purifier category dominated the market in 2021.

Which End-User had the largest market share in the Water Purifier market?

The Residential had the largest share in the global Water Purifier market.

-

--- "Table of Contents

-

Executive Summary 17

-

MARKET ATTRACTIVENESS ANALYSIS 19

- GLOBAL WATER PURIFIER MARKET, BY PRODUCT TYPE 20

- GLOBAL WATER PURIFIER MARKET, BY END USE 21

- GLOBAL WATER PURIFIER MARKET, BY REGION 22

-

MARKET ATTRACTIVENESS ANALYSIS 19

-

Market Introduction 23

- Scope of the Study 23

- RESEARCH OBJECTIVE 23

- MARKET STRUCTURE 24

- KEY BUYING CRITERIA 24

-

Research Methodology 25

- RESEARCH PROCESS 25

- PRIMARY RESEARCH 26

- SECONDARY RESEARCH 27

- MARKET SIZE ESTIMATION 28

- FORECAST MODEL 29

- LIST OF ASSUMPTIONS & LIMITATIONS 30

-

MARKET INSIGHTS 31

-

MARKET DYNAMICS 33

- INTRODUCTION 33

-

DRIVERS 34

- INCREASING AWARENESS ABOUT WATER-BORNE DISEASES 34

- TECHNOLOGICAL ADVANCEMENTS IN WATER PURIFIERS 34

- DRIVERS IMPACT ANALYSIS 35

-

RESTRAINT 35

- HIGH EQUIPMENT AND MAINTENANCE COSTS 35

- RESTRAINT IMPACT ANALYSIS 36

-

OPPORTUNITY 36

- INCREASING PER CAPITA DISPOSABLE INCOME IN ASIA-PACIFIC 36

-

MARKET FACTOR ANALYSIS 37

-

SUPPLY CHAIN ANALYSIS 37

- RAW MATERIAL SUPPLY 37

- MANUFACTURING 38

- DISTRIBUTION 38

- OPERATION & MAINTENANCE 38

-

PORTER’S FIVE FORCES MODEL 39

- THREAT OF NEW ENTRANTS 39

- BARGAINING POWER OF SUPPLIERS 40

- THREAT OF SUBSTITUTES 40

- BARGAINING POWER OF BUYERS 40

- INTENSITY OF RIVALRY 40

-

IMPACT OF THE COVID-19 OUTBREAK ON GLOBAL WATER PURIFIER MARKET 41

- OVERVIEW 41

- IMPACT ON PRODUCTION 41

- IMPACT ON SUPPLY CHAIN 42

- IMPACT ON AVAILABILITY OF RAW MATERIAL 42

- CASH FLOW CONSTRAINTS 43

- IMPACT ON WORLD TRADE 43

-

SUPPLY CHAIN ANALYSIS 37

-

GLOBAL WATER PURIFIER MARKET, BY PRODUCT TYPE 44

-

OVERVIEW 44

- GLOBAL WATER PURIFIER MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2024-2030 45

-

RO WATER PURIFIERS 46

- RO WATER PURIFIERS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 46

-

UV WATER PURIFIERS 47

- UV WATER PURIFIERS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 47

-

ACTIVATED CARBON FILTERS 48

- ACTIVATED CARBON FILTERS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 48

-

OVERVIEW 44

-

GLOBAL WATER PURIFIER MARKET, BY END USE 49

-

OVERVIEW 49

- GLOBAL WATER PURIFIER MARKET ESTIMATES & FORECAST, BY END USE, 2024-2030 50

-

RESIDENTIAL 51

- OFFLINE SALES 51

- ONLINE SALES 51

- RESIDENTIAL: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 51

-

OVERVIEW 49

-

-

COMMERCIAL 52

- OFFLINE SALES 52

- ONLINE SALES 52

- COMMERCIAL: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 52

-

COMMERCIAL 52

-

GLOBAL WATER PURIFIER MARKET, BY REGION 53

-

OVERVIEW 53

- GLOBAL WATER PURIFIER MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 54

