Government Incentives and Support

Government incentives and support mechanisms are increasingly shaping the landscape of the Green Hydrogen Market. Various countries have introduced policies aimed at promoting the adoption of green hydrogen technologies, including subsidies, tax breaks, and research funding. For example, several nations have committed to investing billions in hydrogen infrastructure as part of their energy transition strategies. This financial backing is expected to accelerate the deployment of green hydrogen projects, thereby fostering market growth. The Green Hydrogen Market stands to gain from these initiatives, as they not only lower the barriers to entry for new players but also stimulate innovation and collaboration across sectors.

Advancements in Electrolysis Technology

Technological advancements in electrolysis, the primary method for producing green hydrogen, are likely to play a crucial role in the Green Hydrogen Market. Innovations in electrolyzer efficiency and cost reduction have the potential to make green hydrogen production more economically viable. For instance, the cost of electrolyzers has decreased significantly, with projections suggesting a further reduction of up to 50% by 2030. This trend may enhance the competitiveness of green hydrogen against conventional hydrogen production methods. As a result, the Green Hydrogen Market could witness increased investment and development, leading to a more robust infrastructure for hydrogen production and distribution.

Growing Interest from Industrial Sectors

The industrial sector's growing interest in green hydrogen as a feedstock for various applications is likely to drive the Green Hydrogen Market forward. Industries such as steel, cement, and chemicals are exploring hydrogen as a means to decarbonize their operations. For instance, the steel industry, which accounts for approximately 7% of global CO2 emissions, is increasingly looking at hydrogen-based direct reduction methods. This shift could lead to a substantial increase in demand for green hydrogen, with projections indicating that the industrial sector could account for over 30% of total hydrogen consumption by 2030. The Green Hydrogen Market is thus poised to benefit from this trend, as companies seek sustainable alternatives to traditional fossil fuel-based processes.

Rising Demand for Clean Energy Solutions

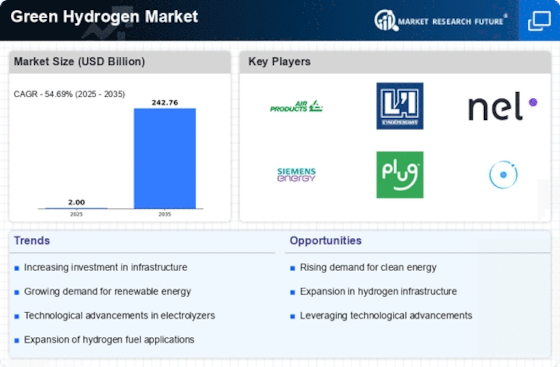

The increasing The Green Hydrogen Industry. As nations strive to meet their climate goals, the demand for hydrogen as a clean fuel source is likely to surge. According to recent estimates, the hydrogen market could reach a valuation of over 200 billion USD by 2030, with green hydrogen accounting for a substantial share. This shift is driven by the need to decarbonize various sectors, including transportation and industrial processes, which traditionally rely on fossil fuels. The Green Hydrogen Market is thus positioned to benefit from this growing demand, as stakeholders seek to invest in technologies that facilitate the production and utilization of hydrogen in a sustainable manner.

Integration with Energy Storage Solutions

The integration of green hydrogen with energy storage solutions is emerging as a pivotal driver for the Green Hydrogen Market. As renewable energy sources like wind and solar become more prevalent, the need for effective energy storage solutions is becoming increasingly critical. Green hydrogen can serve as a versatile energy carrier, enabling the storage of excess renewable energy for later use. This capability may enhance grid stability and facilitate the transition to a more resilient energy system. The Green Hydrogen Market could see significant growth as energy storage technologies evolve, allowing for greater adoption of hydrogen in various applications, including transportation and power generation.