Us Carbon Monoxide Size

US Carbon Monoxide Market Growth Projections and Opportunities

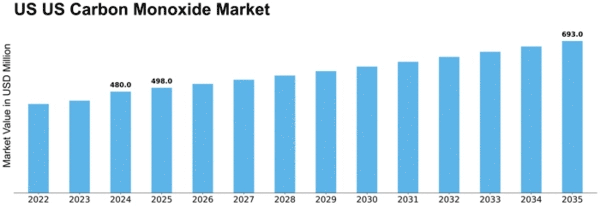

The US Carbon Monoxide (CO) Market is shaped by a variety of market factors that contribute to its growth and dynamics. One of the primary drivers is the widespread use of carbon monoxide in various industries. CO is employed in processes such as metal fabrication, chemicals production, and the manufacturing of certain gases. As these industries expand, the demand for carbon monoxide as a key industrial gas has increased, propelling the growth of the US CO market. The versatility and utility of CO across different sectors contribute to its consistent demand in the industrial landscape. The US carbon monoxide market size was valued at USD 0.51 Billion in 2022. The carbon monoxide industry is projected to grow from USD 0.54 Billion in 2023 to USD 0.83 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.50%

Moreover, safety regulations and standards play a pivotal role in influencing the US Carbon Monoxide Market. Given the toxic nature of carbon monoxide, stringent safety guidelines govern its production, storage, and usage. Compliance with these regulations is crucial for ensuring workplace safety and preventing environmental hazards. Manufacturers and users of carbon monoxide must adhere to strict safety protocols, which, in turn, shape the market dynamics by emphasizing the importance of maintaining high safety standards in the handling of this industrial gas.

Technological advancements and innovations in industrial processes also impact the market. As industries evolve and adopt new technologies, the requirements for specific gases, including carbon monoxide, may change. Innovations in manufacturing processes, such as those in the production of specialty chemicals or electronic components, may lead to an increased demand for carbon monoxide as a feedstock or reaction gas. This dynamic relationship between technological advancements and industrial applications influences the demand for carbon monoxide in the US market.

The energy sector, particularly the interest in hydrogen production, contributes significantly to the US Carbon Monoxide Market. CO is a key raw material in the water gas shift reaction used to produce hydrogen. With the growing focus on hydrogen as a clean energy carrier, there is an increased demand for carbon monoxide in hydrogen production processes. This trend is closely tied to the broader goals of reducing carbon emissions and transitioning towards cleaner energy sources, positioning carbon monoxide as a crucial component in the evolving energy landscape.

Competitive dynamics and industry consolidation further shape the US CO market. The presence of both global and regional players results in a competitive market environment, leading to strategic partnerships, acquisitions, and technological collaborations. These activities are driven by the pursuit of expanding market share, diversifying product portfolios, and leveraging synergies. The competitive landscape encourages companies to invest in research and development to improve production efficiency and explore new applications for carbon monoxide.

Environmental considerations and sustainability are gaining prominence in the carbon monoxide market. Industries are increasingly seeking environmentally friendly alternatives and cleaner production processes. As a result, carbon monoxide producers are exploring ways to minimize their environmental impact, enhance energy efficiency, and reduce greenhouse gas emissions associated with CO production. This aligns with broader industry trends towards sustainability and responsible environmental practices.

Leave a Comment