-

NORTH AMERICA 55

- NORTH AMERICA WATER PURIFIER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2024-2030 56

- US 57

- CANADA 58

-

EUROPE 59

- EUROPE WATER PURIFIER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2024-2030 60

- GERMANY 61

- UK 62

- FRANCE 63

- SPAIN 64

- REST OF EUROPE 65

-

ASIA-PACIFIC 66

- ASIA-PACIFIC WATER PURIFIER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2024-2030 67

- CHINA 68

- JAPAN 69

- SOUTH KOREA 70

- INDIA 71

- SOUTHEAST ASIA 72

- REST OF ASIA-PACIFIC 73

-

REST OF THE WORLD 74

- REST OF THE WORLD WATER PURIFIER MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 75

- LATIN AMERICA 76

- MIDDLE EAST & AFRICA 77

-

OVERVIEW 53

-

Competitive Landscape 78

- COMPETITIVE OVERVIEW 78

- COMPETITIVE BENCHMARKING 79

- MARKET SHARE ANALYSIS 81

-

KEY DEVELOPMENTS IN THE GLOBAL WATER PURIFIER MARKET 81

- KEY DEVELOPMENTS: MERGERS & ACQUISITIONS 81

- KEY DEVELOPMENTS: COLLABORATION 82

- KEY DEVELOPMENTS: CONTRACTS & AGREEMENTS 83

- KEY DEVELOPMENTS: PARTNERSHIP 83

- KEY DEVELOPMENTS: EXPANSION 83

- KEY DEVELOPMENTS: PRODUCT LAUNCH 84

-

COMPANY PROFILES 85

-

PANASONIC CORPORATION 85

- COMPANY OVERVIEW 85

- FINANCIAL OVERVIEW 86

- PRODUCTS OFFERED 87

- KEY DEVELOPMENTS 87

- SWOT ANALYSIS 88

- KEY STRATEGIES 88

-

COWAY CO., LTD. 89

- COMPANY OVERVIEW 89

- FINANCIAL OVERVIEW 89

- PRODUCTS OFFERED 90

- KEY DEVELOPMENTS 91

- SWOT ANALYSIS 91

- KEY STRATEGIES 91

-

XIAOMI INC. 92

- COMPANY OVERVIEW 92

- FINANCIAL OVERVIEW 92

- PRODUCTS OFFERED 92

- KEY DEVELOPMENTS 93

- SWOT ANALYSIS 93

- KEY STRATEGIES 93

-

A. O. SMITH (A. O. SMITH CORPORATION) 94

- COMPANY OVERVIEW 94

- FINANCIAL OVERVIEW 95

- PRODUCTS OFFERED 95

- KEY DEVELOPMENTS 96

- SWOT ANALYSIS 97

- KEY STRATEGIES 97

-

UNILEVER 98

- COMPANY OVERVIEW 98

- FINANCIAL OVERVIEW 99

- PRODUCTS OFFERED 99

- KEY DEVELOPMENTS 100

- SWOT ANALYSIS 101

- KEY STRATEGIES 101

-

EUREKA FORBES 102

- COMPANY OVERVIEW 102

- FINANCIAL OVERVIEW 103

- PRODUCTS OFFERED 104

- KEY DEVELOPMENTS 104

- SWOT ANALYSIS 105

- KEY STRATEGIES 105

-

BWT AG 106

- COMPANY OVERVIEW 106

- FINANCIAL OVERVIEW 106

- PRODUCTS OFFERED 107

- KEY DEVELOPMENTS 107

- KEY STRATEGIES 107

-

CULLIGAN 108

- COMPANY OVERVIEW 108

- FINANCIAL OVERVIEW 108

- PRODUCTS OFFERED 109

- KEY DEVELOPMENTS 109

- KEY STRATEGIES 109

-

