Virtual Router Size

Market Size Snapshot

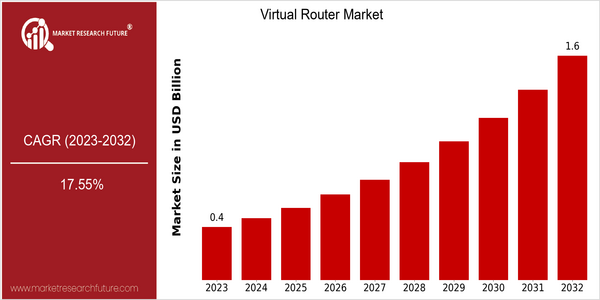

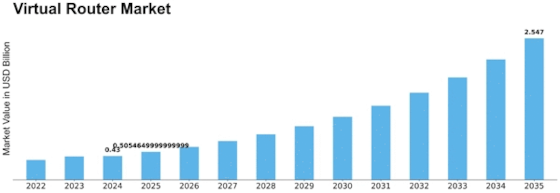

| Year | Value |

|---|---|

| 2023 | USD 0.36 Billion |

| 2032 | USD 1.58 Billion |

| CAGR (2024-2032) | 17.55 % |

Note – Market size depicts the revenue generated over the financial year

The Virtual Routers Market is expected to grow at a CAGR of 36%, reaching a market size of $363.1 million in 2023 and is projected to reach $1,580.4 million by 2032. This represents a CAGR of 17.55% from 2024 to 2032, indicating a strong growth trend. The rising volume of data traffic and the increasing popularity of cloud-based services and the Internet of Things are driving the demand for virtual routers. In addition, the emergence of new technological trends, such as the development of 5G and the transition to SDN, will further drive the growth of the virtual routers market. The innovation of virtual routers enables the flexible and efficient network configuration, and the business can optimize the resources and reduce the cost. The industry is a large industry, and the major players, such as Cisco, VMware, and Juniper, have made significant investments in research and development, establishing strategic alliances, and launching new products. Recent technological developments by Cisco, for example, have demonstrated its leadership in virtual routing technology.

Regional Market Size

Regional Deep Dive

The Virtual Router Market is growing at a fast pace across the globe. The increasing need for network management and the rising popularity of cloud services are the major factors driving the growth of the Virtual Router Market. In North America, the market is characterized by advanced technology and high adoption of virtualization. Europe is experiencing a rise in regulations that promote digital transformation. The Asia-Pacific region is expanding rapidly, owing to the growing number of internet users and mobile devices. The Middle East and Africa are witnessing an increase in investment in telecommunications, whereas Latin America is focusing on increasing digital services and improving digital access.

Europe

- The European Union's Digital Single Market strategy is fostering innovation in the virtual router space, encouraging companies like Nokia and Ericsson to develop advanced networking solutions.

- Sustainability initiatives are prompting organizations to adopt energy-efficient virtual routing technologies, with companies like Deutsche Telekom investing in greener network solutions.

Asia Pacific

- The rapid digital transformation in countries like India and China is propelling the virtual router market, with local players such as Huawei and ZTE making significant advancements in virtualization technologies.

- Government initiatives aimed at improving internet infrastructure, such as the Digital India program, are creating a favorable environment for the adoption of virtual routers.

Latin America

- The push for improved internet access in Latin America is driving the adoption of virtual routers, with companies like Movistar and Claro exploring innovative solutions to enhance their network capabilities.

- Government programs aimed at bridging the digital divide are encouraging the deployment of virtual routing technologies, particularly in underserved areas.

North America

- The rise of 5G technology is significantly influencing the virtual router market in North America, with companies like Cisco and Juniper Networks leading the charge in developing solutions that support high-speed connectivity.

- Regulatory changes, such as the FCC's initiatives to promote broadband access, are driving demand for virtual routers as service providers seek to enhance their network capabilities.

Middle East And Africa

- Telecommunications companies in the Middle East, such as Etisalat and STC, are investing heavily in virtual routing technologies to enhance their service offerings and improve network efficiency.

- The African Union's Agenda 2063 emphasizes the importance of digital infrastructure, leading to increased investments in virtual routers to support connectivity across the continent.

Did You Know?

“As of 2023, over 70% of enterprises are expected to adopt virtual routers as part of their network infrastructure, highlighting the shift towards virtualization in networking.” — Gartner Research

Segmental Market Size

Virtual Routers are a growing market, driven by the growing need for network management and the growing popularity of cloud computing. A growing need for scalability of network solutions and the trend towards SDN (software-defined networking) which increases flexibility and reduces operating costs are the main driving forces for this market. Also, regulations encouraging digital transformation in various sectors are pushing up the demand for virtual routers. At the moment, virtual routers are in the process of mass deployment, with Cisco and VMware leading the market. North America and Europe are leading the way in the deployment of virtual routers in enterprise networks and data centres. Applications for virtual routers include telecommunications, remote business access, and IoT. In addition to the general trend towards remote work, trends towards promoting green IT and the rise of artificial intelligence (AI) are shaping the development of this market.

Future Outlook

Virtual Router Market is expected to experience a CAGR of 17.55% from 2023 to 2032. The growth is driven by the growing need for efficient network management solutions, especially as enterprises are migrating to cloud-based infrastructures. The adoption of virtual routers is expected to account for approximately 30% of the global network equipment market by 2032. The integration of machine learning and artificial intelligence in virtual routers is also expected to drive the market growth. These innovations will enable the smart management of traffic and advanced data analytics, enabling businesses to optimize their network resources. Moreover, the expansion of 5G networks and supportive government policies to digitally transform industries will provide a conducive environment for the adoption of virtual routers. Meanwhile, the emergence of Software-Defined Networking and Network Functions Virtualization will play a key role in shaping the market landscape. These trends will bring about greater flexibility and agility to the network operations.

Leave a Comment