Regulatory Support and Standards

Regulatory support plays a crucial role in shaping the Veterinary POC Diagnostic Market. Governments and regulatory bodies are increasingly establishing standards and guidelines that facilitate the development and approval of veterinary diagnostic products. This support not only ensures the safety and efficacy of diagnostic tools but also encourages innovation within the industry. As regulatory frameworks become more favorable, manufacturers are likely to invest in research and development, leading to the introduction of new and improved diagnostic solutions. This regulatory environment is expected to positively influence the growth trajectory of the Veterinary POC Diagnostic Market.

Growing Pet Ownership and Spending

The Veterinary POC Diagnostic Market is significantly influenced by the growing trend of pet ownership and increased spending on pet care. As more households adopt pets, there is a corresponding rise in demand for veterinary services, including diagnostics. Pet owners are increasingly willing to invest in their pets' health, leading to higher expenditures on veterinary care. This trend is reflected in the projected growth of the veterinary diagnostics market, which is anticipated to reach USD 3.5 billion by 2026. The increasing focus on pet health and wellness is likely to drive the expansion of the Veterinary POC Diagnostic Market.

Increased Focus on Preventive Care

There is a notable shift towards preventive care within the Veterinary POC Diagnostic Market. Pet owners and veterinarians are increasingly recognizing the importance of early detection of diseases to ensure better health outcomes for animals. This trend is reflected in the rising demand for routine diagnostic tests, which are essential for monitoring the health of pets. The market is expected to grow as more veterinary practices adopt preventive care protocols, leading to an increase in the utilization of point-of-care diagnostics. This proactive approach not only enhances animal welfare but also contributes to the overall growth of the Veterinary POC Diagnostic Market.

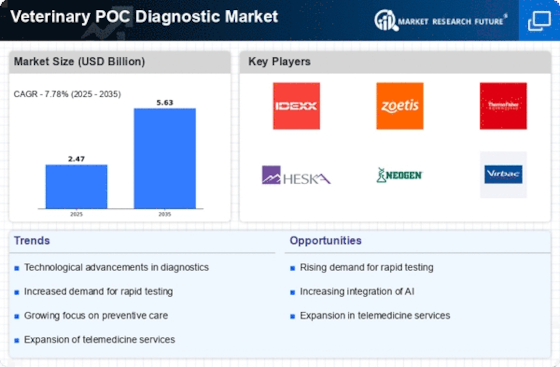

Technological Advancements in Diagnostics

The Veterinary POC Diagnostic Market is experiencing a surge in technological advancements that enhance diagnostic capabilities. Innovations such as portable diagnostic devices and rapid testing kits are becoming increasingly prevalent. These technologies allow for immediate results, which is crucial in veterinary practices where timely decisions can significantly impact animal health. The market for veterinary diagnostics is projected to reach USD 3.5 billion by 2026, driven by these advancements. Furthermore, the integration of artificial intelligence and machine learning into diagnostic tools is expected to improve accuracy and efficiency, thereby fostering growth in the Veterinary POC Diagnostic Market.

Rising Demand for Zoonotic Disease Testing

The Veterinary POC Diagnostic Market is witnessing a rising demand for testing related to zoonotic diseases. As awareness of the transmission of diseases from animals to humans increases, there is a growing need for rapid and accurate diagnostic tools. This demand is particularly evident in regions where zoonotic diseases are prevalent, prompting veterinarians to utilize point-of-care diagnostics for timely identification and management. The market for zoonotic disease testing is projected to expand, driven by the need for effective surveillance and control measures. Consequently, this trend is likely to bolster the Veterinary POC Diagnostic Market.