ECOWATER SYSTEMS LLC 110

- COMPANY OVERVIEW 110

- FINANCIAL OVERVIEW 110

- PRODUCTS OFFERED 111

- KEY DEVELOPMENTS 111

- KEY STRATEGIES 111

-

BRITA, LP 112

- COMPANY OVERVIEW 112

- FINANCIAL OVERVIEW 112

- PRODUCTS OFFERED 113

- KEY DEVELOPMENTS 113

- KEY STRATEGIES 113

-

3M 114

- COMPANY OVERVIEW 114

- FINANCIAL OVERVIEW 115

- PRODUCTS OFFERED 116

- KEY DEVELOPMENTS 116

- SWOT ANALYSIS 117

- KEY STRATEGIES 117

-

PENTAIR PLC 118

- COMPANY OVERVIEW 118

- FINANCIAL OVERVIEW 119

- PRODUCTS/SOLUTIONS/SERVICES OFFERED 120

- KEY DEVELOPMENTS 120

- SWOT ANALYSIS 121

- KEY STRATEGIES 121

-

MITSUBISHI CHEMICAL CORPORATION 122

- COMPANY OVERVIEW 122

- FINANCIAL OVERVIEW 123

- PRODUCTS OFFERED 124

- KEY DEVELOPMENTS 124

- SWOT ANALYSIS 125

- KEY STRATEGIES 125

-

TORAY INDUSTRIES, INC. 126

- COMPANY OVERVIEW 126

- FINANCIAL OVERVIEW 127

- PRODUCTS OFFERED 127

- KEY DEVELOPMENTS 128

- SWOT ANALYSIS 128

- KEY STRATEGIES 128

-

KONINKLIJKE PHILIPS N.V. 129

- COMPANY OVERVIEW 129

- FINANCIAL OVERVIEW 130

- PRODUCTS OFFERED 130

- KEY DEVELOPMENTS 131

- SWOT ANALYSIS 131

- KEY STRATEGIES 131

-

ENMETEC GMBH 132

- COMPANY OVERVIEW 132

- FINANCIAL OVERVIEW 132

- PRODUCTS OFFERED 133

- KEY DEVELOPMENTS 133

- KEY STRATEGIES 133

-

CARRIER MIDEA INDIA 134

- COMPANY OVERVIEW 134

- FINANCIAL OVERVIEW 134

- PRODUCTS OFFERED 135

- KEY DEVELOPMENTS 135

- KEY STRATEGIES 135

-

KENT RO SYSTEMS LTD. 136

- COMPANY OVERVIEW 136

- FINANCIAL OVERVIEW 136

- PRODUCTS OFFERED 137

- KEY DEVELOPMENTS 139

- KEY STRATEGIES 139

-

LIVPURE PVT. LTD. 140

- COMPANY OVERVIEW 140

- FINANCIAL OVERVIEW 140

- PRODUCTS OFFERED 141

- KEY DEVELOPMENTS 142

- KEY STRATEGIES 142

-

SHENZHEN ANGEL DRINKING WATER EQUIPMENT CO., LTD. 143

- COMPANY OVERVIEW 143

- FINANCIAL OVERVIEW 143

- PRODUCTS OFFERED 144

- KEY DEVELOPMENTS 144

- KEY STRATEGIES 144

-

NINGBO LAMO DRINKING WATER EQUIPMENT CO., LTD 145

- COMPANY OVERVIEW 145

- FINANCIAL OVERVIEW 145

- PRODUCTS OFFERED 146

- KEY DEVELOPMENTS 146

- KEY STRATEGIES 146

-

PANASONIC CORPORATION 85

-

APPENDIX 147

- REFERENCES 147

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 PRIMARY INTERVIEWS 26

- TABLE 2 LIST OF ASSUMPTIONS & LIMITATIONS 30

- TABLE 3 GDP PER CAPITA IN DEVELOPING NATIONS (USD) 36

- TABLE 4 GLOBAL WATER PURIFIER MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 45

