Market Trends

Key Emerging Trends in the UAE Green Hydrogen Market

The UAE Green Hydrogen market is experiencing a noteworthy surge in recent years, reflecting a broader global trend towards sustainable and clean energy solutions. Green hydrogen, produced through the electrolysis of water using renewable energy sources, has gained significant traction in the UAE due to the country's commitment to reducing carbon emissions and diversifying its energy mix. As a key player in the global energy landscape, the UAE recognizes the importance of embracing environmentally friendly technologies to meet its ambitious sustainability goals.

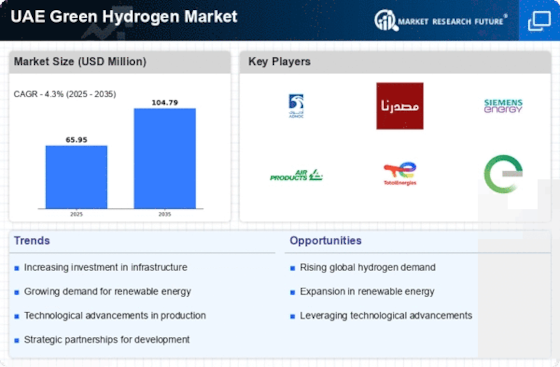

One of the driving forces behind the growth of the green hydrogen market in the UAE is the government's strategic vision and substantial investments in renewable energy projects. The country has set ambitious targets to increase the share of clean energy in its total energy mix, with a particular focus on hydrogen as a versatile and sustainable fuel. Government initiatives and policies, such as the UAE Energy Strategy 2050 and the Green Hydrogen Alliance, have provided a clear roadmap for the development and integration of green hydrogen projects across the nation.

Moreover, partnerships and collaborations between government entities, private sector companies, and international players have played a pivotal role in fostering innovation and accelerating the adoption of green hydrogen technologies. The UAE has been actively engaging in joint ventures with global leaders in renewable energy and hydrogen production to leverage their expertise and advance the country's position in the green hydrogen market.

The increasing awareness and acceptance of green hydrogen as a viable and clean alternative to traditional fossil fuels have also fueled market growth. Industries across various sectors, including transportation, manufacturing, and power generation, are recognizing the potential of green hydrogen to decarbonize their operations. As a result, there is a growing demand for green hydrogen as an energy carrier and feedstock for various applications.

Technological advancements and cost reductions in electrolysis technology have contributed significantly to the competitiveness of green hydrogen in the UAE market. As the efficiency of electrolyzers improves and production costs decrease, green hydrogen becomes more economically viable, aligning with the UAE's commitment to achieving cost-competitive renewable energy solutions.

The UAE's geographic advantage, abundant sunlight, and vast open spaces make it conducive for large-scale renewable energy projects, including solar-powered electrolysis for green hydrogen production. The integration of these projects into the existing energy infrastructure further strengthens the UAE's position as a regional leader in sustainable energy development.

Despite the positive momentum, challenges remain for the UAE Green Hydrogen market. The initial capital costs of establishing green hydrogen production facilities, coupled with the need for further advancements in storage and transportation infrastructure, present hurdles that require strategic planning and investment. Additionally, global market dynamics and the evolving landscape of hydrogen technologies pose uncertainties that necessitate adaptability and continuous innovation.

The UAE Green Hydrogen market is experiencing a robust upward trajectory, driven by the government's commitment to sustainability, strategic partnerships, increasing awareness among industries, and advancements in technology. As the UAE continues to position itself as a global hub for clean energy, the green hydrogen market is expected to play a pivotal role in shaping the nation's energy landscape and contributing to the broader transition towards a more sustainable and low-carbon future.

Leave a Comment