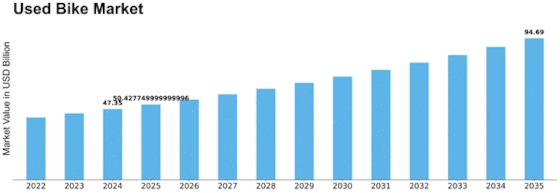

Used Bike Size

Used Bike Market Growth Projections and Opportunities

The used bike market has a distinctive design that is progressing and changing all the time. This particular segment holds a major share of the automotive sphere. These dynamics are influenced by multiple factors that deal with both the number of offer and demand. Economic climate is one the most important driving factors for the market dynamics. When the market is experiencing economic difficulties, consumers will often purchase second-hand bikes instead of new ones. It becomes obvious that this trend takes root mostly during the times when unpredictable financial situations have arisen, thus forcing the individuals to look for cheaper means of transport.

Every step of the market dynamics is next technological innovation. As soon as the new innovative features and improvements appear in the latest bikes, the used bike models could be less popular. Regularly, consumers buy a new model in which they sell their older bikes to the market and then create a continual supply of used bikes. However, the reason for changes in consumer preferences also plays an active part in these dynamics. The differentiation of lifestyles, increased environmental awareness and preference certain types of bikes are the main factors that cause the growth of good bikes in the used market in the recent times.

The supply and demand of the used bicycle market are further altered by factors such as seasonal change. For example, demand may rise rapidly in summer when the weather is favorable and riding is more comfortable, hence resulting in the sale of more motorcycles at higher prices for the popular ones. However, during those cold months, there is a likely chance that the demand may drop, when again both prices and the turnover of used bikes are affected. The regionality also matters because you will find that the interest in biking has different rates across different geographical locations.

The condition of the bikes is a key factor that the market is hanged on. Mint condition and less mileage bikes get easily sold and are usually worth more. Issues including maintenance records, the accident history, and overall depreciation are taken into consideration by prospective buyers when buying a used vehicle. Consequently, dealers who possess documents certifying the lien-free condition of a used bike and prove that the used bike is in good condition will likely remain competitive.

Thanks to digital platforms the rules of the game in the used bike field have changed drastically. Digital online sites and classical ads have made it possible for buyers as well as sellers to connect and easily sell their products beyond local boundaries. With this level of availability, there is a high chance of price transparency and competition. This, in turn, speeds up the rate of buying and selling.

Leave a Comment