- TABLE 5 CONTAMINANTS REMOVED BY HOUSEHOLD REVERSE OSMOSIS UNITS 46

- TABLE 6 RO WATER PURIFIERS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 46

- TABLE 7 UV WATER PURIFIERS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 47

- TABLE 8 ACTIVATED CARBON FILTERS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 48

- TABLE 9 GLOBAL WATER PURIFIER MARKET ESTIMATES & FORECAST, BY END USE, 2024-2030 (USD MILLION) 50

- TABLE 10 RESIDENTIAL: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 51

- TABLE 11 COMMERCIAL: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 52

- TABLE 12 GLOBAL WATER PURIFIER MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 54

- TABLE 13 NORTH AMERICA: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2024-2030 (USD MILLION) 56

- TABLE 14 NORTH AMERICA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 56

- TABLE 15 NORTH AMERICA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 56

- TABLE 16 US: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 57

- TABLE 17 US: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 57

- TABLE 18 CANADA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 58

- TABLE 19 CANADA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 58

- TABLE 20 EUROPE: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2024-2030 (USD MILLION) 60

- TABLE 21 EUROPE: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 60

- TABLE 22 EUROPE: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 61

- TABLE 23 GERMANY: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 61

- TABLE 24 GERMANY: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 61

- TABLE 25 UK: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 62

- TABLE 26 UK: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 62

- TABLE 27 FRANCE: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 63

- TABLE 28 FRANCE: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 63

- TABLE 29 SPAIN: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 64

- TABLE 30 SPAIN: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 64

- TABLE 31 REST OF EUROPE: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 65

- TABLE 32 REST OF EUROPE: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 65

- TABLE 33 ASIA-PACIFIC: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2024-2030 (USD MILLION) 67

- TABLE 34 ASIA-PACIFIC: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 67

- TABLE 35 ASIA-PACIFIC: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 68

- TABLE 36 CHINA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 68

- TABLE 37 CHINA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 68

- TABLE 38 JAPAN: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 69

- TABLE 39 JAPAN: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 69

- TABLE 40 SOUTH KOREA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 70

- TABLE 41 SOUTH KOREA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 70

- TABLE 42 INDIA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 71

- TABLE 43 INDIA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 71

- TABLE 44 SOUTHEAST ASIA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 72

- TABLE 45 SOUTHEAST ASIA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 72

- TABLE 46 REST OF ASIA-PACIFIC: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 73

- TABLE 47 REST OF ASIA-PACIFIC: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 73

- TABLE 48 REST OF THE WORLD: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2030 (USD MILLION) 75

- TABLE 49 REST OF THE WORLD: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 75

- TABLE 50 REST OF THE WORLD: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 75

