Us Geotextiles Size

US Geotextiles Market Growth Projections and Opportunities

The US Geotextiles Market is influenced by a variety of market factors that contribute to its growth and dynamics. One of the primary drivers is the increasing infrastructure development across the country. As the US invests in projects such as road construction, landfills, erosion control, and environmental protection, the demand for geotextiles has surged. Geotextiles, with their versatile applications in civil engineering and construction, provide solutions for soil stabilization, drainage, and reinforcement, making them an integral component in modern infrastructure projects.

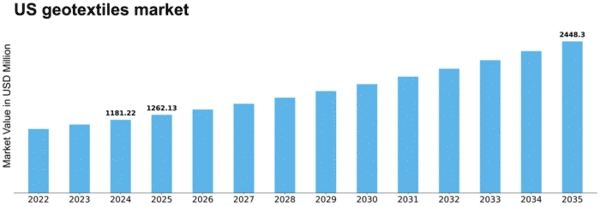

The US geotextiles market size was valued at USD 0.81 Billion in 2022. The geotextiles industry is projected to grow from USD 0.86 Billion in 2023 to USD 1.35 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.80%

Moreover, environmental awareness and regulations play a crucial role in shaping the US Geotextiles Market. With a growing emphasis on sustainable construction practices and environmental protection, geotextiles have become instrumental in addressing challenges related to soil erosion, sediment control, and water management. Regulatory requirements for erosion and sediment control in construction sites have further increased the adoption of geotextiles, positioning them as a sustainable solution to mitigate environmental impacts.

Technological advancements in manufacturing processes and materials contribute to the market dynamics. Innovations in geotextile materials, such as high-performance polymers and natural fibers, enhance the durability and effectiveness of these materials in various applications. Advanced manufacturing techniques allow for the production of geotextiles with specific characteristics tailored to meet the requirements of different projects. This continuous innovation fosters the growth of the US Geotextiles Market by providing engineers and construction professionals with an expanding range of geotextile solutions.

The construction industry's inclination towards cost-effective and sustainable solutions is another key factor shaping the geotextiles market. Geotextiles offer advantages such as reduced construction time, lower maintenance costs, and improved long-term performance. As construction projects seek ways to optimize costs and adhere to sustainability goals, the use of geotextiles becomes increasingly attractive. This economic and environmental value proposition positions geotextiles as a preferred choice in various civil engineering applications.

Government infrastructure spending and policies related to public works projects also impact the US Geotextiles Market. Federal and state investments in infrastructure development, such as the Fixing America's Surface Transportation (FAST) Act, contribute to the demand for geotextiles in road construction and transportation projects. Policies that prioritize the use of geotextiles in erosion control and stormwater management further drive market growth by creating a favorable environment for the incorporation of these materials in construction projects.

The competitive landscape and industry consolidation play a role in the market dynamics. The presence of both global and regional players leads to competition and strategic alliances. Mergers, acquisitions, and partnerships contribute to market consolidation, enabling companies to expand their product portfolios and geographic reach. This dynamic environment encourages manufacturers to invest in research and development, fostering innovation in geotextile technologies and applications.

The resilience and adaptability of geotextiles in responding to climate-related challenges also influence market trends. As extreme weather events become more frequent, the need for solutions that address soil erosion, slope stabilization, and flood control has increased. Geotextiles provide a flexible and effective means of mitigating the impact of climate-related issues on infrastructure and land development projects.

Leave a Comment