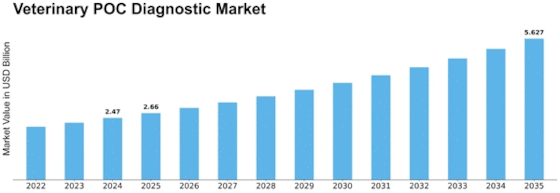

Veterinary Poc Diagnostic Size

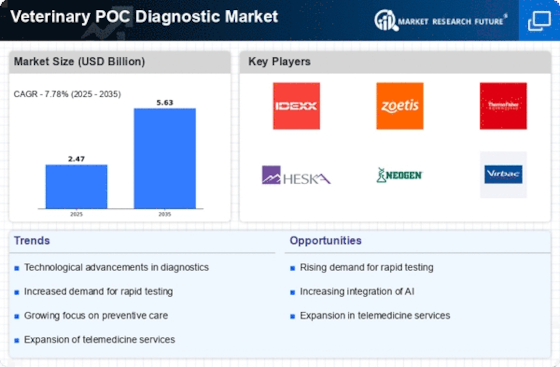

Veterinary POC Diagnostic Market Growth Projections and Opportunities

The veterinary point-of-care (POC) diagnostic market is driven by the increasing trend of pet ownership and the growing humanization of pets. As more people consider pets as integral members of their families, there is a higher demand for accessible and rapid diagnostic solutions for animal healthcare. Major factor driving the veterinary point of care diagnostic market is high prevalence of different animal diseases such as infectious diseases, allergic conditions, cancer and others. In the cases of companion animals and livestock, timely treatment and management of diseases require timely accurate diagnosis aimed at containing the spread of infections. It is continuous technological evolution in the area of veterinary diagnostics which steers the market. Innovations occurring in POC diagnostic devices, such as higher accuracy, mobility, and user-friendliness enable veterinarians to diagnose and treat animal problems with more capability. There is increased focus on preventive trends in veterinary practice thus leading to increased demand for instruments that can detect early stages of diseases. Preventive healthcare services are facilitated by vet POC diagnostics since the vet can detect and manage health problems early before they blow out of proportion. The veterinary POC diagnostic market is indirectly affected by increasing public knowledge of the zoonotic diseases. The importance of diagnosing and managing diseases of animals is not only limited to animal health but rather goes beyond in protecting human beings from suffering together with zoonotic infections. Veterinarian goods and services leadto the increase in the veterinary POC diagnostic market especially in the emerging economies. Rise in veterinary care availability in these geographies gives a thrust to the implementation of point- of care diagnostic products. The use of remote monitoring as well as telemedicine in veterinary care impacts the market for the POC diagnostic. Mobile and connected diagnostic devices allow remote animal observations whereby the information acquired can be used by a veterinarian in decision making away from the site. The economic factors as veterinary care affordability affect the implementation of POC diagnostic solutions. As a result, manufacturers have much motivation to produce affordable instruments for service providers at different physiotherapy levels as well as to enhance the potential market shaping. Accessibility and reach of pet insurance directly affect the vet POC diagnostic market. People who have insurance pertaining to the ownership of their pets would be more willing to avail diagnostic tests for their animals and contribute to the market consumption of POC diagnostic devices. The One Health approach, recognizing the interconnectedness of human, animal, and environmental health, influences the veterinary POC diagnostic market. As awareness of the importance of veterinary diagnostics in the broader context of public health grows, the demand for POC solutions increases.

Leave a Comment