- TABLE 51 LATIN AMERICA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 76

- TABLE 52 LATIN AMERICA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 76

- TABLE 53 MIDDLE EAST & AFRICA: MARKET ESTIMATES, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 77

- TABLE 54 MIDDLE EAST & AFRICA: MARKET ESTIMATES, BY END USE, 2024-2030 (USD MILLION) 77

- TABLE 55 KEY DEVELOPMENTS: MERGERS & ACQUISITIONS 81

- TABLE 56 KEY DEVELOPMENTS: COLLABORATION 82

- TABLE 57 KEY DEVELOPMENTS: CONTRACTS & AGREEMENTS 83

- TABLE 58 KEY DEVELOPMENTS: PARTNERSHIP 83

- TABLE 59 KEY DEVELOPMENTS: EXPANSION 83

- TABLE 60 KEY DEVELOPMENTS: PRODUCT LAUNCH 84

- TABLE 61 PANASONIC CORPORATION: PRODUCTS OFFERED 87

- TABLE 62 PANASONIC CORPORATION: KEY DEVELOPMENTS 87

- TABLE 63 COWAY CO., LTD.: PRODUCTS OFFERED 90

- TABLE 64 COWAY CO., LTD.: KEY DEVELOPMENTS 91

- TABLE 65 XIAOMI INC.: PRODUCTS OFFERED 92

- TABLE 66 XIAOMI INC.: KEY DEVELOPMENTS 93

- TABLE 67 A. O. SMITH: PRODUCTS OFFERED 95

- TABLE 68 A. O. SMITH: KEY DEVELOPMENTS 96

- TABLE 69 UNILEVER: PRODUCTS OFFERED 99

- TABLE 70 UNILEVER: KEY DEVELOPMENTS 100

- TABLE 71 EUREKA FORBES: PRODUCTS OFFERED 104

- TABLE 72 BWT AG: PRODUCTS OFFERED 107

- TABLE 73 CULLIGAN: PRODUCTS OFFERED 109

- TABLE 74 CULLIGAN: KEY DEVELOPMENTS 109

- TABLE 75 ECOWATER SYSTEMS LLC: PRODUCTS OFFERED 111

- TABLE 76 BRITA, LP: PRODUCTS OFFERED 113

- TABLE 77 BRITA, LP: KEY DEVELOPMENTS 113

- TABLE 78 3M: PRODUCTS OFFERED 116

- TABLE 79 3M: KEY DEVELOPMENTS 116

- TABLE 80 PENTAIR PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 120

- TABLE 81 PENTAIR PLC: KEY DEVELOPMENTS 120

- TABLE 82 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS OFFERED 124

- TABLE 83 MITSUBISHI CHEMICAL CORPORATION: KEY DEVELOPMENTS 124

- TABLE 84 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED 127

- TABLE 85 TORAY INDUSTRIES, INC.: KEY DEVELOPMENTS 128

- TABLE 86 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED 130

- TABLE 87 KONINKLIJKE PHILIPS N.V.: KEY DEVELOPMENTS 131

- TABLE 88 ENMETEC GMBH: PRODUCTS OFFERED 133

- TABLE 89 CARRIER MIDEA INDIA: PRODUCTS OFFERED 135

- TABLE 90 KENT RO SYSTEMS LTD.: PRODUCTS OFFERED 137

- TABLE 91 KENT RO SYSTEMS LTD: KEY DEVELOPMENTS 139

- TABLE 92 LIVPURE PVT. LTD.: PRODUCTS OFFERED 141

- TABLE 93 LIVPURE PVT. LTD.: KEY DEVELOPMENTS 142

- TABLE 94 SHENZHEN ANGEL DRINKING WATER EQUIPMENT CO., LTD.: PRODUCTS OFFERED 144

- TABLE 95 NINGBO LAMO DRINKING WATER EQUIPMENT CO., LTD.: PRODUCTS OFFERED 146

- TABLE 96 NINGBO LAMO DRINKING WATER EQUIPMENT CO., LTD.: KEY DEVELOPMENTS 146 LIST OF FIGURES

- FIGURE 1 MARKET SYNOPSIS 18

- FIGURE 2 MARKET ATTRACTIVENESS ANALYSIS: GLOBAL WATER PURIFIER MARKET, 2020 19

- FIGURE 3 GLOBAL WATER PURIFIER MARKET ANALYSIS, BY PRODUCT TYPE, 2020 20

- FIGURE 4 GLOBAL WATER PURIFIER MARKET ANALYSIS, BY END USE, 2020 21

- FIGURE 5 GLOBAL WATER PURIFIER MARKET ANALYSIS, BY REGION, 2020 22

- FIGURE 6 GLOBAL WATER PURIFIER MARKET: STRUCTURE 24

- FIGURE 7 KEY BUYING CRITERIA FOR WATER PURIFIER MARKET 24

- FIGURE 8 RESEARCH PROCESS 25

- FIGURE 9 TOP-DOWN AND Bottom-up ApproachES 28

- FIGURE 10 NORTH AMERICA: WATER PURIFIER MARKET SIZE, BY COUNTRY (2020 VS. 2030) 31

- FIGURE 11 EUROPE: WATER PURIFIER MARKET SIZE, BY COUNTRY (2020 VS. 2030) 31

- FIGURE 12 ASIA-PACIFIC: WATER PURIFIER MARKET SIZE, BY COUNTRY (2020 VS. 2030) 32

- FIGURE 13 REST OF THE WORLD: WATER PURIFIER MARKET SIZE, BY REGION (2020 VS. 2030) 32

- FIGURE 14 MARKET DYNAMICS OVERVIEW 33

- FIGURE 15 DRIVERS IMPACT ANALYSIS: GLOBAL WATER PURIFIER MARKET 35

- FIGURE 16 RESTRAINT IMPACT ANALYSIS: GLOBAL WATER PURIFIER MARKET 36

- FIGURE 17 GLOBAL WATER PURIFIER MARKET: SUPPLY CHAIN ANALYSIS 37

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: GLOBAL WATER PURIFIER MARKET 39

- FIGURE 19 GLOBAL WATER PURIFIER MARKET, BY PRODUCT TYPE, 2020 (% SHARE) 44

- FIGURE 20 GLOBAL WATER PURIFIER MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION) 45

- FIGURE 21 GLOBAL WATER PURIFIER MARKET, BY END USE, 2020 (% SHARE) 49

- FIGURE 22 GLOBAL WATER PURIFIER MARKET, BY END USE, 2024-2030 (USD MILLION) 50

- FIGURE 23 GLOBAL WATER PURIFIER MARKET, BY REGION, 2024-2030 (USD MILLION) 53

- FIGURE 24 GLOBAL WATER PURIFIER MARKET, BY REGION, 2020 (% SHARE) 54

- FIGURE 25 NORTH AMERICA: WATER PURIFIER MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 55

- FIGURE 26 EUROPE: WATER PURIFIER MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 59

- FIGURE 27 ASIA-PACIFIC: WATER PURIFIER MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 66

- FIGURE 28 REST OF THE WORLD: WATER PURIFIER MARKET SHARE, BY REGION, 2020 (% SHARE) 74

- FIGURE 29 BENCHMARKING OF MAJOR COMPETITORS 79

- FIGURE 30 BENCHMARKING OF MAJOR COMPETITORS 80

- FIGURE 31 GLOBAL WATER PURIFIER MARKET SHARE ANALYSIS, 2020 81

- FIGURE 32 PANASONIC CORPORATION: FINANCIAL OVERVIEW SNAPSHOT 86

- FIGURE 33 PANASONIC CORPORATION: SWOT ANALYSIS 88

- FIGURE 34 COWAY CO., LTD.: FINANCIAL OVERVIEW SNAPSHOT 89

- FIGURE 35 COWAY CO., LTD.: SWOT ANALYSIS 91

- FIGURE 36 XIAOMI INC.: FINANCIAL OVERVIEW SNAPSHOT 92

- FIGURE 37 XIAOMI INC.: SWOT ANALYSIS 93

- FIGURE 38 A. O. SMITH: FINANCIAL OVERVIEW SNAPSHOT 95

- FIGURE 39 A. O. SMITH: SWOT ANALYSIS 97

- FIGURE 40 UNILEVER: FINANCIAL OVERVIEW SNAPSHOT 99

- FIGURE 41 UNILEVER: SWOT ANALYSIS 101

- FIGURE 42 FORBES & COMPANY LIMITED (PARENT ORGANIZATION): FINANCIAL OVERVIEW SNAPSHOT 103

- FIGURE 43 EUREKA FORBES: SWOT ANALYSIS 105

- FIGURE 44 BWT AG: FINANCIAL OVERVIEW SNAPSHOT 106

- FIGURE 45 CULLIGAN: FINANCIAL OVERVIEW SNAPSHOT 108

- FIGURE 46 ECOWATER SYSTEMS LLC: FINANCIAL OVERVIEW SNAPSHOT 110

- FIGURE 47 BRITA, LP: FINANCIAL OVERVIEW SNAPSHOT 112

- FIGURE 48 3M: FINANCIAL OVERVIEW SNAPSHOT 115

- FIGURE 49 3M: SWOT ANALYSIS 117

- FIGURE 50 PENTAIR PLC: FINANCIAL OVERVIEW SNAPSHOT 119

- FIGURE 51 PENTAIR PLC: SWOT ANALYSIS 121

- FIGURE 52 MITSUBISHI CHEMICAL CORPORATION: FINANCIAL OVERVIEW SNAPSHOT 123

- FIGURE 53 MITSUBISHI CHEMICAL CORPORATION: SWOT ANALYSIS 125

- FIGURE 54 TORAY INDUSTRIES, INC.: FINANCIAL OVERVIEW SNAPSHOT 127

- FIGURE 55 TORAY INDUSTRIES, INC.: SWOT ANALYSIS 128

- FIGURE 56 KONINKLIJKE PHILIPS N.V.: FINANCIAL OVERVIEW SNAPSHOT 130

- FIGURE 57 KONINKLIJKE PHILIPS N.V.: SWOT ANALYSIS 131

- FIGURE 58 ENMETEC GMBH: FINANCIAL OVERVIEW SNAPSHOT 132

- FIGURE 59 CARRIER MIDEA INDIA: FINANCIAL OVERVIEW SNAPSHOT 134

- FIGURE 60 KENT RO SYSTEMS LTD.: FINANCIAL OVERVIEW SNAPSHOT 136

- FIGURE 61 LIVPURE PVT. LTD.: FINANCIAL OVERVIEW SNAPSHOT 140

- FIGURE 62 SHENZHEN ANGEL DRINKING WATER EQUIPMENT CO., LTD.: FINANCIAL OVERVIEW SNAPSHOT 143

- FIGURE 63 NINGBO LAMO DRINKING WATER EQUIPMENT CO., LTD.: FINANCIAL OVERVIEW SNAPSHOT 145"

Water Purifier Market Segmentation

Water Purifier Product Type Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Water Purifier End User Outlook (USD Billion, 2024-2030)

Residential

Commercial

Water Purifier Regional Outlook (USD Billion, 2024-2030)

North America Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

North America Water Purifier by End-UseResidential

Commercial

US Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

US Water Purifier End-Use

Residential

Commercial

CANADA Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

CANADA Water Purifier by End-UseResidential

Commercial

Europe Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Europe Water Purifier End-Use

Residential

Commercial

Germany Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Germany Water Purifier End-Use

Residential

Commercial

France Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

France Water Purifier End-Use

Residential

Commercial

UK Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

UK Water Purifier End-Use

Residential

Commercial

ITALY Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

ITALY Water Purifier End-Use

Residential

Commercial

SPAIN Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Spain Water Purifier End-Use

Residential

Commercial

Rest Of Europe Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

REST OF EUROPE Water Purifier End-Use

Residential

Commercial

Asia-Pacific Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Asia-Pacific Water Purifier End-Use

Residential

Commercial

China Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

China Water Purifier End-Use

Residential

Commercial

Japan Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Japan Water Purifier End-Use

Residential

Commercial

India Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

India Water Purifier End-Use

Residential

Commercial

Australia Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Australia Water Purifier End-Use

Residential

Commercial

Rest of Asia-Pacific Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Rest of Asia-Pacific Water Purifier End-Use

Residential

Commercial

Rest of the World Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Rest of the World Water Purifier End-Use

Residential

Commercial

Middle East Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Middle East Water Purifier End-Use

Residential

Commercial

Africa Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Africa Water Purifier End-Use

Residential

Commercial

Latin America Outlook (USD Billion, 2024-2030)

RO Water Purifier

UV Water Purifier

Activated Carbon Filters

Latin America Water Purifier End-Use

Residential

Commercial

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment